- China

- /

- Professional Services

- /

- SZSE:300688

Dark Horse Technology Group (SZSE:300688) Strong Profits May Be Masking Some Underlying Issues

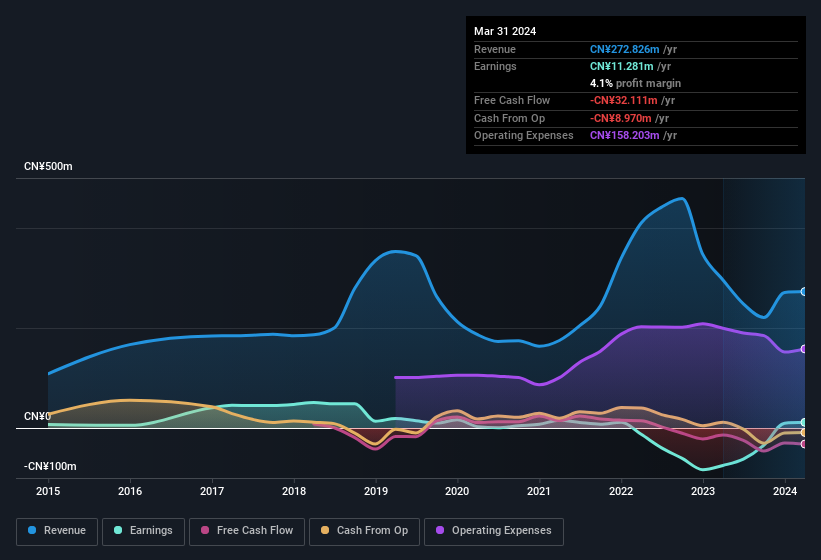

Dark Horse Technology Group Co., Ltd.'s (SZSE:300688) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

Check out our latest analysis for Dark Horse Technology Group

Examining Cashflow Against Dark Horse Technology Group's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Dark Horse Technology Group has an accrual ratio of 0.35 for the year to March 2024. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. Even though it reported a profit of CN¥11.3m, a look at free cash flow indicates it actually burnt through CN¥32m in the last year. We also note that Dark Horse Technology Group's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥32m. However, we can see that a recent tax benefit, along with unusual items, have impacted its statutory profit, and therefore its accrual ratio. One positive for Dark Horse Technology Group shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Dark Horse Technology Group.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) Dark Horse Technology Group saw its profit reduced by unusual items worth CN¥9.7m. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Dark Horse Technology Group took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Dark Horse Technology Group received a tax benefit of CN¥7.3m. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Dark Horse Technology Group's Profit Performance

In conclusion, Dark Horse Technology Group's accrual ratio suggests that its statutory earnings are not backed by cash flow, in part due to the tax benefit it received; but the fact unusual items actually weighed on profit may create upside if those unusual items do not recur. Based on these factors, we think that Dark Horse Technology Group's statutory profits probably make it seem better than it is on an underlying level. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Dark Horse Technology Group is showing 3 warning signs in our investment analysis and 2 of those make us uncomfortable...

Our examination of Dark Horse Technology Group has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300688

Dark Horse Technology Group

Operates business innovation and entrepreneurship services.

Flawless balance sheet minimal.

Similar Companies

Market Insights

Community Narratives