October 2024's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, investors are increasingly focused on growth stocks that demonstrate resilience. In this environment, companies with strong insider ownership often stand out as they suggest confidence from those who know the business best, potentially offering stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Beijing Originwater Technology (SZSE:300070)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Originwater Technology Co., Ltd. operates in the water treatment industry both within China and internationally, with a market cap of CN¥17.83 billion.

Operations: Beijing Originwater Technology Co., Ltd. generates its revenue primarily from the water treatment sector, serving both domestic and international markets.

Insider Ownership: 14.1%

Earnings Growth Forecast: 35.4% p.a.

Beijing Originwater Technology faces challenges with declining revenue and net loss for the nine months ending September 2024, reporting CNY 4.75 billion in sales and a net loss of CNY 42.94 million. Despite this, its earnings are forecast to grow significantly at 35.36% annually, outpacing the broader Chinese market's expected growth rate of 24.2%. However, the company's volatile share price and low return on equity forecast indicate potential risks for investors seeking stability in high insider ownership firms.

- Click to explore a detailed breakdown of our findings in Beijing Originwater Technology's earnings growth report.

- The valuation report we've compiled suggests that Beijing Originwater Technology's current price could be inflated.

Lifedrink Company (TSE:2585)

Simply Wall St Growth Rating: ★★★★☆☆

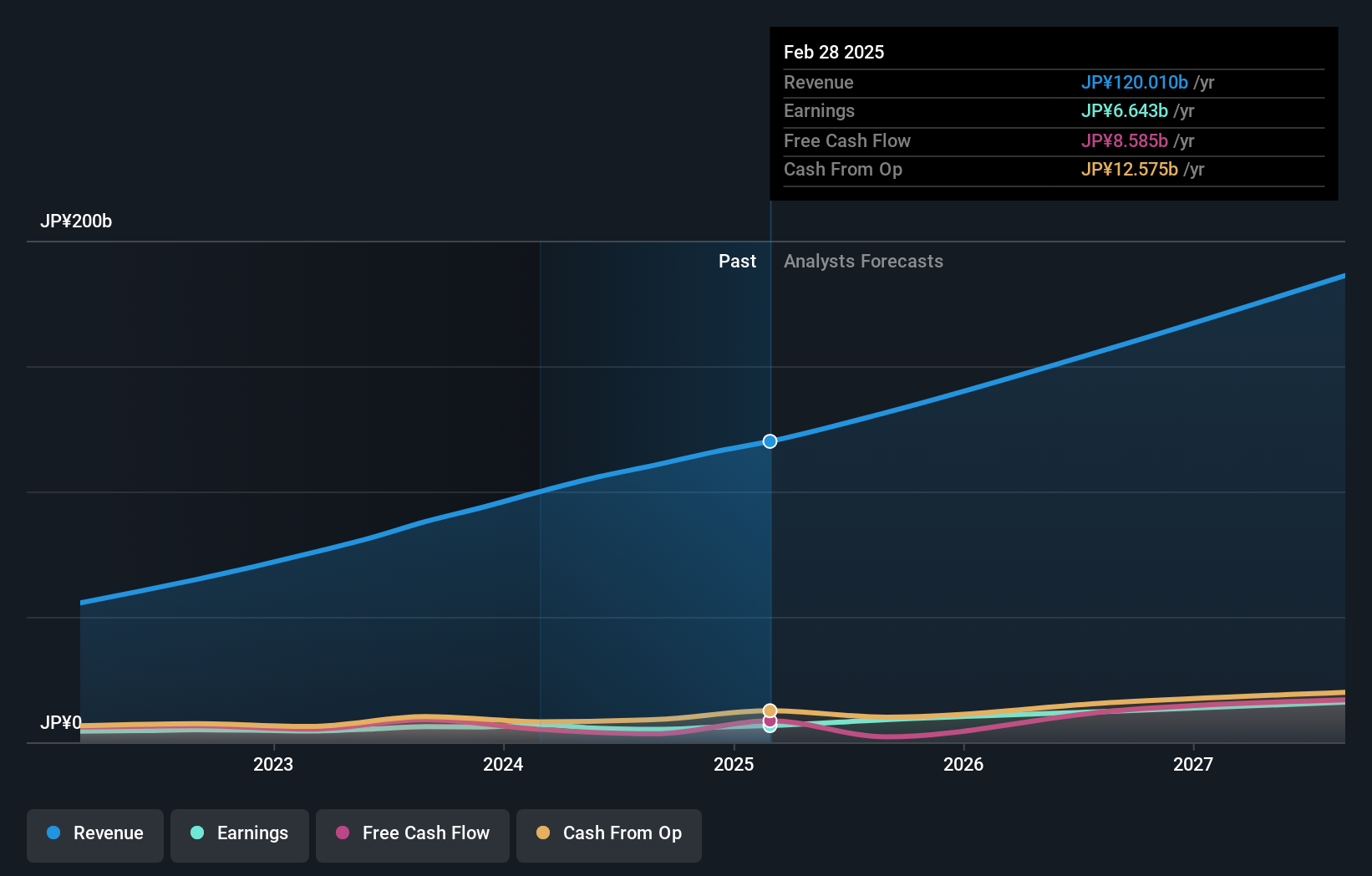

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan with a market cap of ¥88.58 billion.

Operations: The company's revenue primarily comes from its Beverage and Leaf Business, which generated ¥39.57 billion.

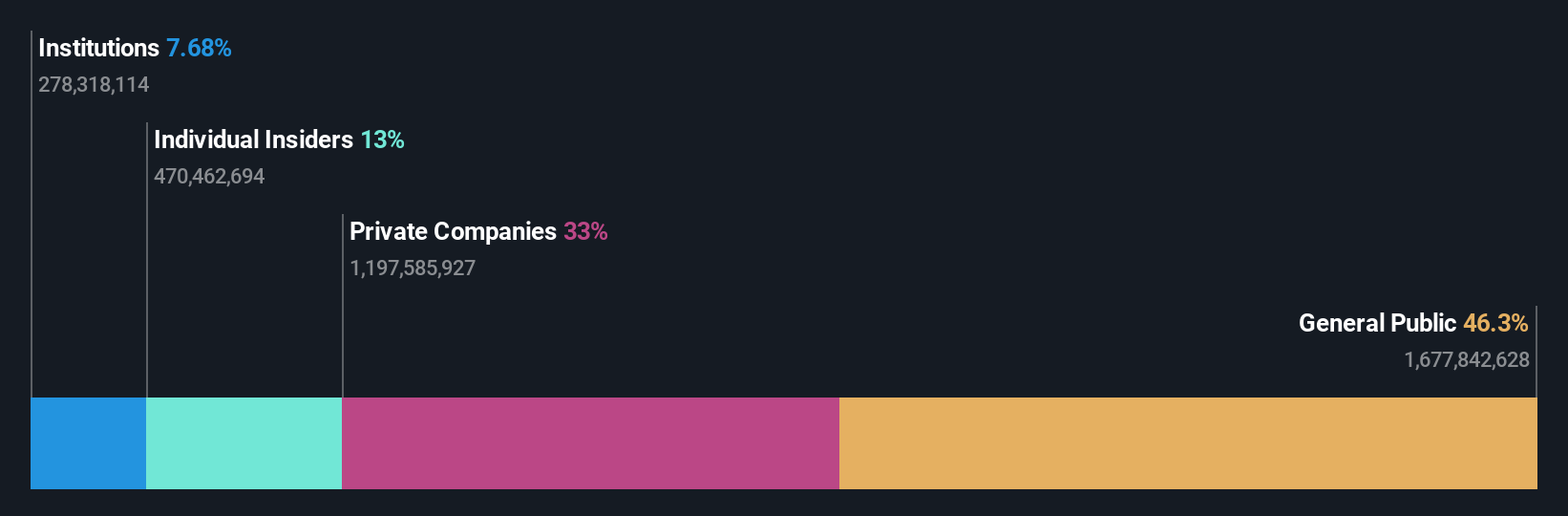

Insider Ownership: 14.6%

Earnings Growth Forecast: 12.1% p.a.

Lifedrink Company is expected to see revenue growth of 8.5% annually, outpacing the JP market's 4.2%, with earnings projected to grow at 12.1% per year. Despite high debt levels and recent share price volatility, the company trades at a significant discount to its estimated fair value and has a strong return on equity forecast of 23.4%. A recent stock split may enhance liquidity and attract more investors, though insider trading activity remains unclear.

- Dive into the specifics of Lifedrink Company here with our thorough growth forecast report.

- Our expertly prepared valuation report Lifedrink Company implies its share price may be lower than expected.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥243.67 billion.

Operations: The company's revenue segments include Software Testing Related Services at ¥71.34 billion and Software Development Related Services at ¥35.01 billion.

Insider Ownership: 35.4%

Earnings Growth Forecast: 33.5% p.a.

SHIFT Inc. is projected to achieve annual revenue growth of 19.3%, surpassing the JP market's 4.2% and with earnings expected to rise significantly at 33.5% annually, indicating robust growth potential despite a highly volatile share price recently. Trading at a considerable discount to its fair value, SHIFT's return on equity is forecasted at an impressive 25.6%. A recent buyback program aims to enhance shareholder value, though insider trading activity over the past three months remains unclear.

- Delve into the full analysis future growth report here for a deeper understanding of SHIFT.

- Our expertly prepared valuation report SHIFT implies its share price may be too high.

Taking Advantage

- Unlock our comprehensive list of 1510 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2585

Reasonable growth potential with adequate balance sheet.