- China

- /

- Commercial Services

- /

- SZSE:002200

It's Down 27% But YCIC Eco-Technology Co.,Ltd. (SZSE:002200) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the YCIC Eco-Technology Co.,Ltd. (SZSE:002200) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

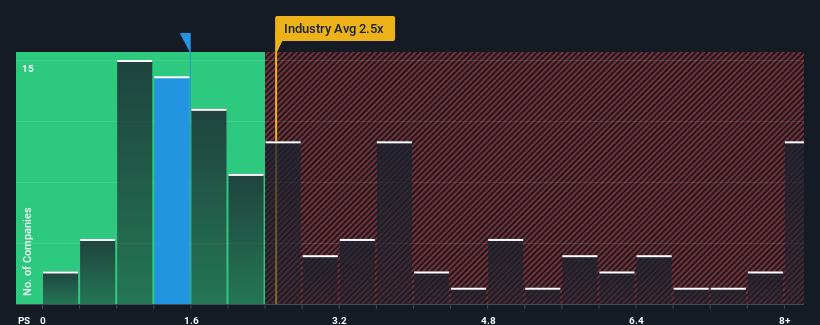

Although its price has dipped substantially, YCIC Eco-TechnologyLtd's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a buy right now compared to the Commercial Services industry in China, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for YCIC Eco-TechnologyLtd

What Does YCIC Eco-TechnologyLtd's Recent Performance Look Like?

YCIC Eco-TechnologyLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for YCIC Eco-TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, YCIC Eco-TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 148% last year. The latest three year period has also seen an excellent 114% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 29% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that YCIC Eco-TechnologyLtd is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

YCIC Eco-TechnologyLtd's recently weak share price has pulled its P/S back below other Commercial Services companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that YCIC Eco-TechnologyLtd currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Before you take the next step, you should know about the 2 warning signs for YCIC Eco-TechnologyLtd (1 is concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on YCIC Eco-TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade YCIC Eco-TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002200

YCIC Eco-TechnologyLtd

Engages in the ecological landscape and eco-environmental protection ecological habitat businesses in China.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives