- China

- /

- Commercial Services

- /

- SZSE:000035

Investors Still Aren't Entirely Convinced By China Tianying Inc.'s (SZSE:000035) Earnings Despite 26% Price Jump

China Tianying Inc. (SZSE:000035) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

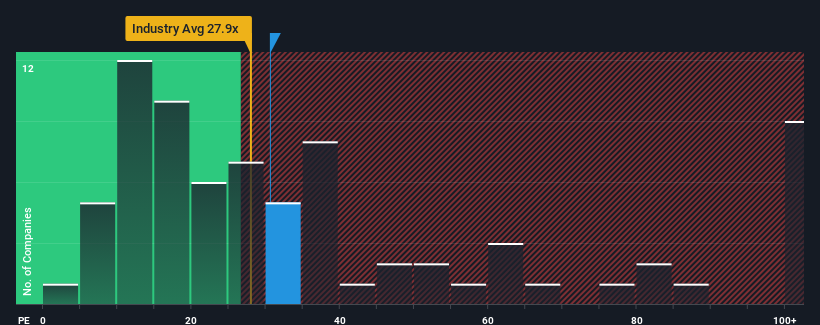

Although its price has surged higher, there still wouldn't be many who think China Tianying's price-to-earnings (or "P/E") ratio of 30.6x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

China Tianying certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for China Tianying

Is There Some Growth For China Tianying?

The only time you'd be comfortable seeing a P/E like China Tianying's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 2.6%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 58% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 130% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we find it interesting that China Tianying is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

China Tianying appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of China Tianying's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for China Tianying you should be aware of.

You might be able to find a better investment than China Tianying. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000035

China Tianying

Engages in urban environmental service and energy businesses in China and internationally.

High growth potential low.

Market Insights

Community Narratives