As global markets show signs of optimism with easing trade tensions and a rebound in U.S. equities, investors are navigating a complex landscape marked by economic slowdowns and cautious consumer sentiment. In such an environment, companies with strong insider ownership can be particularly appealing as they often indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Here's a peek at a few of the choices from the screener.

Zhejiang Weiming Environment Protection (SHSE:603568)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Weiming Environment Protection Co., Ltd. operates in the environmental protection industry and has a market cap of CN¥32.99 billion.

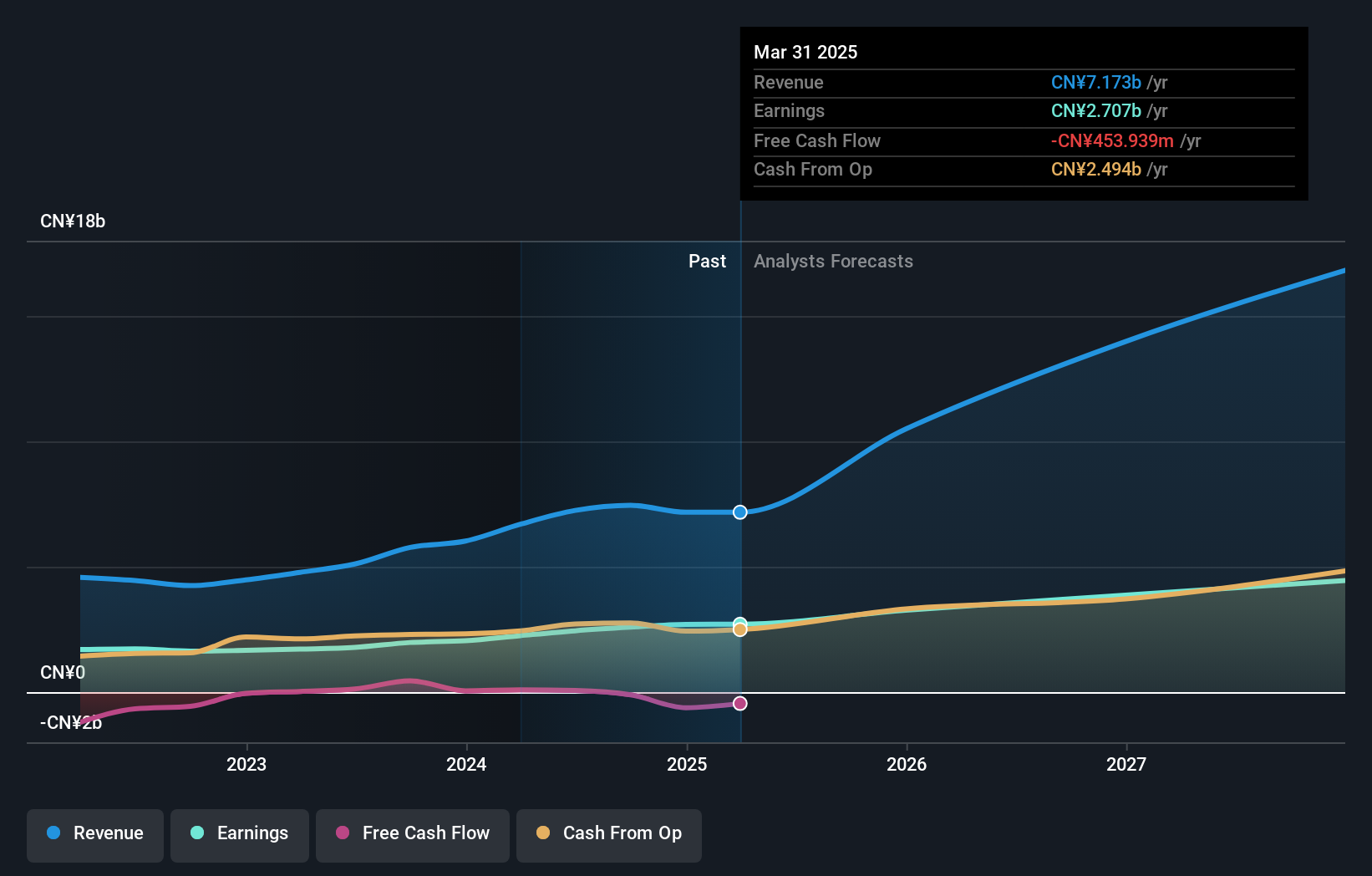

Operations: The company generates revenue primarily from its industrial segment, amounting to CN¥7.17 billion.

Insider Ownership: 24%

Zhejiang Weiming Environment Protection exhibits strong growth potential with forecasted revenue growth of 29.6% annually, surpassing the Chinese market’s average. Despite a modest dividend yield of 2.46% not fully covered by free cash flows, the company shows good relative value with a price-to-earnings ratio of 12.2x, well below the market average. Recent earnings reports indicate stable performance with net income rising to CNY 2,703.88 million for 2024 from CNY 2,048.49 million in the prior year.

- Unlock comprehensive insights into our analysis of Zhejiang Weiming Environment Protection stock in this growth report.

- The analysis detailed in our Zhejiang Weiming Environment Protection valuation report hints at an deflated share price compared to its estimated value.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qi An Xin Technology Group Inc. is a cyber-security company that offers cybersecurity products and services to government, enterprises, and other institutions both in China and internationally, with a market cap of approximately CN¥20.98 billion.

Operations: Qi An Xin Technology Group Inc. generates revenue through its cybersecurity products and services targeted at government bodies, enterprises, and various institutions both domestically in China and on an international scale.

Insider Ownership: 22%

Qi An Xin Technology Group, trading at 43.2% below its estimated fair value, is poised for significant growth with revenue expected to rise by 20.9% annually, outpacing the Chinese market. Although currently unprofitable with a net loss of CNY 1.36 billion in 2024, it is forecasted to become profitable within three years. Despite high volatility and low future return on equity projections, its valuation suggests potential upside for growth-focused investors.

- Click to explore a detailed breakdown of our findings in Qi An Xin Technology Group's earnings growth report.

- Our valuation report here indicates Qi An Xin Technology Group may be undervalued.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. provides digital health services for medical and health institutions in China and has a market cap of CN¥22.50 billion.

Operations: Winning Health Technology Group Co., Ltd. generates revenue by offering digital health services to medical and health institutions across China.

Insider Ownership: 22.2%

Winning Health Technology Group, despite recent financial setbacks with Q1 2025 revenue at CNY 344.98 million and net income dropping to CNY 5.29 million, is forecasted for robust earnings growth of nearly 50% annually, surpassing the Chinese market average. However, its profit margins have contracted from last year's figures and share price volatility remains high. With no substantial insider trading activity recently reported, future prospects hinge on executing growth strategies effectively amidst current challenges.

- Delve into the full analysis future growth report here for a deeper understanding of Winning Health Technology Group.

- Our comprehensive valuation report raises the possibility that Winning Health Technology Group is priced higher than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 844 Fast Growing Global Companies With High Insider Ownership.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cybersecurity company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion