In the current global market landscape, characterized by inflation concerns and political uncertainties, growth stocks have faced significant challenges, with value stocks showing relative resilience. Amidst this volatility, companies with high insider ownership often attract investor interest as insiders' substantial stakes can signal confidence in the company's potential and align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

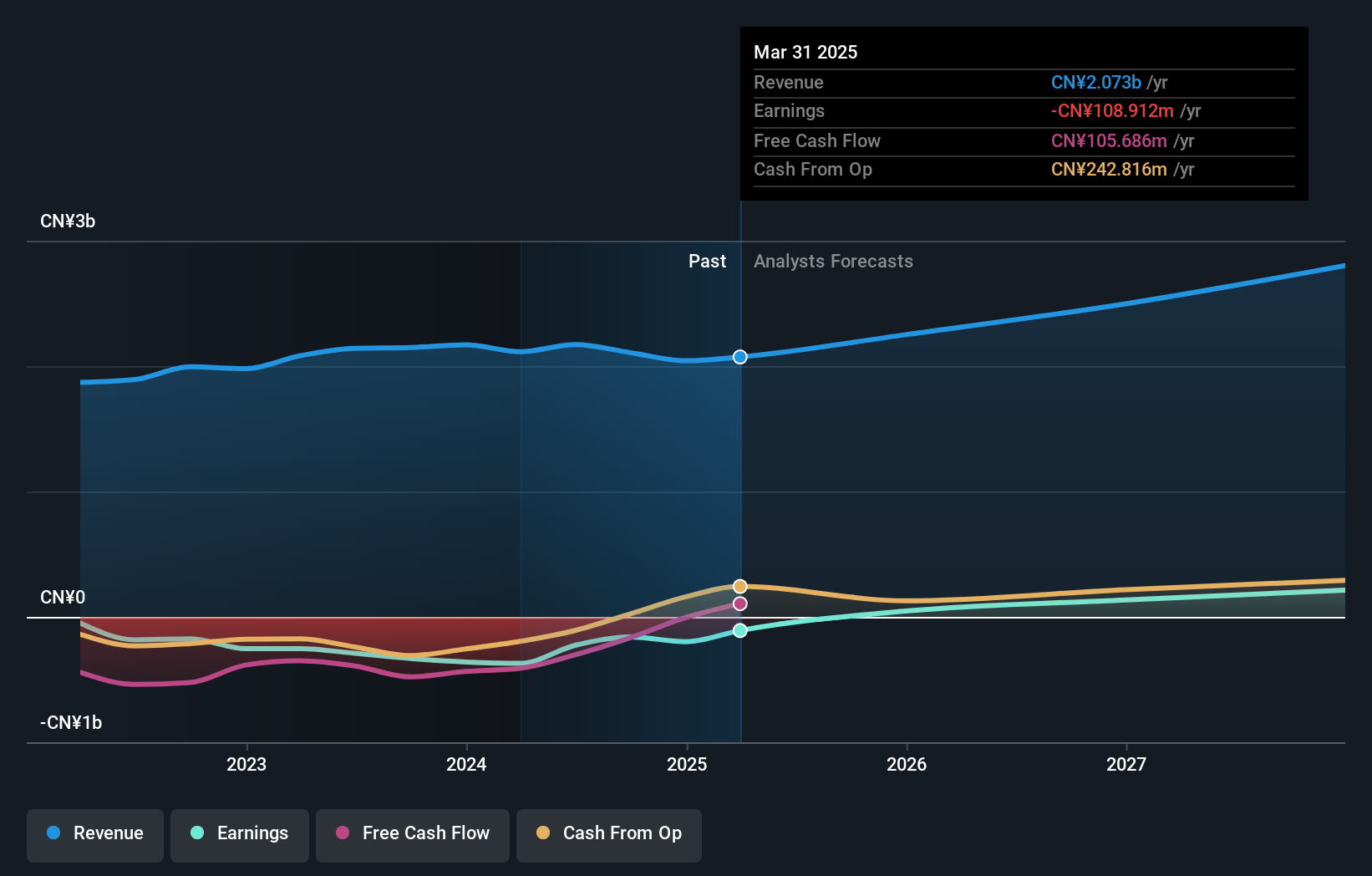

PNC Process Systems (SHSE:603690)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PNC Process Systems Co., Ltd. is engaged in the research, development, production, and sale of semiconductor process equipment, system integration and support equipment, and component materials in China with a market cap of CN¥8.96 billion.

Operations: PNC Process Systems Co., Ltd. generates revenue through its semiconductor process equipment, system integration and support equipment, and component materials segments in China.

Insider Ownership: 30.4%

PNC Process Systems shows strong growth potential, with revenue expected to increase by 20.2% annually, surpassing the Chinese market's average. Despite a recent dip in net income, earnings are forecast to grow significantly at 31% per year. The company trades at a favorable price-to-earnings ratio of 24x compared to the market's 32.8x and has initiated a CNY 160 million share buyback program aimed at enhancing shareholder value and supporting equity incentive plans.

- Take a closer look at PNC Process Systems' potential here in our earnings growth report.

- The analysis detailed in our PNC Process Systems valuation report hints at an deflated share price compared to its estimated value.

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market cap of CN¥4.04 billion.

Operations: DBAPPSecurity Co., Ltd. generates revenue through its activities in research, development, manufacturing, and sales of cybersecurity products within China.

Insider Ownership: 13%

DBAPPSecurity demonstrates growth potential with earnings projected to rise 53.26% annually, despite a recent net loss of CNY 336 million. The company is expected to become profitable within three years, outpacing average market profit growth. However, its revenue growth forecast of 18.8% per year lags behind the desired threshold but exceeds China's market rate of 13.5%. Trading at a significant discount to estimated fair value and peers suggests attractive valuation prospects amidst recent index exclusion challenges.

- Click to explore a detailed breakdown of our findings in DBAPPSecurity's earnings growth report.

- Our valuation report here indicates DBAPPSecurity may be undervalued.

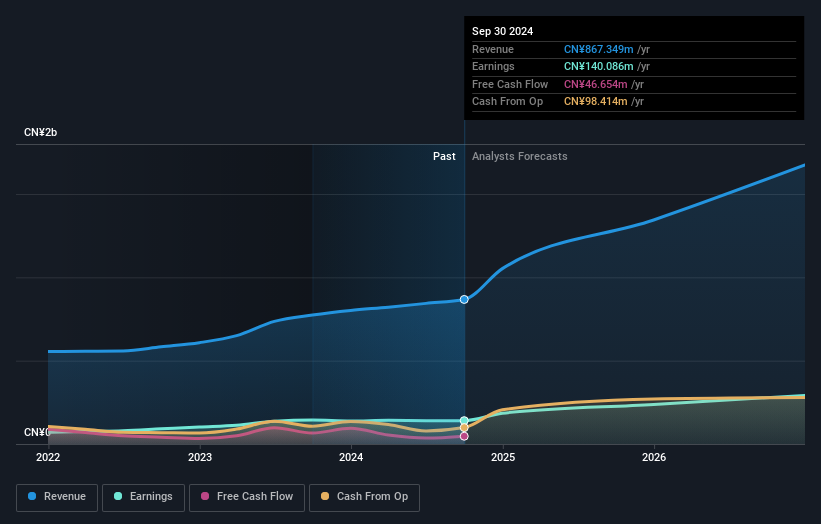

Zhejiang Fengmao Technology (SZSE:301459)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Fengmao Technology Co., Ltd. specializes in the R&D, manufacturing, and sale of belt-driven systems, fluid pipelines, and rubber sealing systems in China with a market cap of CN¥3.10 billion.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, amounting to CN¥867.35 million.

Insider Ownership: 12.5%

Zhejiang Fengmao Technology is poised for strong growth, with earnings expected to rise 29.4% annually, surpassing the CN market average. Revenue growth forecasts at 27.6% also exceed market expectations. Despite a low projected return on equity of 11.1%, the stock trades at a favorable price-to-earnings ratio of 22.1x compared to the CN market's 32.8x, suggesting good relative value. Recent results show increased sales (CNY 670 million) but stable net income year-over-year.

- Click here to discover the nuances of Zhejiang Fengmao Technology with our detailed analytical future growth report.

- According our valuation report, there's an indication that Zhejiang Fengmao Technology's share price might be on the cheaper side.

Key Takeaways

- Embark on your investment journey to our 1442 Fast Growing Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Fengmao Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301459

Zhejiang Fengmao Technology

Engages in the research and development, manufacture, and sale of belt driven, fluid pipeline, and rubber sealing systems in China.

Flawless balance sheet low.

Market Insights

Community Narratives