- China

- /

- Communications

- /

- SHSE:600198

Undiscovered Gems And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to experience record highs, with small-cap indices like the Russell 2000 reaching new peaks, investors are increasingly looking toward promising small-cap stocks as potential opportunities for portfolio enhancement. In this dynamic environment, identifying a good stock often involves seeking companies with strong fundamentals and growth potential that can thrive despite geopolitical uncertainties and economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Datang Telecom Technology (SHSE:600198)

Simply Wall St Value Rating: ★★★★★☆

Overview: Datang Telecom Technology Co., Ltd. engages in integrated circuit design and special communications within China, with a market cap of CN¥14.34 billion.

Operations: Datang Telecom Technology generates revenue through its operations in integrated circuit design and special communications. The company has a market cap of CN¥14.34 billion.

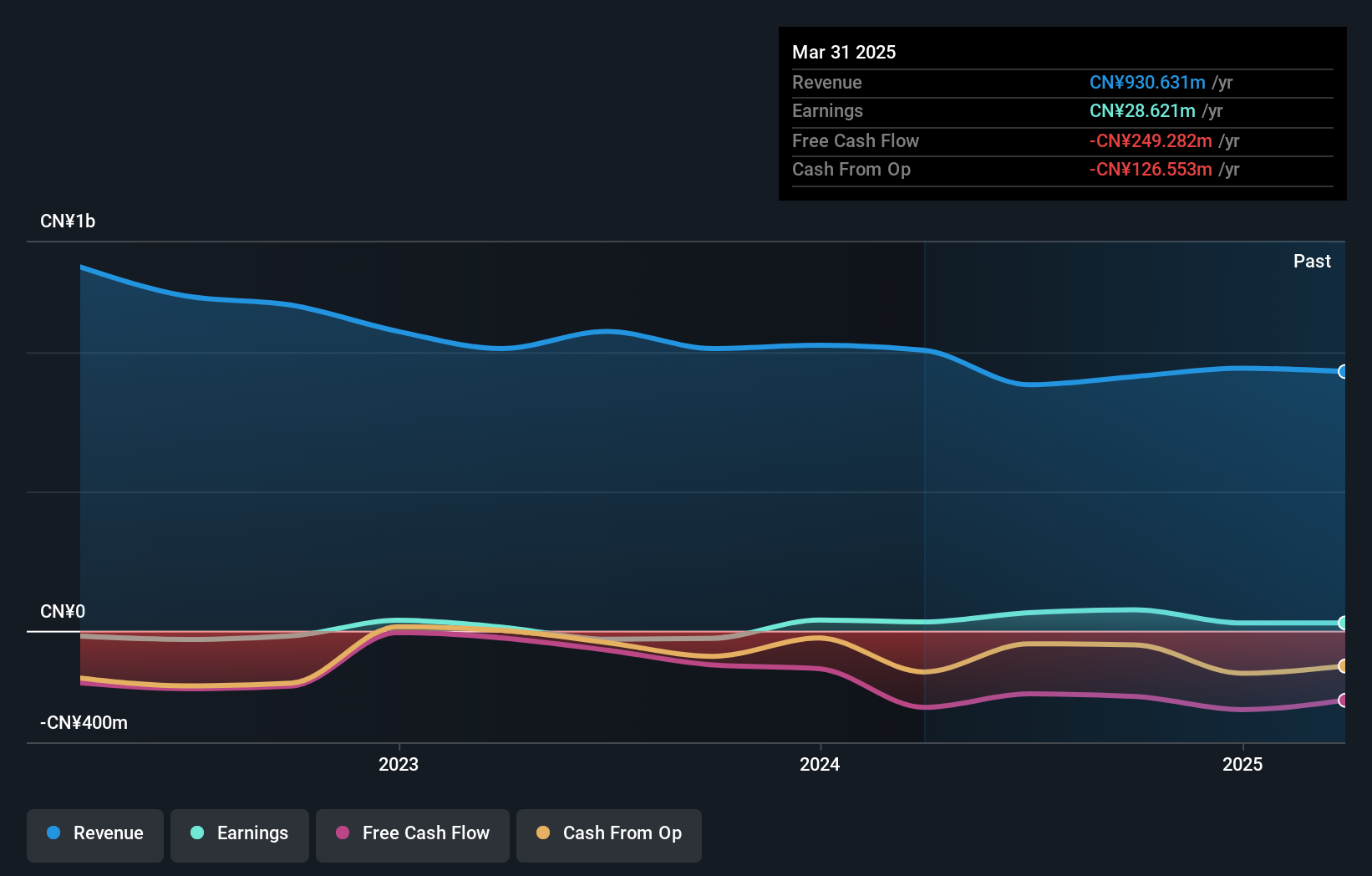

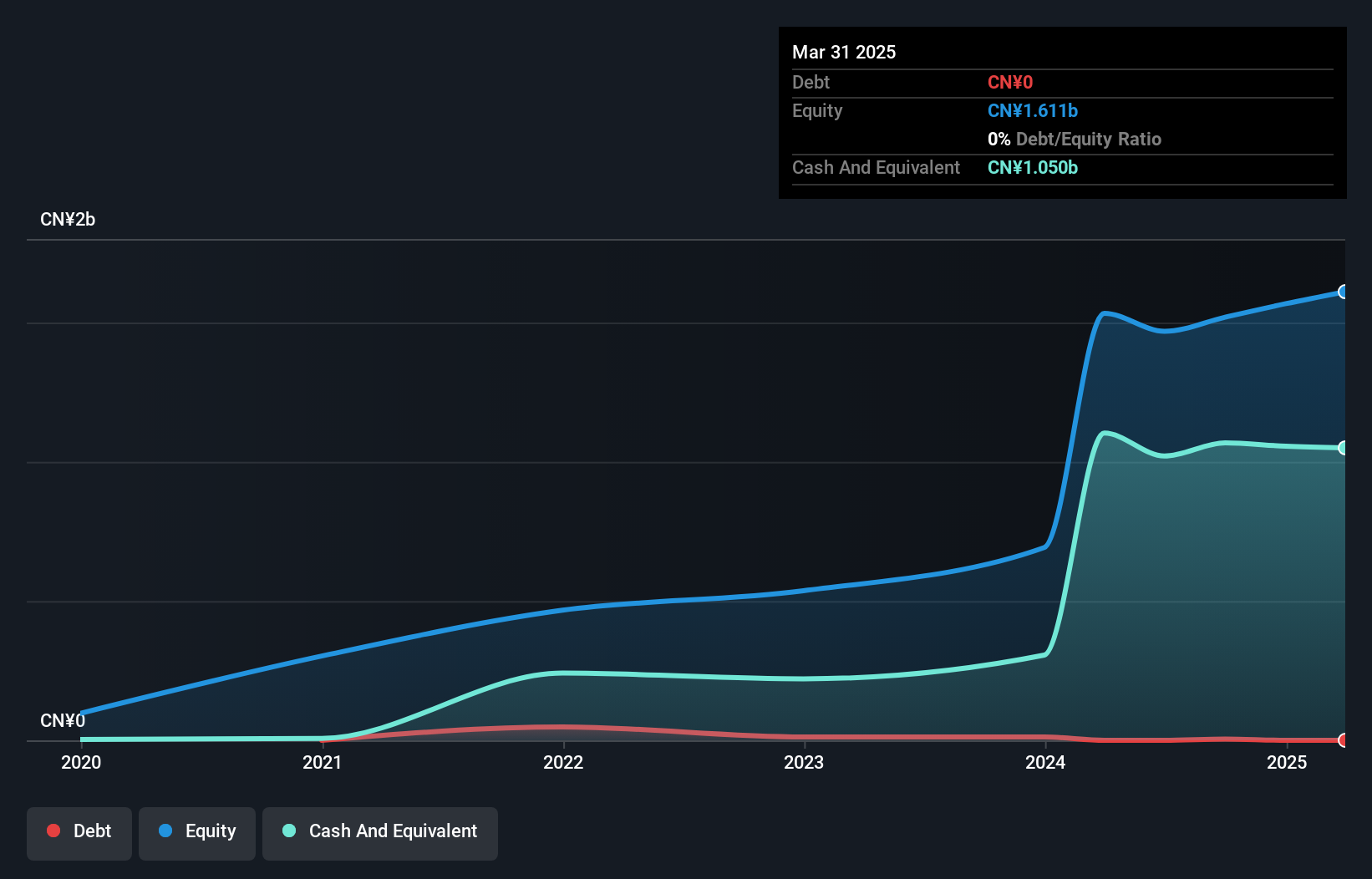

Datang Telecom Technology, a smaller player in the communications sector, recently reported a net loss of CNY 90.55 million for the nine months ending September 2024, an improvement from last year's CNY 126.68 million loss. Despite sales dropping to CNY 454.25 million from CNY 566.44 million, its debt-to-equity ratio impressively shrank from over 4400% to just under 44% in five years, highlighting significant financial restructuring efforts. Although free cash flow remains negative and share price volatility is notable over recent months, the company has become profitable this year and maintains more cash than its total debt obligations.

- Navigate through the intricacies of Datang Telecom Technology with our comprehensive health report here.

Learn about Datang Telecom Technology's historical performance.

RIAMB (Beijing) Technology Development (SHSE:603082)

Simply Wall St Value Rating: ★★★★★☆

Overview: RIAMB (Beijing) Technology Development Co., Ltd. specializes in intelligent logistics systems and has a market capitalization of approximately CN¥6.12 billion.

Operations: RIAMB generates revenue primarily from its Intelligent Logistics System segment, amounting to CN¥1.94 billion.

RIAMB (Beijing) Technology Development, a smaller player in its field, has shown promising financial health with earnings growth of 5.6% over the past year, outpacing the broader Machinery industry. The company reported nine-month sales of CNY 1.45 billion and net income of CNY 121.78 million, reflecting stability despite a dip in basic earnings per share from CNY 0.98 to CNY 0.77 compared to last year. With more cash than total debt and positive free cash flow, RIAMB seems well-positioned financially, suggesting robust operational management amidst challenging market conditions.

Guangdong Huicheng Vacuum Technology (SZSE:301392)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Huicheng Vacuum Technology Co., Ltd. is a company focused on the development and production of vacuum equipment, with a market cap of CN¥8.14 billion.

Operations: Huicheng Vacuum Technology generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to CN¥564.79 million.

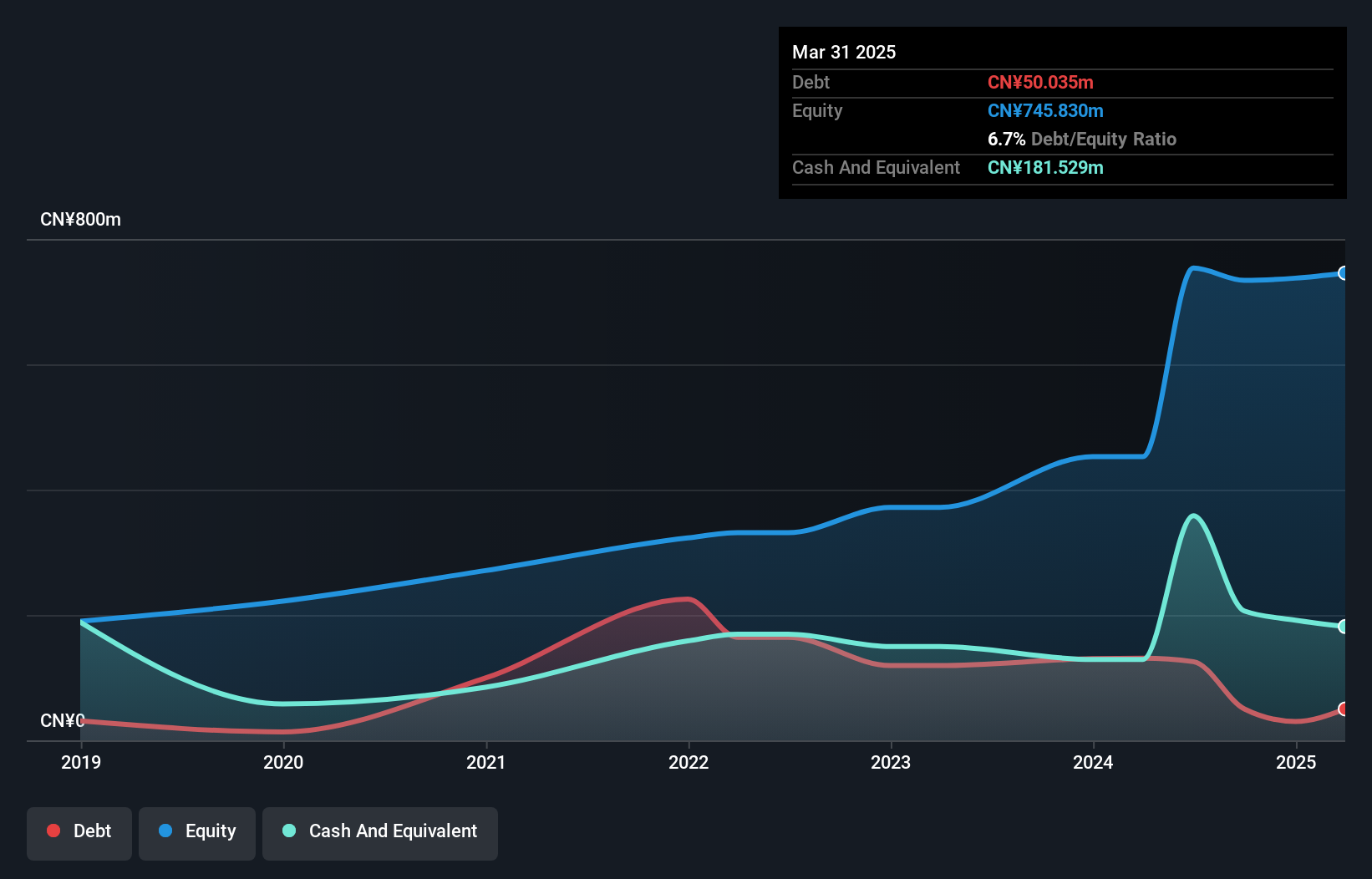

Guangdong Huicheng Vacuum Technology, a smaller player in the industry, reported impressive earnings growth of 12.4% over the past year, outpacing the broader machinery sector's -0.4%. The company's net income for the first nine months of 2024 reached CNY 64.49 million, up from CNY 52.73 million in the previous year, showcasing its strong performance trajectory. Despite a highly volatile share price recently, it boasts more cash than total debt and reduced its debt-to-equity ratio from 8.3 to 6.8 over five years, indicating prudent financial management and potential for future stability amidst market fluctuations.

Summing It All Up

- Discover the full array of 4645 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600198

Datang Telecom Technology

Operates in the integrated circuit (IC) design and special communications business in China.

Excellent balance sheet with acceptable track record.