- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6777

Undiscovered Gems to Watch This November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have captured attention with the Russell 2000 Index leading gains, though still shy of its record highs. Amid this backdrop of anticipated economic growth and regulatory changes, investors are increasingly on the lookout for undiscovered gems that offer potential value and resilience in evolving market conditions. Identifying such stocks often involves assessing their growth potential, financial health, and ability to adapt within a dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products to brand-owners and retailers under the CAROTE brand, with a market cap of HK$3.02 billion.

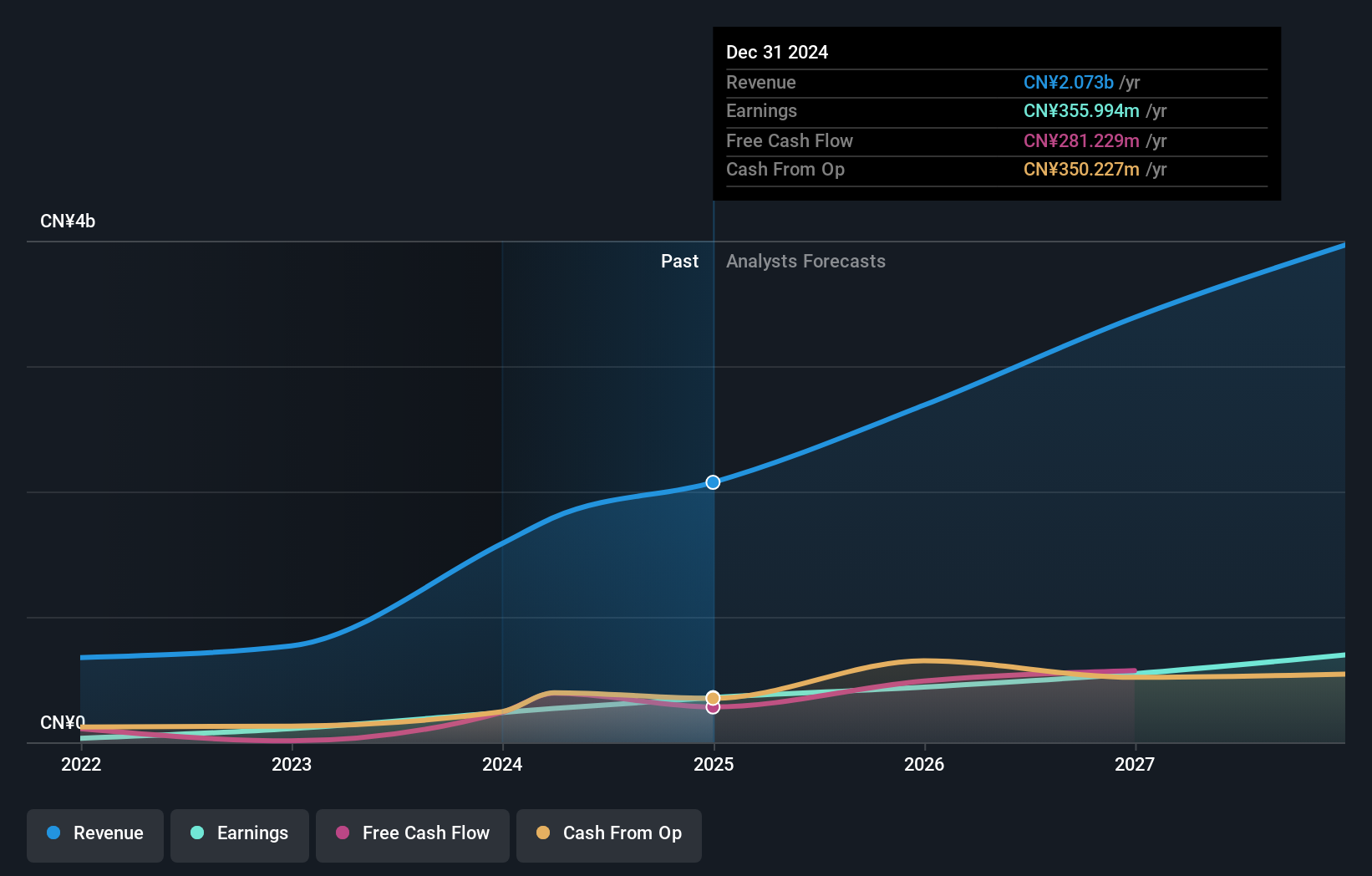

Operations: Carote Ltd generates revenue primarily through its Branded Business and ODM Business segments, with the Branded Business contributing CN¥1.58 billion and the ODM Business adding CN¥210.80 million. The company's financial performance is influenced by these revenue streams, which are crucial for understanding its overall business model.

Carote recently completed an IPO worth HKD 750.62 million, offering shares at a slight discount in the HKD 5.78 range. This small company has shown impressive growth, with earnings surging by 92% over the past year, outpacing its industry peers significantly. Carote's financial health appears robust; it holds more cash than total debt and boasts high-quality earnings while trading at a notable discount of 72% below estimated fair value. Despite its illiquid shares, the company's strong free cash flow and profitable status suggest promising future potential in the market landscape.

- Click to explore a detailed breakdown of our findings in Carote's health report.

Gain insights into Carote's past trends and performance with our Past report.

Dongnan ElectronicsLtd (SZSE:301359)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongnan Electronics Co., Ltd. focuses on the research, development, design, production, and sale of various switch products both in China and internationally, with a market cap of CN¥2.07 billion.

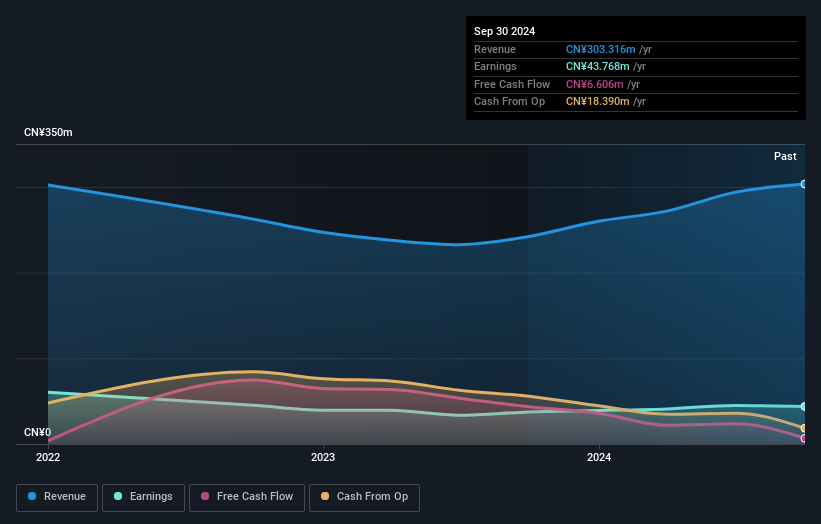

Operations: Dongnan Electronics generates revenue primarily from the production and sales of micro switch products, totaling CN¥303.32 million. The company has a market capitalization of CN¥2.07 billion.

Dongnan Electronics has made notable strides, reporting a revenue increase to CNY 223.85 million for the first nine months of 2024 from CNY 180.35 million the previous year, with net income rising to CNY 33.37 million from CNY 28.66 million. The company is debt-free now, unlike five years ago when it had a debt-to-equity ratio of 3.6%. Impressively, its earnings growth over the past year at 17% outpaced the electrical industry average of just 0.8%. Despite past challenges with an annual earnings decline of about 11%, Dongnan's recent performance suggests a promising turnaround in its financial health and market position.

santec Holdings (TSE:6777)

Simply Wall St Value Rating: ★★★★★☆

Overview: Santec Holdings Corporation develops, manufactures, and sells components for fiber optic telecommunication systems, with a market cap of ¥65.04 billion.

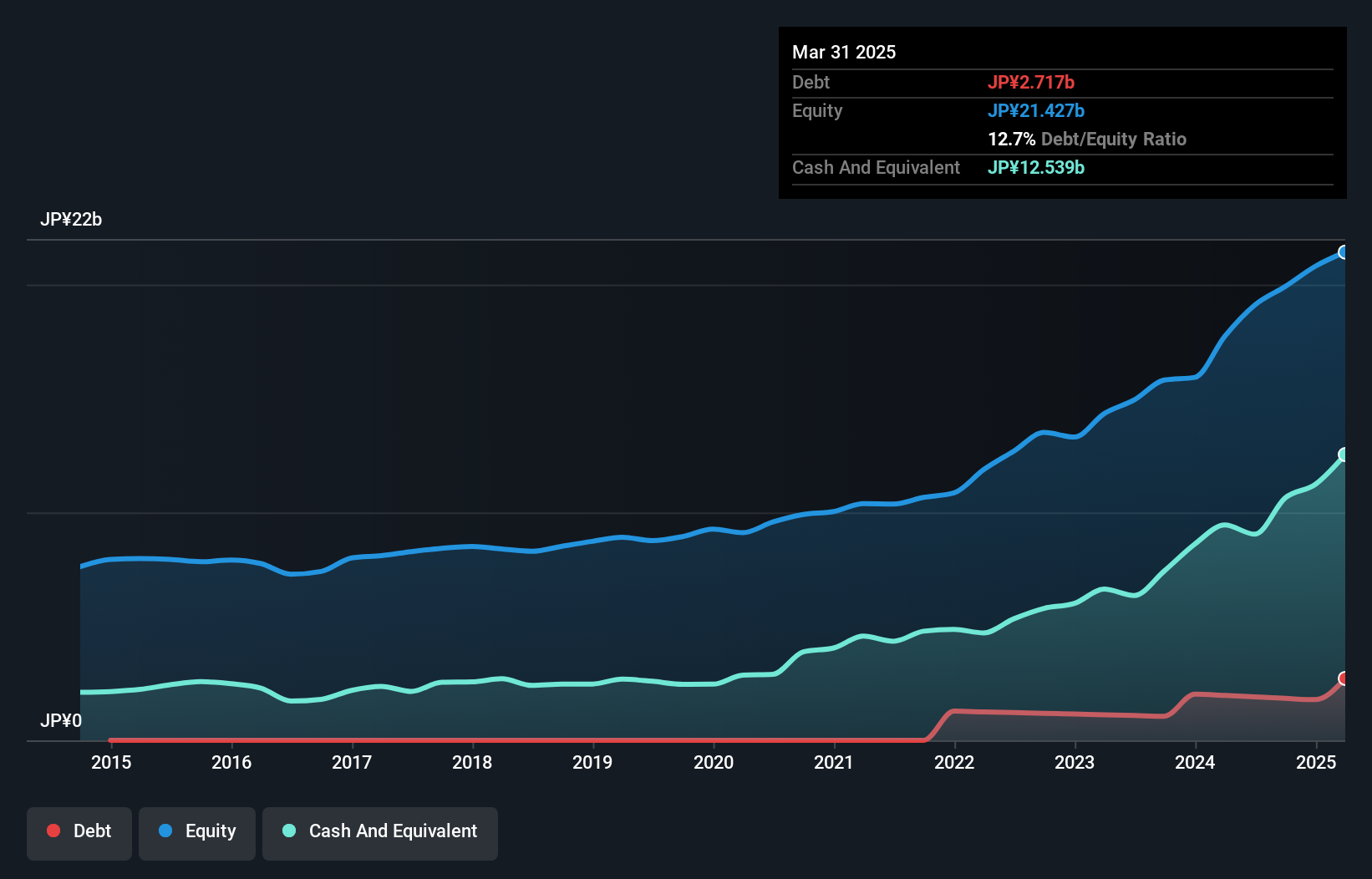

Operations: The company generates revenue primarily from its fiber optic telecommunication components. The net profit margin has shown variability, highlighting fluctuations in profitability over time.

Santec Holdings, a nimble player in the electronics sector, has shown impressive earnings growth of 59% over the past year, outpacing the industry's -0.3%. The company is financially sound with more cash than total debt and maintains positive free cash flow. Despite a volatile share price recently, Santec's high-quality earnings and interest coverage indicate robust financial health. The addition to the S&P Global BMI Index highlights its growing recognition in global markets. With earnings forecasted to grow at 7.51% annually, Santec appears poised for continued expansion within its industry landscape.

- Click here to discover the nuances of santec Holdings with our detailed analytical health report.

Understand santec Holdings' track record by examining our Past report.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4668 more companies for you to explore.Click here to unveil our expertly curated list of 4671 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6777

santec Holdings

Develops, manufactures, and sells components for fiber optic telecommunication systems.

Outstanding track record with excellent balance sheet and pays a dividend.