Market Participants Recognise Zhejiang Tianzhen Technology Co., Ltd.'s (SZSE:301356) Revenues Pushing Shares 35% Higher

Zhejiang Tianzhen Technology Co., Ltd. (SZSE:301356) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

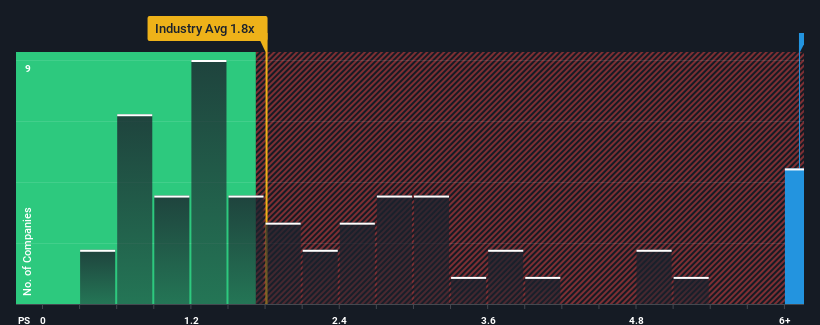

After such a large jump in price, when almost half of the companies in China's Building industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Zhejiang Tianzhen Technology as a stock not worth researching with its 6.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Zhejiang Tianzhen Technology

What Does Zhejiang Tianzhen Technology's P/S Mean For Shareholders?

Zhejiang Tianzhen Technology has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Tianzhen Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

Zhejiang Tianzhen Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 77%. The last three years don't look nice either as the company has shrunk revenue by 69% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 339% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Zhejiang Tianzhen Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Zhejiang Tianzhen Technology's P/S?

Zhejiang Tianzhen Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Zhejiang Tianzhen Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Zhejiang Tianzhen Technology.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Tianzhen Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301356

Zhejiang Tianzhen Technology

Manufactures and sells floor coverings and decorative materials.

Adequate balance sheet low.

Market Insights

Community Narratives