- China

- /

- Electrical

- /

- SZSE:301168

Global Growth Companies With High Insider Ownership May 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism following a U.S.-China tariff pause and cooling inflation, investors are keenly observing the potential impacts on growth sectors. In this environment, companies with high insider ownership often capture attention due to their alignment of interests between management and shareholders, which can be particularly appealing amid fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 23.4% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.6% | 30.4% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 79.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Guangdong Zhongsheng Pharmaceutical (SZSE:002317)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Zhongsheng Pharmaceutical Co., Ltd. operates in the pharmaceutical industry with a market cap of CN¥10.64 billion.

Operations: Guangdong Zhongsheng Pharmaceutical Co., Ltd. generates its revenue from various segments within the pharmaceutical industry.

Insider Ownership: 27.8%

Revenue Growth Forecast: 21.1% p.a.

Guangdong Zhongsheng Pharmaceutical is poised for substantial growth, with revenue expected to rise 21.1% annually, outpacing the Chinese market's 12.3% growth rate. Despite a net loss of CNY 299.16 million in 2024, earnings are forecasted to grow significantly by over 100% per year, indicating a potential turnaround. Trading at a significant discount to its estimated fair value enhances its appeal as an investment prospect in the growth sector despite unsustainable dividend coverage and no recent insider trading activity.

- Unlock comprehensive insights into our analysis of Guangdong Zhongsheng Pharmaceutical stock in this growth report.

- Upon reviewing our latest valuation report, Guangdong Zhongsheng Pharmaceutical's share price might be too pessimistic.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation and positioning technology, with a market cap of CN¥23.87 billion.

Operations: Shanghai Huace Navigation Technology Ltd. generates its revenue from various segments within the navigation and positioning technology industry.

Insider Ownership: 24.7%

Revenue Growth Forecast: 24.4% p.a.

Shanghai Huace Navigation Technology is positioned for robust growth, with revenue projected to increase 24.4% annually, surpassing the Chinese market's 12.3%. Recent earnings showed a rise to CNY 142.74 million from CNY 103.06 million year-over-year, reflecting strong performance momentum. The company trades at a price-to-earnings ratio of 38.4x, below the industry average of 74.1x, suggesting relative value in its sector despite no recent insider trading activity or substantial insider buying over three months.

- Delve into the full analysis future growth report here for a deeper understanding of Shanghai Huace Navigation Technology.

- According our valuation report, there's an indication that Shanghai Huace Navigation Technology's share price might be on the expensive side.

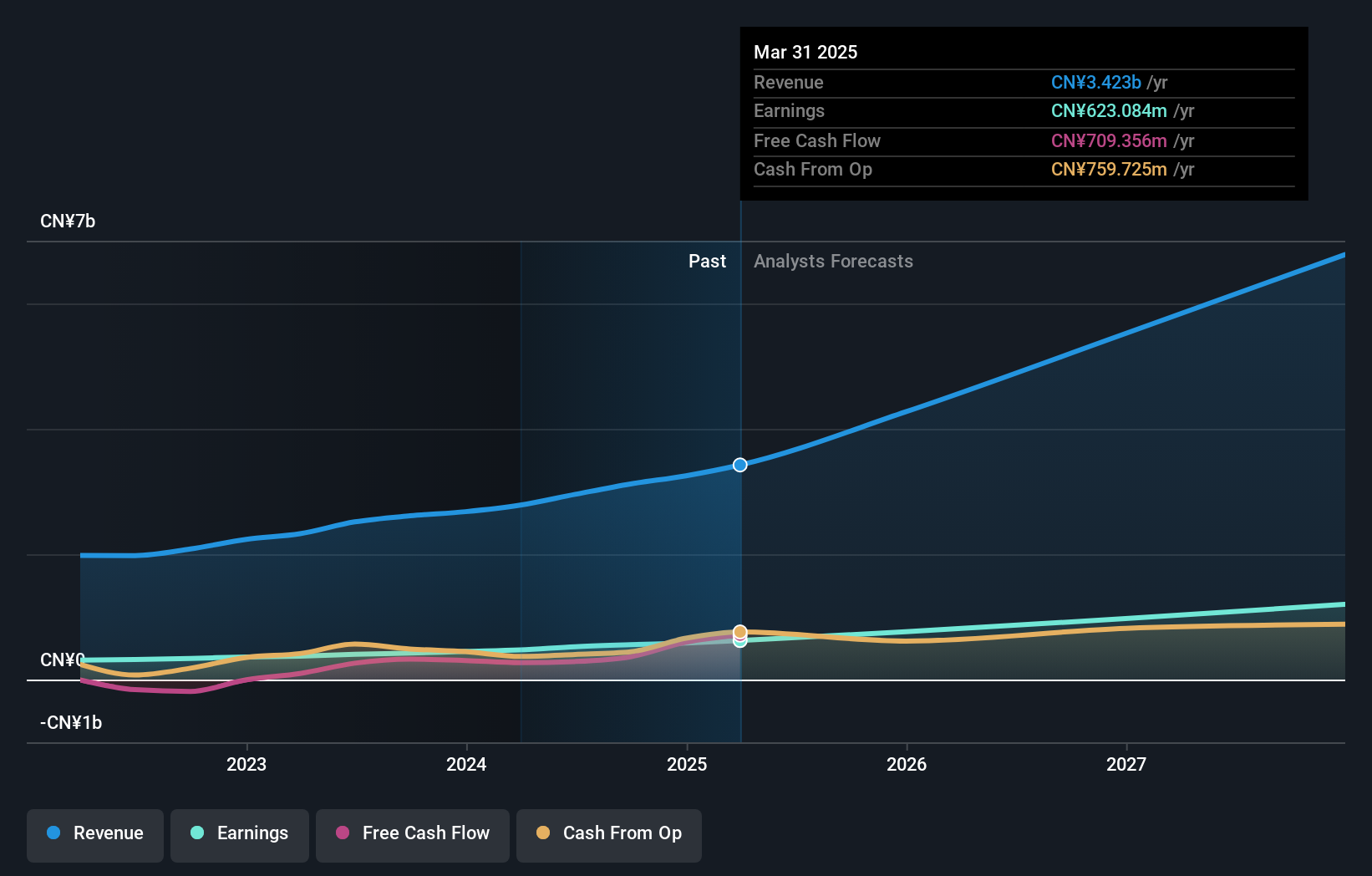

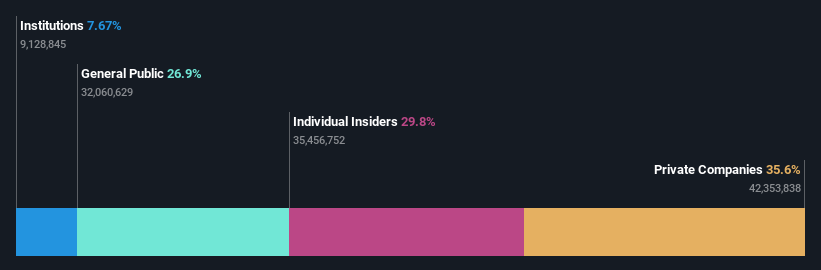

Jiangsu TongLin ElectricLtd (SZSE:301168)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu TongLin Electric Co., Ltd. focuses on the research, development, and manufacture of photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions in China with a market cap of CN¥3.82 billion.

Operations: Jiangsu TongLin Electric Co., Ltd. generates revenue through its involvement in photovoltaic connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions in China.

Insider Ownership: 29.8%

Revenue Growth Forecast: 30.7% p.a.

Jiangsu TongLin Electric is set for significant growth, with earnings expected to rise 76.6% annually, outpacing the Chinese market's 23.4%. Revenue growth is also strong at 30.7% per year. Despite this, recent financials show a decline in net income and profit margins compared to last year, indicating potential challenges ahead. No substantial insider trading activity was reported recently, and the company announced a CNY 0.62 cash dividend per ten shares for 2024.

- Click here to discover the nuances of Jiangsu TongLin ElectricLtd with our detailed analytical future growth report.

- The analysis detailed in our Jiangsu TongLin ElectricLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 846 Fast Growing Global Companies With High Insider Ownership right here.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Jiangsu TongLin ElectricLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301168

Jiangsu TongLin ElectricLtd

Engages in the research, development, and manufacture of photovoltaic (PV) connection systems, PV power stations, electrical equipment, cables and wires, and industrial automation solutions in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives