- China

- /

- Electronic Equipment and Components

- /

- SZSE:300279

Promising Undiscovered Gems To Watch In February 2025

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and consumer spending concerns, global markets have experienced volatility, with major U.S. indices like the S&P 500 seeing fluctuations despite early-week gains. As investors navigate these uncertain waters, small-cap stocks often present intriguing opportunities due to their potential for growth and innovation in challenging economic conditions. Identifying promising undiscovered gems requires a keen eye for companies that can thrive despite broader market headwinds, focusing on those with strong fundamentals and adaptability.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Invest Bank | 126.08% | 12.31% | 20.26% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Center International GroupLtd (SHSE:603098)

Simply Wall St Value Rating: ★★★★★★

Overview: Center International Group Co., Ltd. offers building metal enclosure systems solutions in China and has a market cap of CN¥5.22 billion.

Operations: The company's revenue streams primarily derive from providing building metal enclosure systems solutions. It has a market capitalization of CN¥5.22 billion, reflecting its scale within the industry.

Center International Group Ltd. has shown a robust earnings growth of 48% over the past year, significantly outpacing the construction industry's -3.9%. Despite a one-off gain of CN¥40M impacting recent financial results, this small cap entity remains profitable with its debt to equity ratio improving from 29.4% to 27.1% over five years. The company boasts free cash flow positivity and maintains strong interest coverage at 12.9 times EBIT, indicating solid operational efficiency and financial health despite historical earnings challenges averaging a decline of nearly 40% annually over five years.

Wuxi Hodgen Technology (SZSE:300279)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Hodgen Technology Co., Ltd. operates in the intelligent manufacturing and informatization sector in China, with a market capitalization of CN¥3.39 billion.

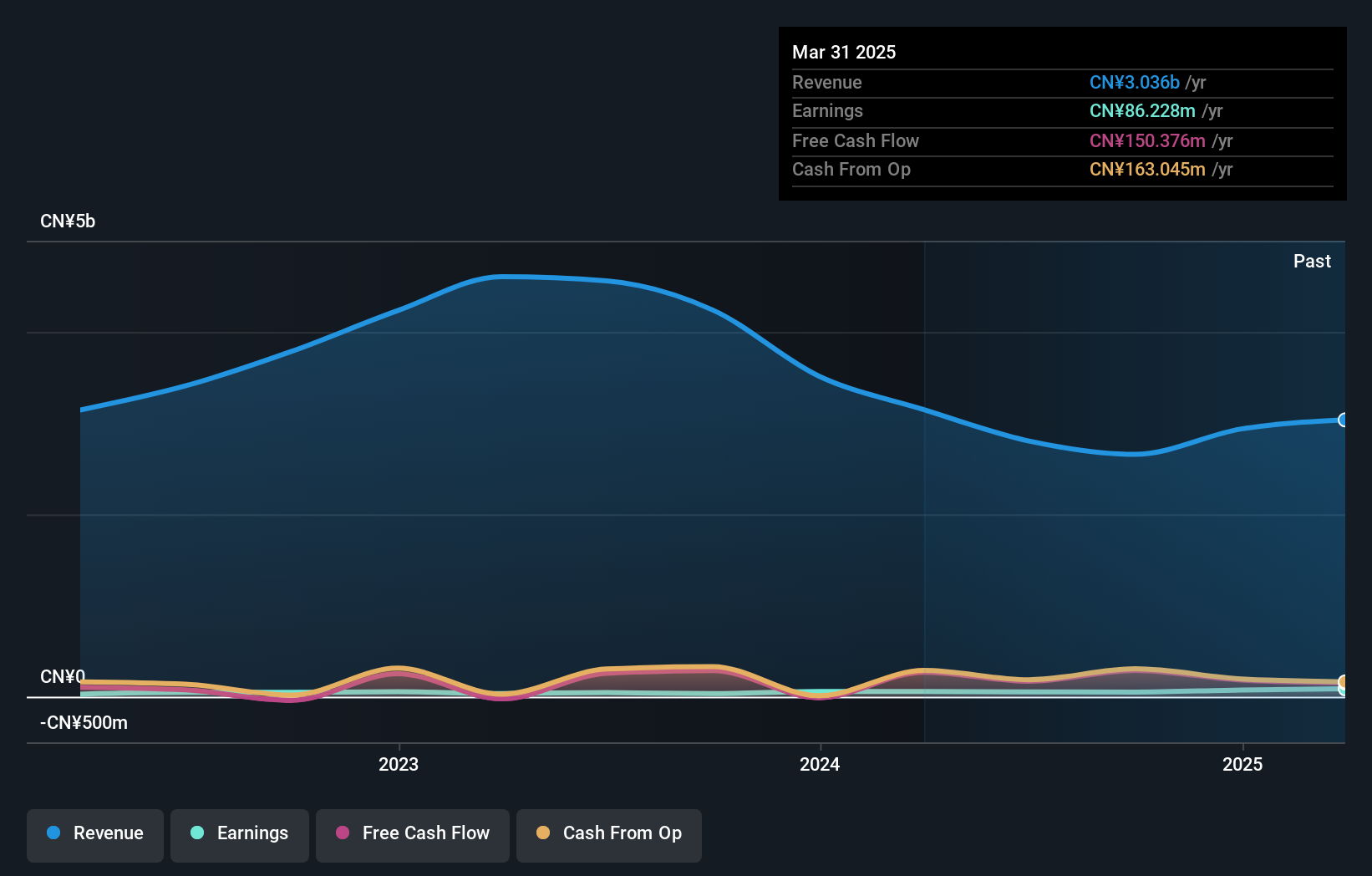

Operations: Wuxi Hodgen Technology generates revenue primarily from its operations in intelligent manufacturing and informatization. The company's financial performance is characterized by a net profit margin that has shown variability over recent periods.

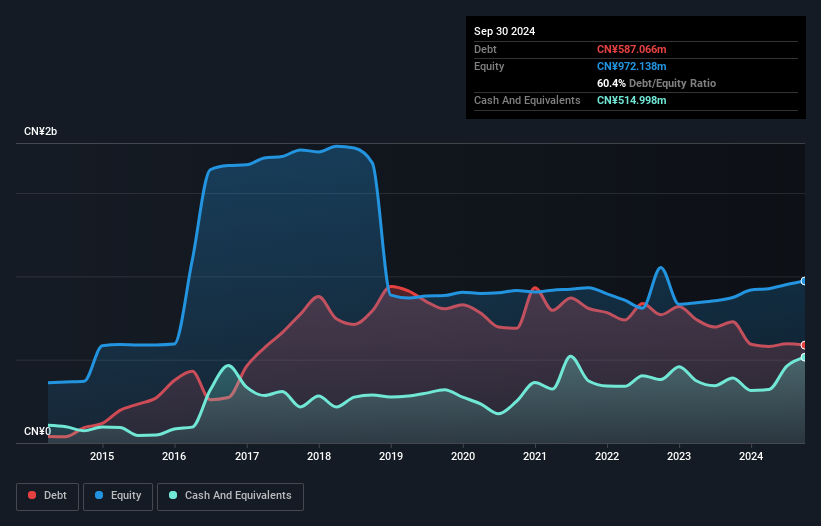

Wuxi Hodgen Technology, a smaller player in the electronics space, has recently become profitable, outpacing the industry's 1.6% growth rate. With an EBIT that covers interest payments 7.8 times over and a debt to equity ratio reduced from 91% to 60.4% over five years, its financial health seems robust. The company is trading at a significant discount of 87.1% below its estimated fair value, suggesting potential for value appreciation. Recent board changes include new independent directors and a non-employee supervisor, indicating strategic shifts that may influence future direction positively or negatively depending on execution.

- Dive into the specifics of Wuxi Hodgen Technology here with our thorough health report.

Assess Wuxi Hodgen Technology's past performance with our detailed historical performance reports.

Voneseals Technology (Shanghai) (SZSE:301161)

Simply Wall St Value Rating: ★★★★★★

Overview: Voneseals Technology (Shanghai) Inc. focuses on the research, development, production, and sale of hydraulic and pneumatic sealing products in China, with a market cap of CN¥2.72 billion.

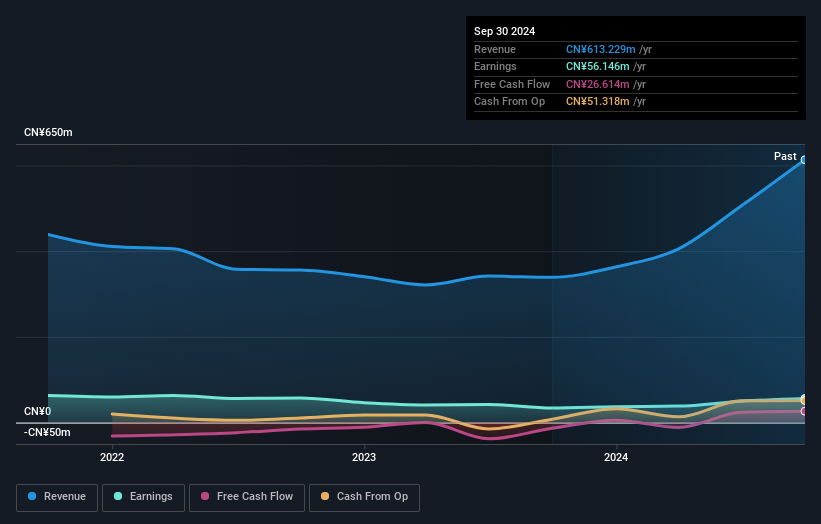

Operations: Voneseals Technology generates revenue primarily from the sale of hydraulic and pneumatic sealing products. The company has observed fluctuations in its net profit margin, which is currently at 12.5%.

Voneseals Technology, a nimble player in the machinery sector, has shown impressive earnings growth of 64.3% over the past year, outpacing the industry average. Despite this surge, earnings have decreased by 11% annually over five years. The company's debt situation appears manageable as it holds more cash than total debt and has reduced its debt-to-equity ratio from 14.6% to 9.3%. Recently announced plans for a share repurchase program valued at CNY 20 million aim to support employee stock ownership and equity incentives, signaling confidence in its financial health and future prospects.

Key Takeaways

- Discover the full array of 4749 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Hodgen Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300279

Wuxi Hodgen Technology

Engages in the intelligent manufacturing and intelligent informatization business in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives