- China

- /

- Electrical

- /

- SZSE:301023

Subdued Growth No Barrier To Jiangnan Yifan Motor Co.,Ltd (SZSE:301023) With Shares Advancing 31%

Jiangnan Yifan Motor Co.,Ltd (SZSE:301023) shares have continued their recent momentum with a 31% gain in the last month alone. The last month tops off a massive increase of 155% in the last year.

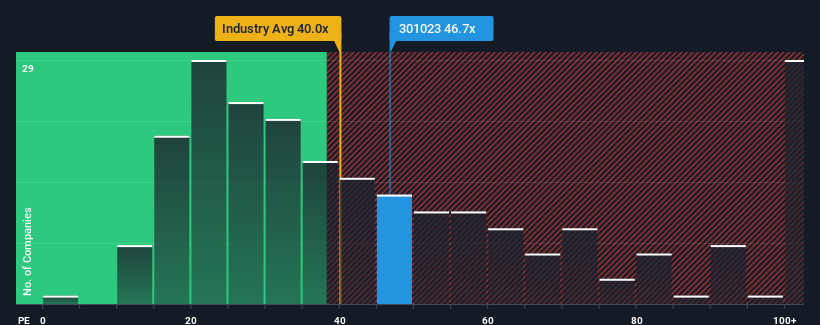

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 38x, you may consider Jiangnan Yifan MotorLtd as a stock to potentially avoid with its 46.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for Jiangnan Yifan MotorLtd as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Jiangnan Yifan MotorLtd

How Is Jiangnan Yifan MotorLtd's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Jiangnan Yifan MotorLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 54% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Jiangnan Yifan MotorLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Jiangnan Yifan MotorLtd's P/E?

Jiangnan Yifan MotorLtd shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Jiangnan Yifan MotorLtd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Jiangnan Yifan MotorLtd is showing 4 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Jiangnan Yifan MotorLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301023

Jiangnan Yifan MotorLtd

Engages in the design, development, manufacture, and sale of gear energy storage motors and operating mechanisms with medium and high voltage switch circuit breaker equipment in China and internationally.

Flawless balance sheet slight.