- Japan

- /

- Basic Materials

- /

- TSE:7821

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a global market landscape marked by fluctuating indices and economic uncertainties, small-cap stocks have recently faced challenges as evidenced by the Russell 2000 Index's continued underperformance against larger peers like the S&P 500. Amidst this backdrop, investors may find opportunities in lesser-known stocks that possess strong fundamentals and potential for growth, making them compelling candidates for further exploration.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Hong Tai Electric Industrial | 0.03% | 11.52% | 12.52% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lion Travel Service | 1.97% | -0.25% | 46.60% | ★★★★★☆ |

| Central Finance | 1.16% | 10.03% | 16.10% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

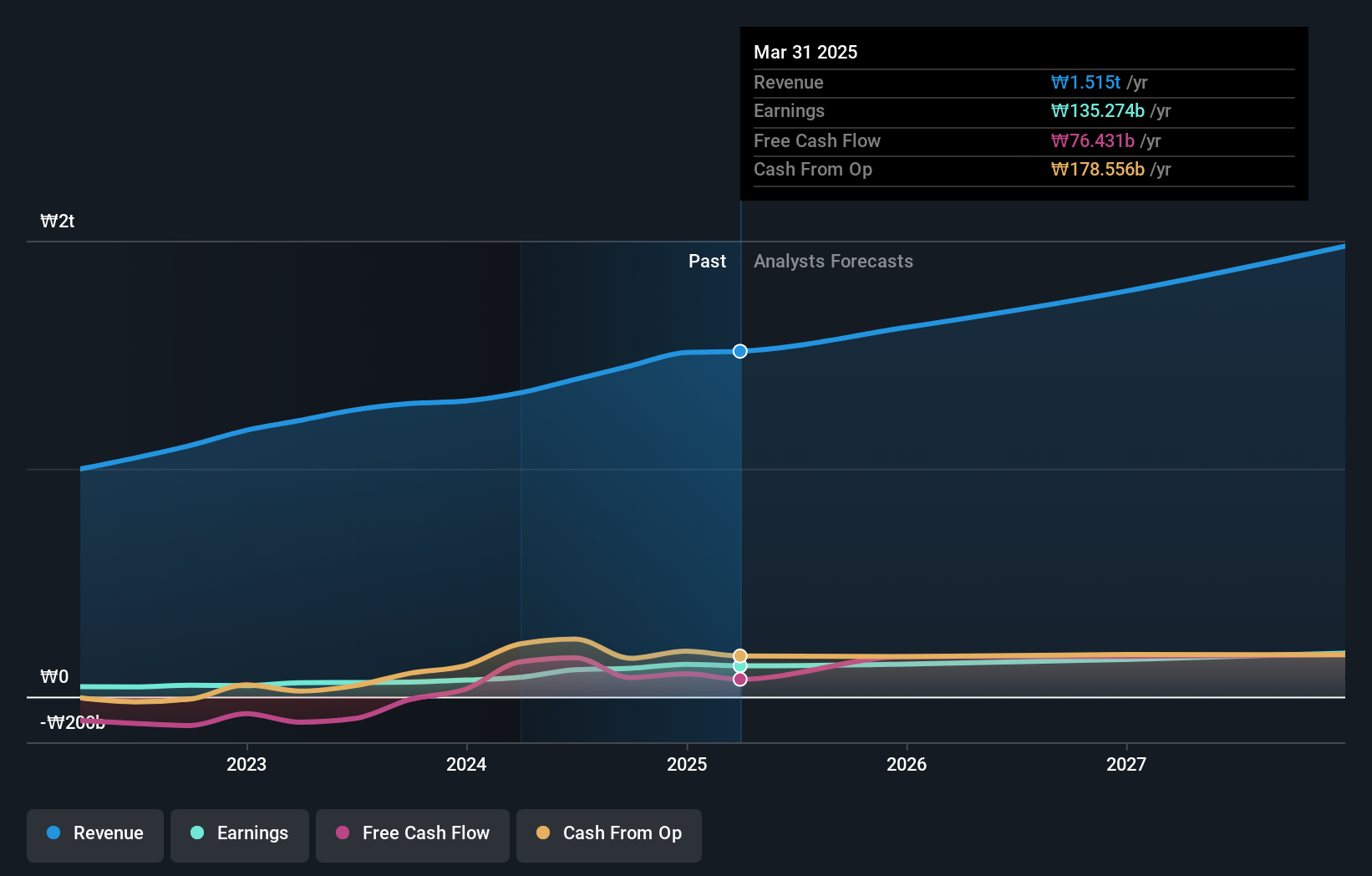

Korea Electric Terminal (KOSE:A025540)

Simply Wall St Value Rating: ★★★★★☆

Overview: Korea Electric Terminal Co., Ltd. manufactures and sells parts for the automotive and electronics industries both in South Korea and internationally, with a market cap of ₩707.61 billion.

Operations: The primary revenue stream for Korea Electric Terminal comes from the automotive and electronics sector, generating approximately ₩1.45 trillion. The company's financial performance can be further analyzed by examining its net profit margin trends over recent periods.

Korea Electric Terminal, a small player in the electrical industry, has shown impressive earnings growth of 94.7% over the past year, significantly outpacing the industry's 14%. Trading at a remarkable 92.3% below its estimated fair value, it offers good relative value compared to peers. Despite an increase in its debt-to-equity ratio from 1.7% to 12.3% over five years, interest payments are well covered by EBIT at a substantial 522 times coverage. The company is free cash flow positive and holds more cash than total debt, indicating financial stability and potential for future growth.

- Click here to discover the nuances of Korea Electric Terminal with our detailed analytical health report.

Learn about Korea Electric Terminal's historical performance.

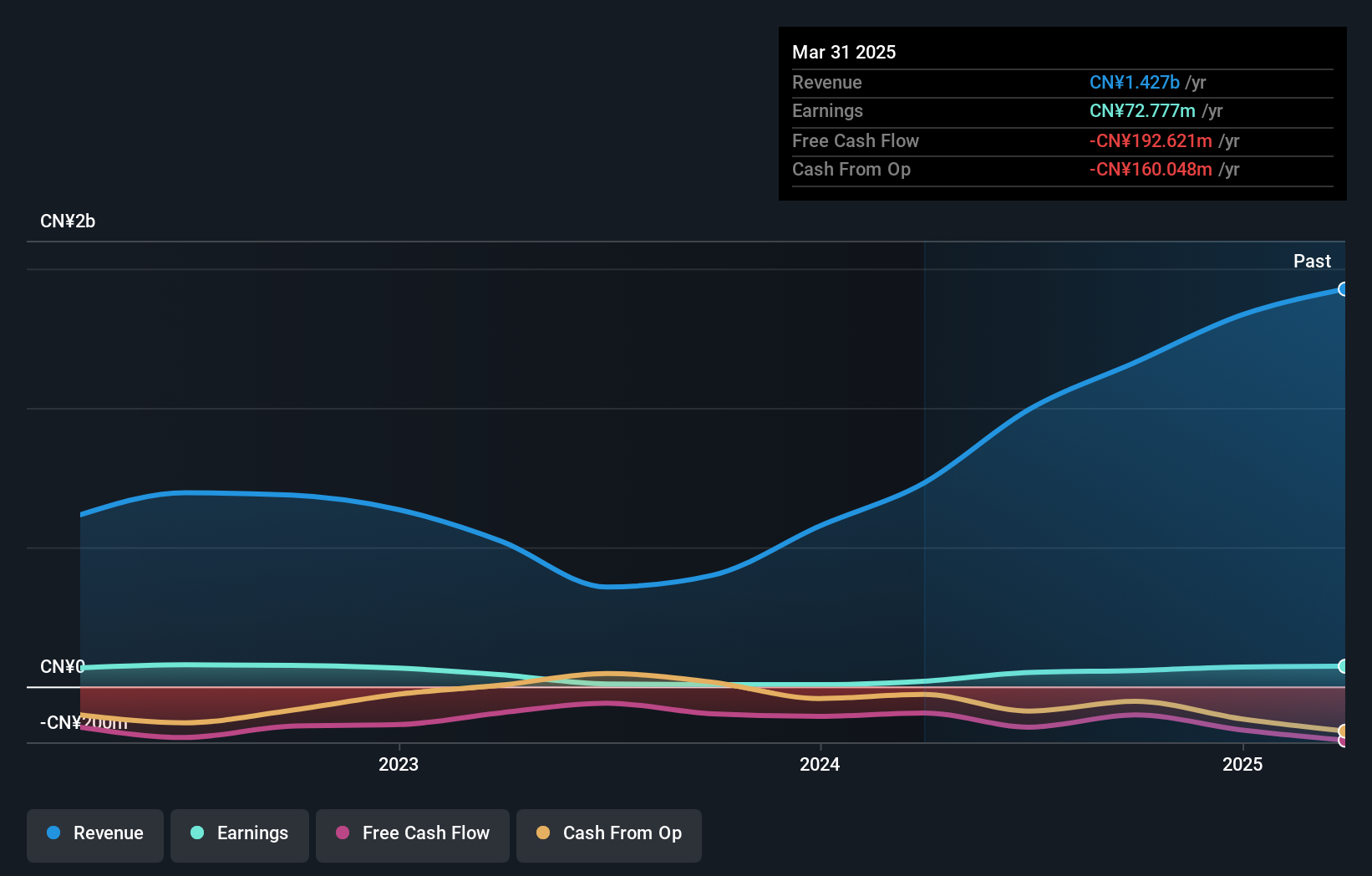

Jiangsu Yangdian Science & Technology (SZSE:301012)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Yangdian Science & Technology Co. is a company with a market cap of CN¥3.55 billion, engaged in operations related to science and technology sectors.

Operations: The company's revenue streams and cost breakdowns are not explicitly detailed in the provided information.

Jiangsu Yangdian Science & Technology has shown impressive growth, with earnings surging by 696% over the past year, significantly outpacing the Electrical industry's 1.1% increase. This small company reported sales of CNY 893.07 million for nine months ending September 2024, a substantial rise from CNY 304.64 million the previous year, while net income jumped to CNY 53.6 million from CNY 2.78 million. The debt-to-equity ratio improved from 33.6% to a more manageable 25.2% over five years, and its interest payments are comfortably covered by EBIT at a rate of nearly seventy-four times coverage, indicating robust financial health despite negative free cash flow trends in recent periods due to capital expenditures reaching up to -CNY113 million as of September this year.

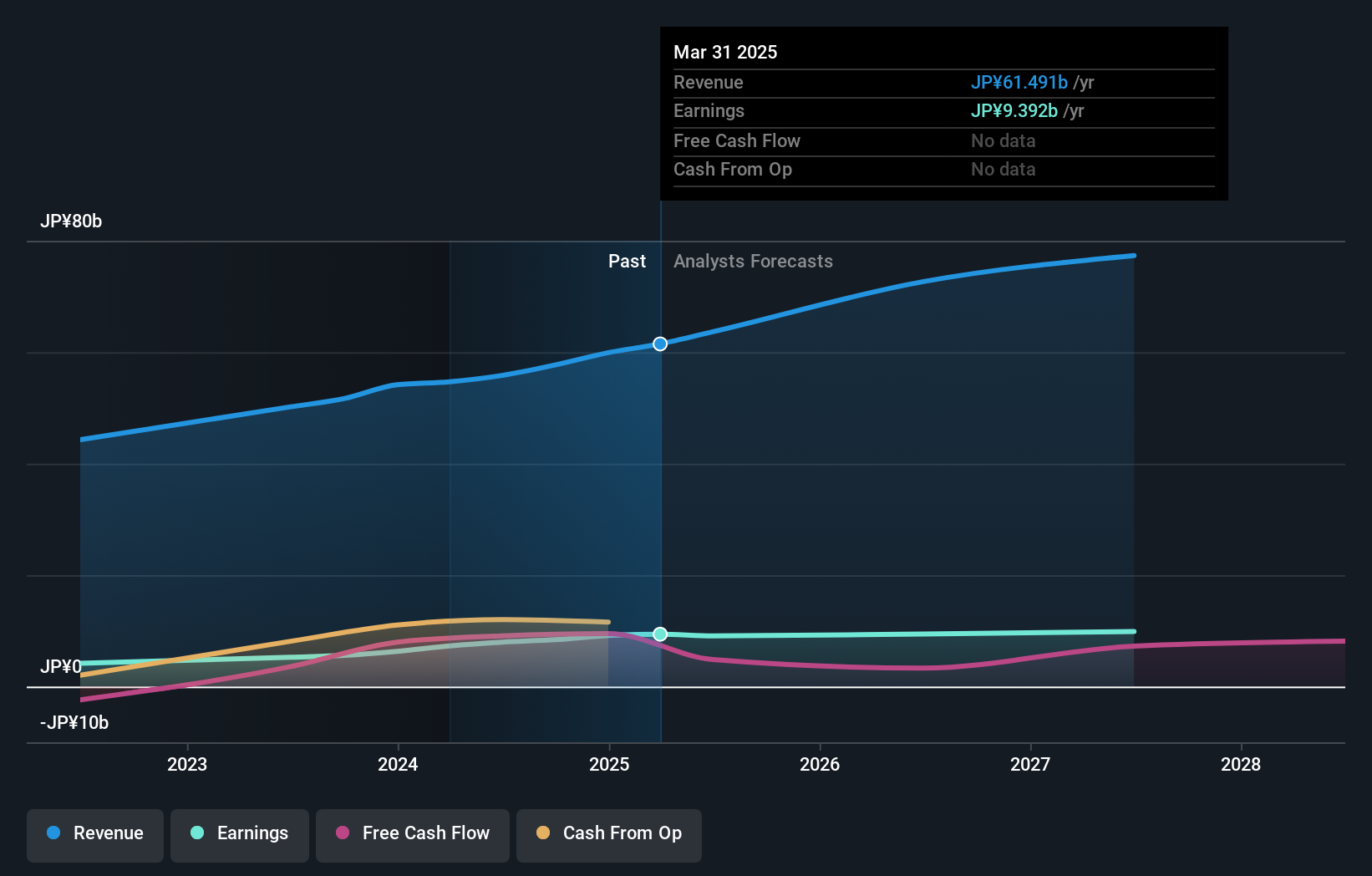

Maeda Kosen (TSE:7821)

Simply Wall St Value Rating: ★★★★★★

Overview: Maeda Kosen Co., Ltd. is a Japanese company that manufactures and sells civil engineering, construction, agricultural materials, and nonwoven fabrics, with a market cap of approximately ¥125.46 billion.

Operations: The company generates revenue primarily from its Social Infrastructure Business and Industry Infrastructure Business, with ¥31.93 billion and ¥25.80 billion respectively.

Maeda Kosen, a smaller player in the industry, has shown impressive growth with earnings rising by 50% over the past year, outpacing the Basic Materials sector's 5%. The company is trading at a significant discount of 43.9% below its estimated fair value. Financially sound, it boasts more cash than total debt and an exceptionally low debt-to-equity ratio of 1.4%, down from 44.1% five years ago. Despite shareholder dilution in the past year, Maeda Kosen's high-quality earnings and strong interest coverage (388x EBIT) highlight its robust financial health and potential for future gains.

- Unlock comprehensive insights into our analysis of Maeda Kosen stock in this health report.

Understand Maeda Kosen's track record by examining our Past report.

Summing It All Up

- Gain an insight into the universe of 4625 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7821

Maeda Kosen

Manufactures and sells civil engineering materials, construction materials, agricultural materials, and nonwoven fabrics in Japan.

Flawless balance sheet with solid track record.