Exploring Three Promising Small Caps in Asia with Strong Fundamentals

Reviewed by Simply Wall St

In recent weeks, Asian markets have experienced a mixed performance, with some regions showing resilience despite global economic uncertainties and others facing challenges from slowing growth. As smaller-cap stocks in Asia continue to navigate these dynamic conditions, investors are increasingly looking for companies with strong fundamentals that can withstand market volatility and capitalize on emerging opportunities. Identifying such promising small caps requires a keen eye for solid financial health and strategic positioning in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Woori Technology Investment | NA | 11.06% | -3.63% | ★★★★★★ |

| Konishi | 0.13% | 1.06% | 11.48% | ★★★★★★ |

| Miwon Chemicals | 0.12% | 10.40% | 16.52% | ★★★★★★ |

| Pacific Construction | 17.46% | -12.87% | 37.11% | ★★★★★☆ |

| FCE | 7.36% | 11.78% | 26.35% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| ASL Marine Holdings | 155.37% | 13.24% | 51.91% | ★★★★☆☆ |

| Shenzhen Leaguer | 61.86% | 0.65% | -18.79% | ★★★★☆☆ |

| ILSEUNG | 34.83% | -10.92% | 30.64% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhou Liu Fu Jewellery (SEHK:6168)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhou Liu Fu Jewellery Co., Ltd. is involved in the research, design, development, manufacture, and retail of jewelry in China with a market capitalization of approximately HK$13.33 billion.

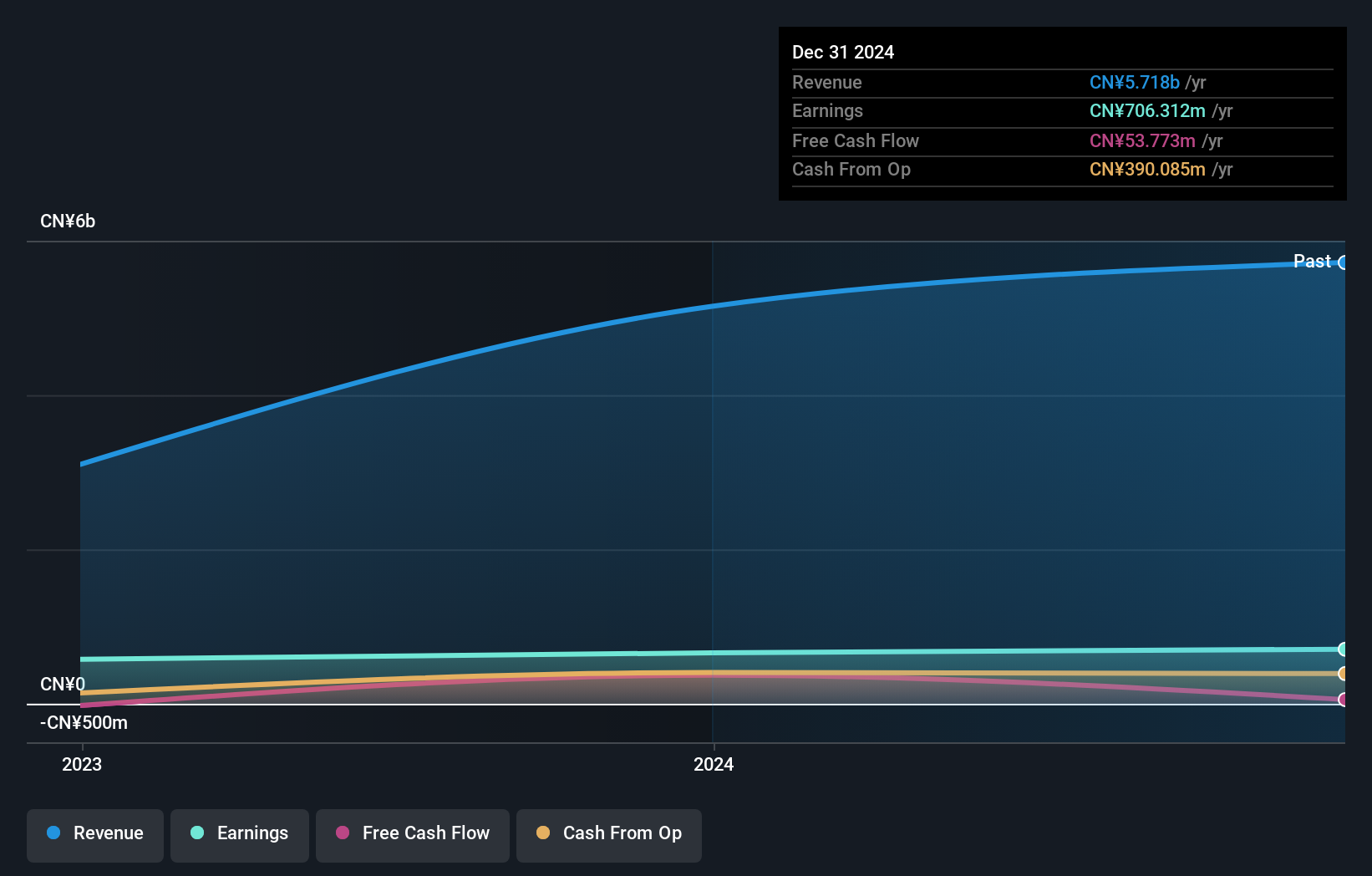

Operations: The primary revenue stream for Zhou Liu Fu Jewellery comes from its jewelry segment, generating CN¥5.87 billion. The company's financial data provides insight into its operations, but specific cost breakdowns and margin trends are not detailed in the available information.

Zhou Liu Fu Jewellery, a smaller player in the jewellery market, has shown promising growth with earnings increasing by 9.9% over the past year, outpacing the industry average. The company recently reported sales of CNY 3.15 billion for the first half of 2025, up from CNY 2.99 billion a year ago, and net income rose to CNY 415 million from CNY 371 million. With an IPO raising HKD 1.29 billion and a robust cash position exceeding total debt, Zhou Liu Fu is well-positioned financially despite its volatile share price in recent months.

Zhejiang Dragon Technology (SHSE:603004)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Dragon Technology Co., Ltd. focuses on the research, development, production, and sale of fine chemical products in China with a market capitalization of CN¥6.21 billion.

Operations: The company's revenue streams are primarily derived from the sale of fine chemical products. It incurs costs related to research, development, and production activities.

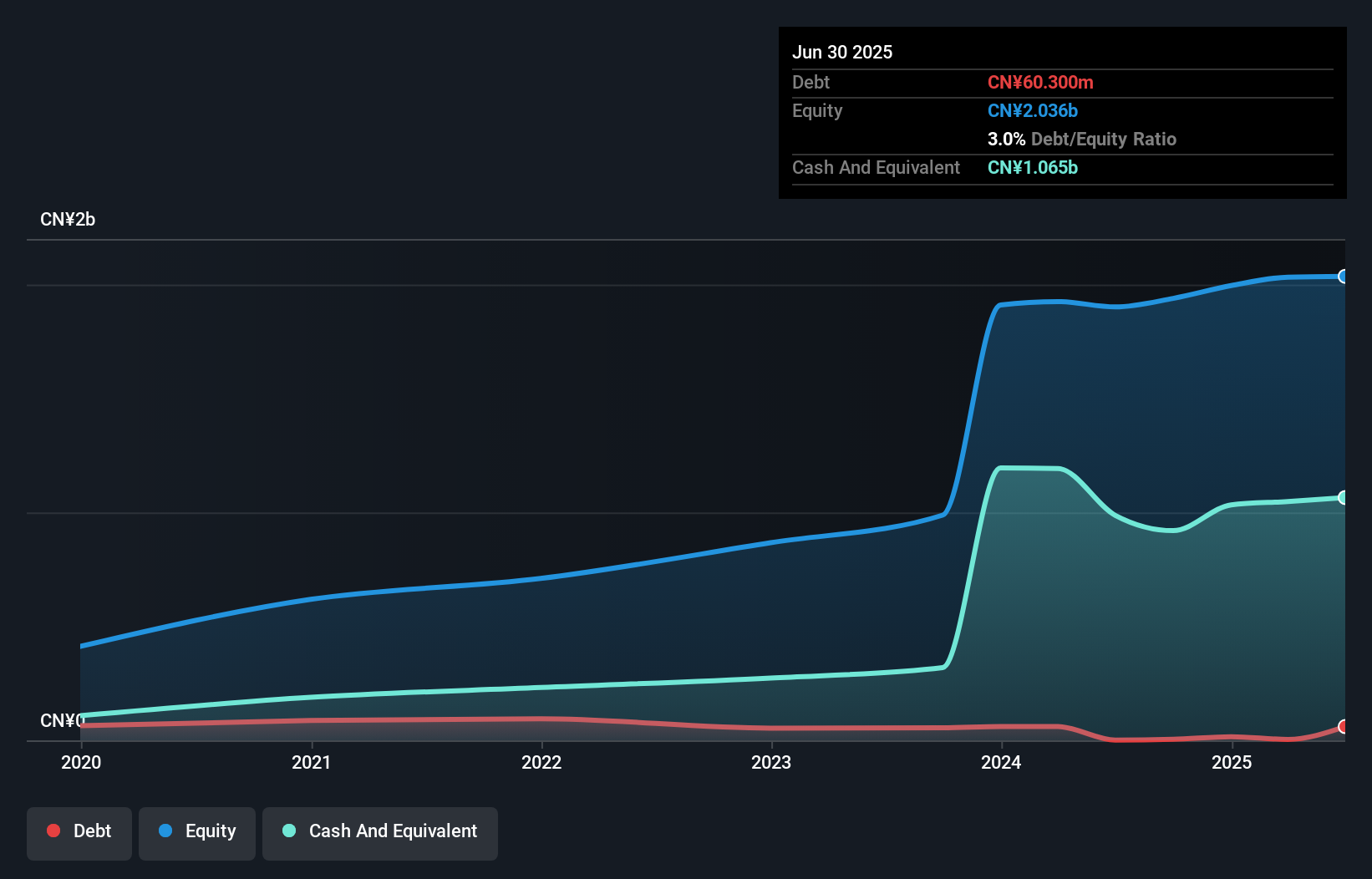

Zhejiang Dragon Technology, a promising player in the Asian market, has shown robust financial health with earnings growth of 12.5% over the past year, surpassing the Chemicals industry's 0.7%. The company reported half-year sales of CNY 350.92 million and net income of CNY 86.34 million, reflecting a solid performance compared to last year's figures. With a price-to-earnings ratio of 34.8x below the CN market average and reduced debt-to-equity from 14.7% to just 3% over five years, it seems well-positioned financially. These factors highlight its potential for continued growth and stability in its sector.

- Click to explore a detailed breakdown of our findings in Zhejiang Dragon Technology's health report.

Zhejiang JW Precision MachineryLtd (SZSE:300984)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang JW Precision Machinery Co., Ltd. focuses on the research, development, production, and sale of bearing rings both in China and internationally, with a market cap of CN¥8.09 billion.

Operations: Zhejiang JW Precision Machinery generates revenue primarily from the sale of bearing rings. The company's financial performance is characterized by a gross profit margin trend that has shown variability over recent periods.

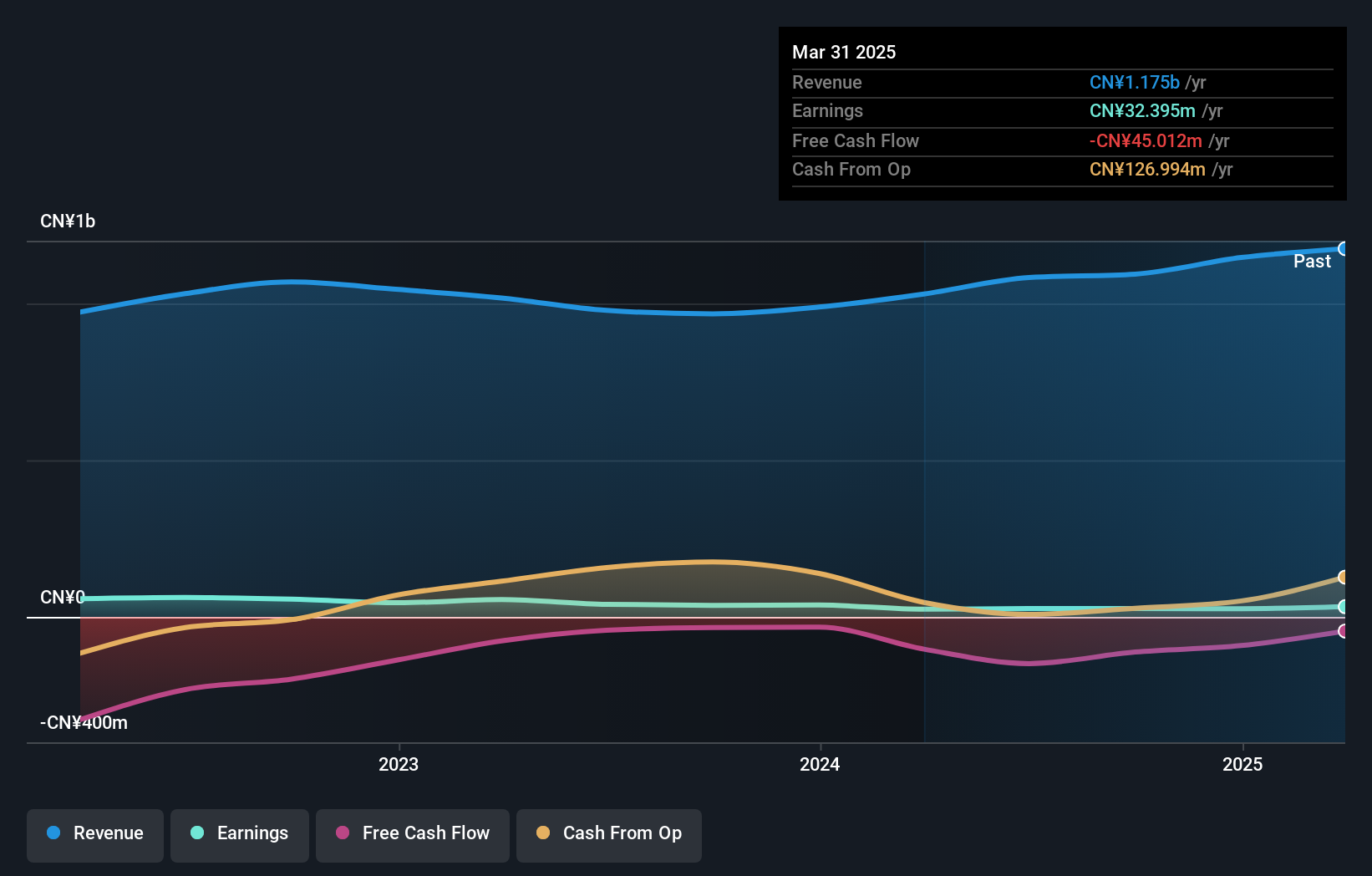

Zhejiang JW Precision Machinery, a compact player in the machinery sector, showcases intriguing financial dynamics. Over the past year, earnings surged by 43%, outpacing the industry average of 3.8%. The company's net income for the first half of 2025 reached CNY 25.47 million, up from CNY 13.13 million a year prior, with revenue climbing to CNY 613.6 million from CNY 568.39 million last year. A satisfactory net debt to equity ratio at 12% underscores prudent financial management while interest payments are well-covered with EBIT at a multiple of 5x interest repayments, reflecting robust operational efficiency despite historical earnings contraction over five years by an annual rate of approximately -20%.

Taking Advantage

- Access the full spectrum of 2406 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dragon Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603004

Zhejiang Dragon Technology

Engages in the research and development, production, and sale of fine chemical products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives