Ningbo Zhenyu Technology Co., Ltd.'s (SZSE:300953) P/E Is Still On The Mark Following 32% Share Price Bounce

Ningbo Zhenyu Technology Co., Ltd. (SZSE:300953) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 7.6% isn't as impressive.

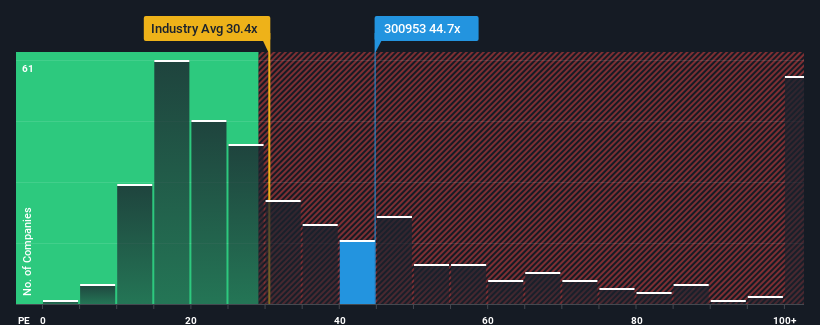

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider Ningbo Zhenyu Technology as a stock to potentially avoid with its 44.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningbo Zhenyu Technology has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Ningbo Zhenyu Technology

Is There Enough Growth For Ningbo Zhenyu Technology?

In order to justify its P/E ratio, Ningbo Zhenyu Technology would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 305% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 39% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 76% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 18% per year growth forecast for the broader market.

With this information, we can see why Ningbo Zhenyu Technology is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ningbo Zhenyu Technology's P/E

The large bounce in Ningbo Zhenyu Technology's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ningbo Zhenyu Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Ningbo Zhenyu Technology has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Ningbo Zhenyu Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo Zhenyu Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300953

Ningbo Zhenyu Technology

Researches, develops, manufactures, and sells lamination dies and precision machining equipment in China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives