Investors Appear Satisfied With Ningbo Zhenyu Technology Co., Ltd.'s (SZSE:300953) Prospects As Shares Rocket 40%

Ningbo Zhenyu Technology Co., Ltd. (SZSE:300953) shares have continued their recent momentum with a 40% gain in the last month alone. The annual gain comes to 279% following the latest surge, making investors sit up and take notice.

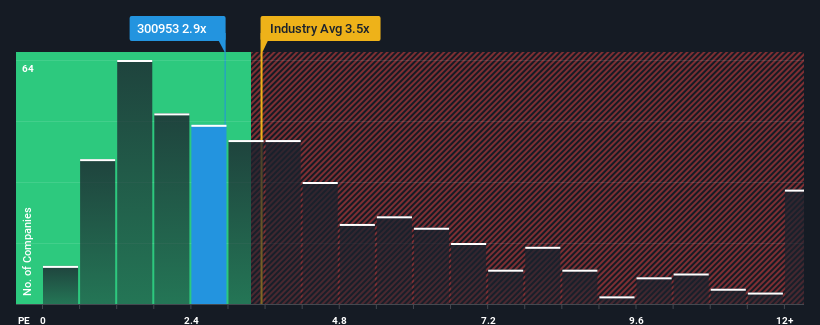

Although its price has surged higher, there still wouldn't be many who think Ningbo Zhenyu Technology's price-to-sales (or "P/S") ratio of 2.9x is worth a mention when the median P/S in China's Machinery industry is similar at about 3.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ningbo Zhenyu Technology

How Has Ningbo Zhenyu Technology Performed Recently?

With revenue growth that's superior to most other companies of late, Ningbo Zhenyu Technology has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Zhenyu Technology.How Is Ningbo Zhenyu Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Ningbo Zhenyu Technology would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Pleasingly, revenue has also lifted 179% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 18% per year over the next three years. That's shaping up to be similar to the 18% per annum growth forecast for the broader industry.

In light of this, it's understandable that Ningbo Zhenyu Technology's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Ningbo Zhenyu Technology's P/S?

Ningbo Zhenyu Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Ningbo Zhenyu Technology maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ningbo Zhenyu Technology you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Zhenyu Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300953

Ningbo Zhenyu Technology

Researches, develops, manufactures, and sells lamination dies and precision machining equipment in China and internationally.

Reasonable growth potential with acceptable track record.