- Taiwan

- /

- Semiconductors

- /

- TPEX:8299

Discover 3 Global Growth Companies With Up To 27% Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic data, investors are increasingly focused on growth opportunities, particularly in sectors like technology where optimism is tempered by valuation concerns. In such an environment, companies with substantial insider ownership can be appealing as they often signal confidence from those closest to the business and align management's interests with shareholders'.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

Let's review some notable picks from our screened stocks.

Beijing Roborock Technology (SHSE:688169)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Roborock Technology Co., Ltd. focuses on the design, research and development, production, and sales of intelligent sweeping robots in China with a market cap of CN¥39.92 billion.

Operations: The company generates its revenue primarily from intelligent cleaning products, amounting to CN¥17.00 billion.

Insider Ownership: 27%

Beijing Roborock Technology is trading at a significant discount to its estimated fair value, with analysts anticipating a 32.3% price rise. Despite profit margins decreasing from the previous year, earnings are expected to grow significantly at 31.8% annually over the next three years, outpacing market averages. Revenue growth is also projected to be robust at 20.1% per year. Recent product launches and innovations highlight the company's commitment to expanding its market presence and technological capabilities.

- Unlock comprehensive insights into our analysis of Beijing Roborock Technology stock in this growth report.

- The valuation report we've compiled suggests that Beijing Roborock Technology's current price could be quite moderate.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. operates in the technology sector, focusing on the development and manufacturing of interconnect solutions, with a market cap of CN¥16.72 billion.

Operations: The company generates revenue primarily from the Digital Communication Cable Industry, amounting to CN¥2.01 billion.

Insider Ownership: 24.2%

Zhejiang Zhaolong Interconnect Technology is poised for robust growth, with earnings expected to increase significantly at 46.67% annually over the next three years, surpassing market averages. Revenue is forecast to grow at a rapid 31% per year. Recent amendments to the company's articles of association indicate strategic adjustments, while earnings for the nine months ended September 2025 showed strong performance with net income rising to CNY 138.21 million from CNY 89.85 million year-on-year.

- Click to explore a detailed breakdown of our findings in Zhejiang Zhaolong Interconnect TechnologyLtd's earnings growth report.

- Upon reviewing our latest valuation report, Zhejiang Zhaolong Interconnect TechnologyLtd's share price might be too optimistic.

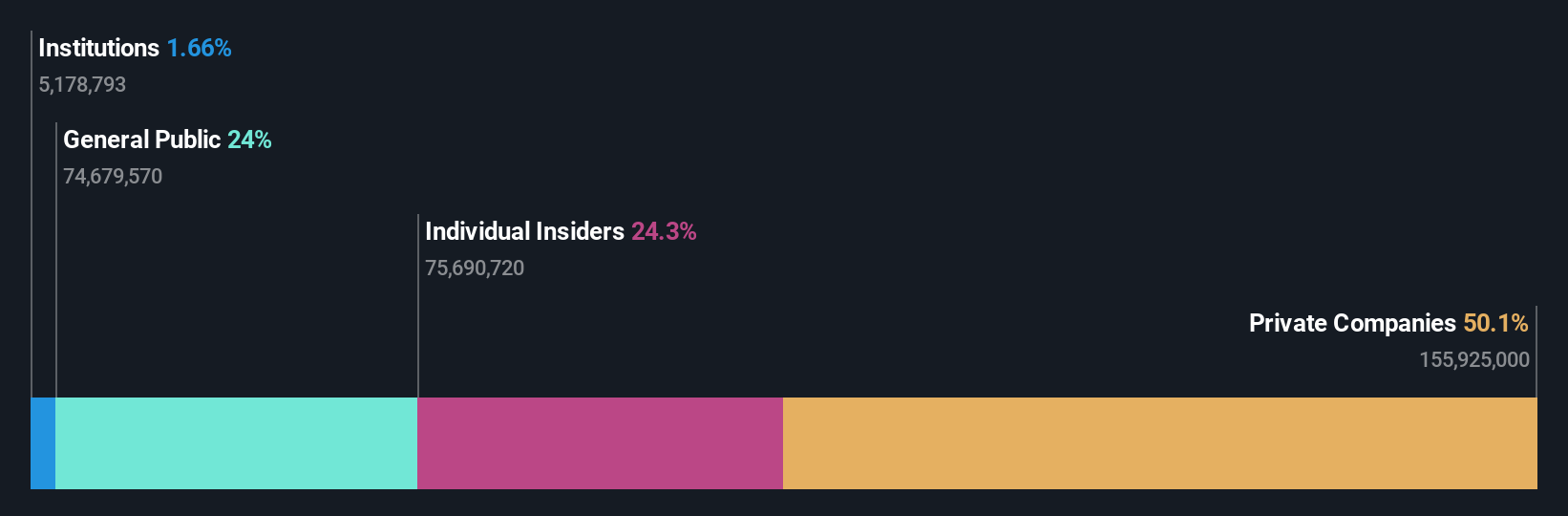

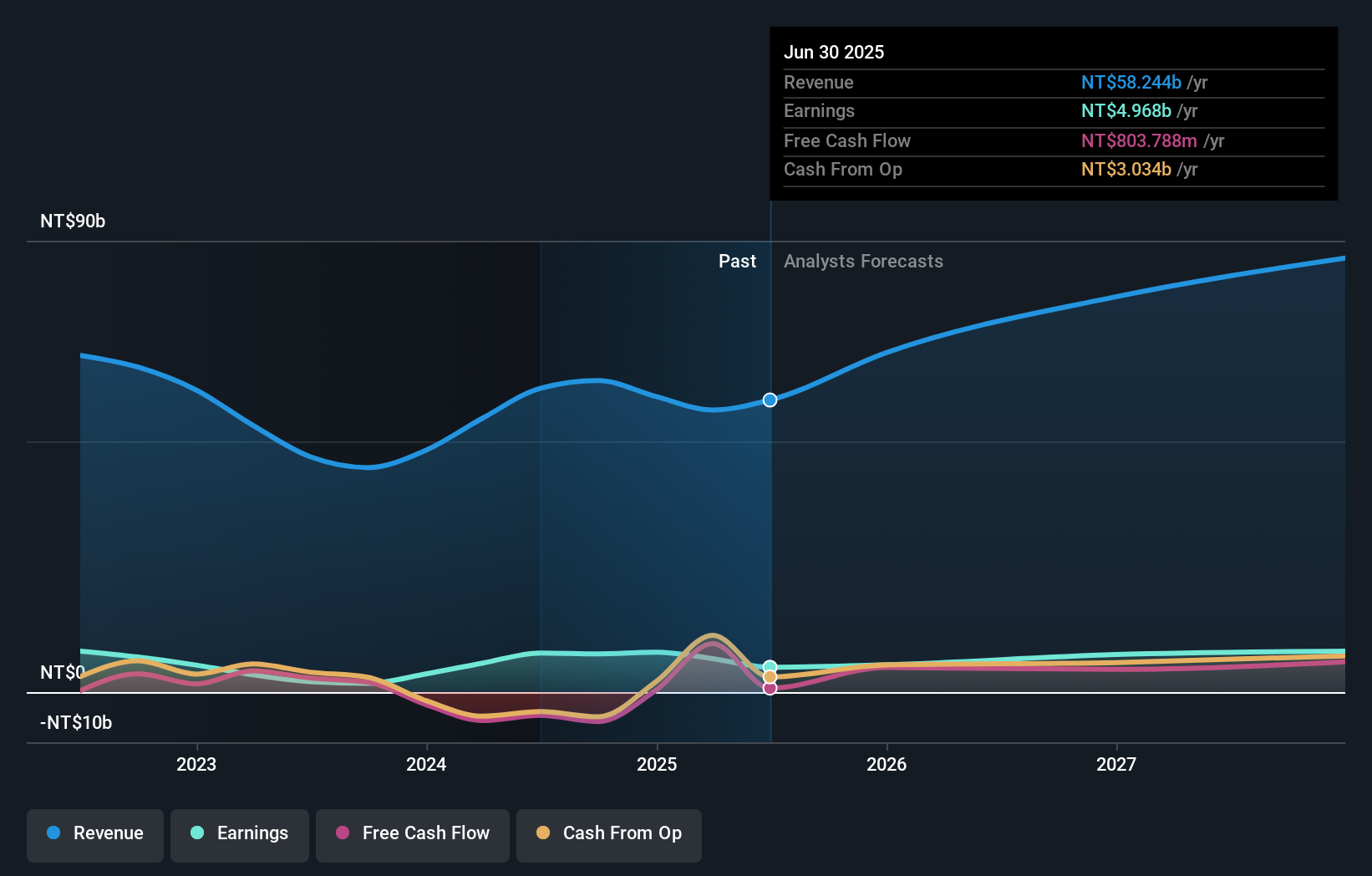

Phison Electronics (TPEX:8299)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Phison Electronics Corp., along with its subsidiaries, designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$222.67 billion.

Operations: The company's revenue from flash memory control chip design amounts to NT$62.44 billion.

Insider Ownership: 10.9%

Phison Electronics is set for substantial growth, with earnings forecast to rise significantly at 24.3% annually, outpacing the TW market. Revenue is expected to grow faster than 20% per year. The company recently launched cutting-edge PCIe Gen5 enterprise SSDs and AI solutions, enhancing its position in data-intensive applications and AI infrastructure. Despite trading below fair value, Phison's dividend isn't well covered by free cash flow, and share price volatility remains high.

- Click here to discover the nuances of Phison Electronics with our detailed analytical future growth report.

- Our valuation report here indicates Phison Electronics may be undervalued.

Key Takeaways

- Unlock our comprehensive list of 859 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8299

Phison Electronics

Designs, manufactures, and sells flash memory controllers and peripheral system applications in Asia, the United States, Europe, Australia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026