Take Care Before Jumping Onto Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) Even Though It's 26% Cheaper

Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

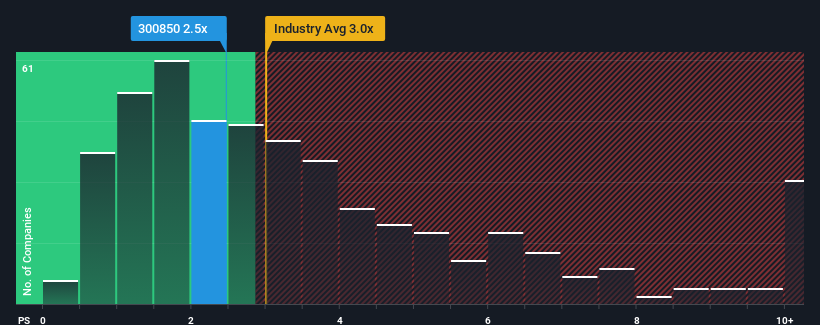

In spite of the heavy fall in price, it's still not a stretch to say that Luoyang Xinqianglian Slewing Bearing's price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Luoyang Xinqianglian Slewing Bearing

What Does Luoyang Xinqianglian Slewing Bearing's P/S Mean For Shareholders?

Luoyang Xinqianglian Slewing Bearing hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Luoyang Xinqianglian Slewing Bearing.Is There Some Revenue Growth Forecasted For Luoyang Xinqianglian Slewing Bearing?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Luoyang Xinqianglian Slewing Bearing's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 30% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this information, we find it interesting that Luoyang Xinqianglian Slewing Bearing is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Luoyang Xinqianglian Slewing Bearing's P/S

With its share price dropping off a cliff, the P/S for Luoyang Xinqianglian Slewing Bearing looks to be in line with the rest of the Machinery industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Luoyang Xinqianglian Slewing Bearing's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 1 warning sign for Luoyang Xinqianglian Slewing Bearing that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300850

Luoyang Xinqianglian Slewing Bearing

Luoyang Xinqianglian Slewing Bearing Co., Ltd.

High growth potential with adequate balance sheet.