A Piece Of The Puzzle Missing From Luoyang Xinqianglian Slewing Bearing Co., Ltd.'s (SZSE:300850) 25% Share Price Climb

Those holding Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

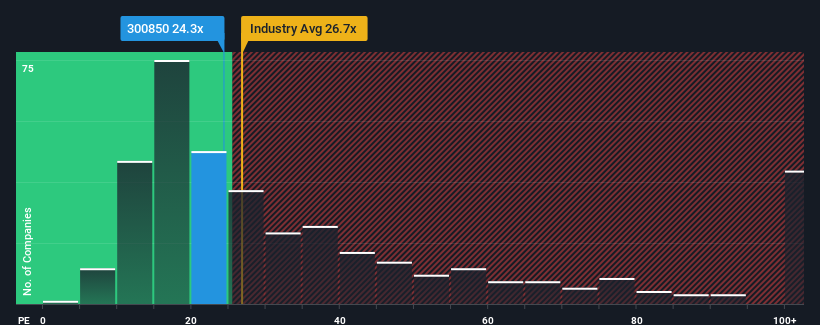

In spite of the firm bounce in price, Luoyang Xinqianglian Slewing Bearing's price-to-earnings (or "P/E") ratio of 24.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 53x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Luoyang Xinqianglian Slewing Bearing has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Luoyang Xinqianglian Slewing Bearing

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Luoyang Xinqianglian Slewing Bearing's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.4% last year. Still, lamentably EPS has fallen 54% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 94% as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 36%, which is noticeably less attractive.

In light of this, it's peculiar that Luoyang Xinqianglian Slewing Bearing's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Luoyang Xinqianglian Slewing Bearing's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Luoyang Xinqianglian Slewing Bearing currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Luoyang Xinqianglian Slewing Bearing (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Luoyang Xinqianglian Slewing Bearing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300850

Luoyang Xinqianglian Slewing Bearing

Luoyang Xinqianglian Slewing Bearing Co., Ltd.

High growth potential with adequate balance sheet.