- China

- /

- Electrical

- /

- SZSE:002076

3 Promising Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

As global markets navigate mixed performances, with U.S. stocks showing resilience despite some year-end slumps, investors are keenly observing opportunities that might arise from these fluctuations. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors due to their affordability and potential for growth. Despite being considered a niche area today, penny stocks can offer significant value when backed by strong financials; here we examine several such stocks that stand out for their financial health and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Gohigh NetworksLtd (SZSE:000851)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gohigh Networks Co., Ltd. operates in China, focusing on digital intelligence applications, information services, and IT sales, with a market capitalization of CN¥3.50 billion.

Operations: The company generates revenue of CN¥3.38 billion from its operations within China.

Market Cap: CN¥3.5B

Gohigh Networks Co., Ltd. has faced significant challenges, with a sharp decline in revenue to CN¥1.51 billion for the first nine months of 2024 from CN¥4.06 billion a year ago, resulting in a net loss of CN¥62.91 million. The company is unprofitable and has seen its losses increase at an annual rate of 74.8% over the past five years, though it maintains short-term assets exceeding both short and long-term liabilities, suggesting some financial stability. The board's lack of experience and limited cash runway are concerns for potential investors in this volatile sector.

- Unlock comprehensive insights into our analysis of Gohigh NetworksLtd stock in this financial health report.

- Learn about Gohigh NetworksLtd's historical performance here.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cnlight Co., Ltd is a company that manufactures and sells lighting products in China, with a market cap of CN¥3.01 billion.

Operations: Cnlight Co., Ltd has not reported any revenue segments.

Market Cap: CN¥3.01B

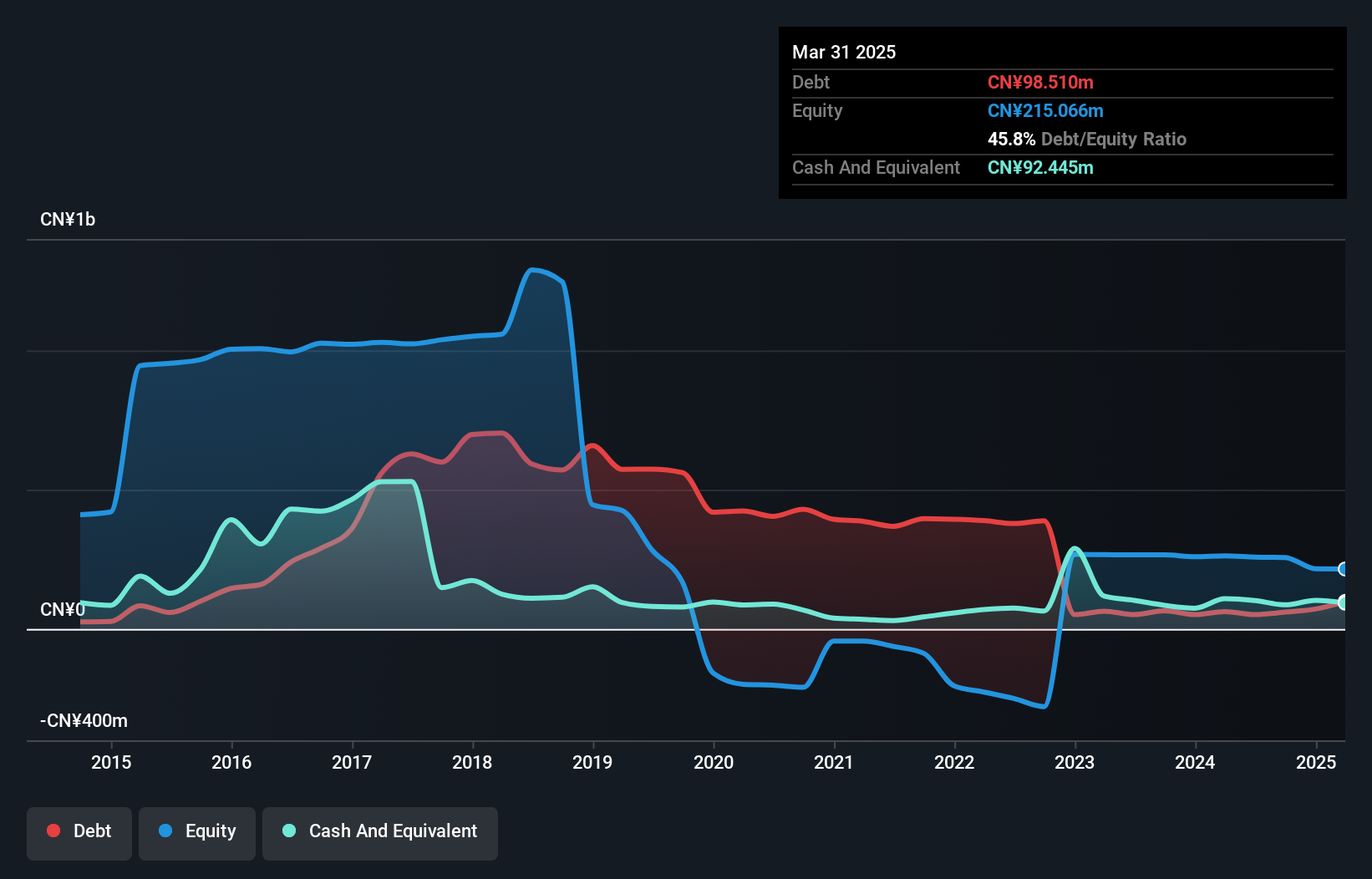

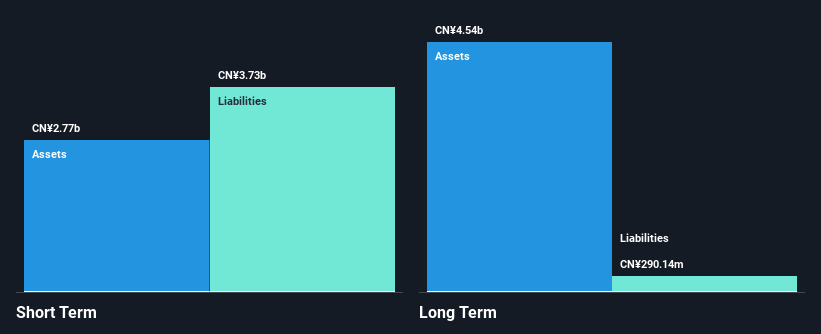

Cnlight Co., Ltd has shown some resilience despite being unprofitable, with a reduction in net loss from CN¥7.08 million to CN¥2.05 million over the past year, indicating progress in cost management. The company reported sales of CN¥123.98 million for the first nine months of 2024, reflecting growth from the previous year. Its financial position is stable with short-term assets of CN¥267.8 million covering both short and long-term liabilities, and it holds more cash than total debt. However, its cash runway is less than a year and share price volatility remains high, posing risks for investors seeking stability in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of CnlightLtd.

- Gain insights into CnlightLtd's past trends and performance with our report on the company's historical track record.

Suzhou Victory Precision Manufacture (SZSE:002426)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Suzhou Victory Precision Manufacture Co., Ltd. operates in the precision manufacturing industry and has a market cap of approximately CN¥9.94 billion.

Operations: Suzhou Victory Precision Manufacture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥9.94B

Suzhou Victory Precision Manufacture Co., Ltd. has made strides in reducing its losses, reporting a net loss of CN¥28.65 million for the first nine months of 2024, down from CN¥147.69 million the previous year, indicating improved cost management despite ongoing unprofitability. The company completed a share buyback program totaling 15 million shares for CN¥27.34 million, signaling confidence in its valuation amidst high share price volatility over recent months. While it maintains sufficient cash runway exceeding three years and short-term assets surpassing long-term liabilities, its high debt levels and uncovered short-term liabilities pose financial challenges that investors should consider carefully.

- Get an in-depth perspective on Suzhou Victory Precision Manufacture's performance by reading our balance sheet health report here.

- Assess Suzhou Victory Precision Manufacture's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our Penny Stocks list of 5,810 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002076

Adequate balance sheet very low.

Market Insights

Community Narratives