- China

- /

- Electrical

- /

- SZSE:300827

After Leaping 36% Sineng Electric Co.,Ltd. (SZSE:300827) Shares Are Not Flying Under The Radar

Those holding Sineng Electric Co.,Ltd. (SZSE:300827) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

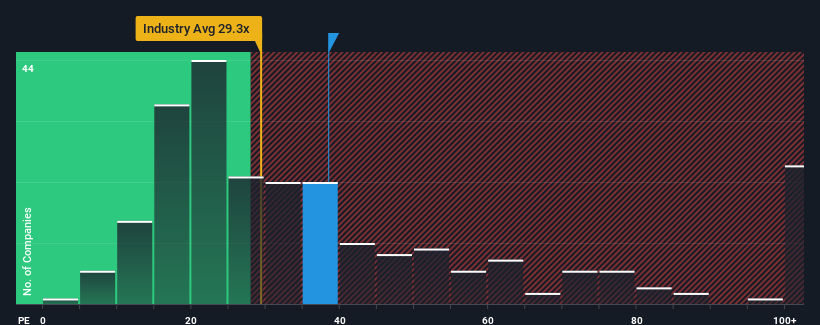

Following the firm bounce in price, Sineng ElectricLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 38.4x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Sineng ElectricLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Sineng ElectricLtd

Is There Enough Growth For Sineng ElectricLtd?

The only time you'd be truly comfortable seeing a P/E as high as Sineng ElectricLtd's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 316% gain to the company's bottom line. Pleasingly, EPS has also lifted 128% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 143% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we can see why Sineng ElectricLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The large bounce in Sineng ElectricLtd's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sineng ElectricLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Sineng ElectricLtd (1 doesn't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300827

Sineng ElectricLtd

Engages in the research and development, manufacture, maintenance, and trading of power electronic products in the People's Republic of China and internationally.

Exceptional growth potential with proven track record.