In the midst of a volatile week for global markets, with U.S. stocks experiencing fluctuations due to AI competition fears and mixed earnings reports, small-cap stocks have been navigating their own unique challenges and opportunities. As investors seek stability amid economic uncertainties such as steady interest rates from the Federal Reserve and tariff concerns, identifying promising small-cap companies can offer potential growth avenues. In this environment, a good stock often possesses strong fundamentals, innovative capabilities, or operates in niche markets that may not be immediately impacted by broader market turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Abu Dhabi National Insurance Company PJSC (ADX:ADNIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi National Insurance Company PJSC offers a range of insurance and reinsurance products to both individuals and businesses in the UAE and beyond, with a market cap of AED3.78 billion.

Operations: ADNIC generates revenue primarily through its diverse portfolio of insurance and reinsurance products. The company's net profit margin is a key financial metric, reflecting the profitability of its operations.

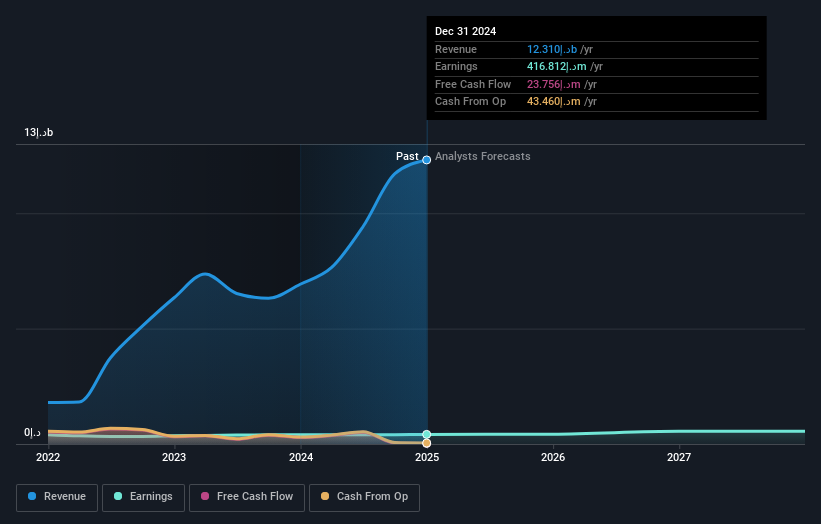

Abu Dhabi National Insurance Company (ADNIC) showcases a compelling profile with its earnings growth of 3.9% over the past year, outpacing the insurance industry's 3.4%. Despite a dip in net profit margins from 5.8% to 3.4%, ADNIC remains an attractive proposition with a price-to-earnings ratio of 9x, lower than the AE market's average of 13.3x, indicating potential value. The company is debt-free and has consistently demonstrated high-quality earnings, ensuring robust financial health and stability in its operations. Recent annual net income reached AED 416.81 million, up from AED 401.16 million last year, affirming steady performance improvements.

Anhui Higasket PlasticsLtd (SHSE:603150)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anhui Higasket Plastics Co., Ltd. specializes in the manufacturing and sale of refrigerator door seals in China, with a market cap of CN¥2.45 billion.

Operations: Anhui Higasket Plastics Co., Ltd. generates revenue primarily from manufacturing and selling refrigerator door seals in China. The company has a market cap of CN¥2.45 billion, indicating its valuation in the market.

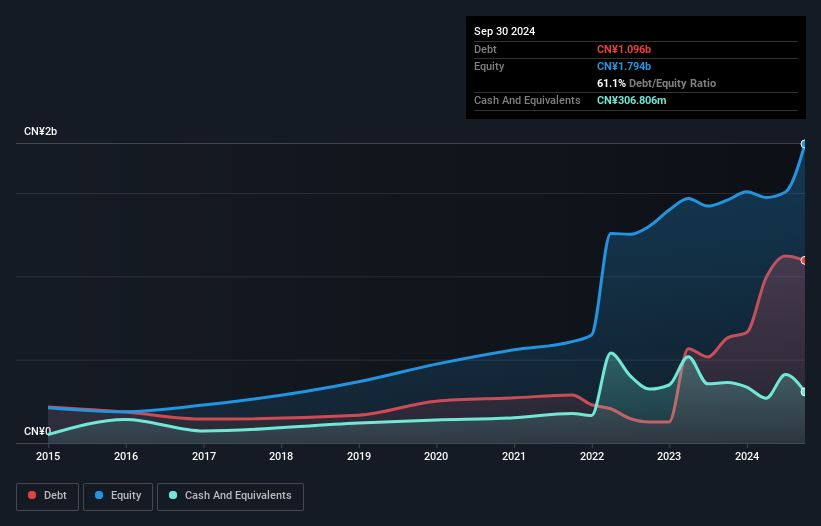

Anhui Higasket Plastics, a smaller player in the market, shows promise with earnings growth of 3.4% over the past year, outpacing the overall Chemicals industry which saw a -5.4% change. The company boasts high-quality earnings and maintains a price-to-earnings ratio of 19x, which is favorable compared to China's market average of 35.8x. Despite this positive outlook, its debt situation is notable; the net debt to equity ratio stands at 44%, indicating a high level of leverage that has increased from 52.6% to 61.1% in five years, suggesting careful monitoring is necessary moving forward.

Shenzhen Bestek Technology (SZSE:300822)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Bestek Technology Co., Ltd. specializes in the research, development, manufacture, and sale of smart controllers and products both in China and internationally, with a market cap of CN¥8.36 billion.

Operations: Bestek Technology generates revenue primarily from the sale of smart controllers and related products. The company has a market capitalization of CN¥8.36 billion.

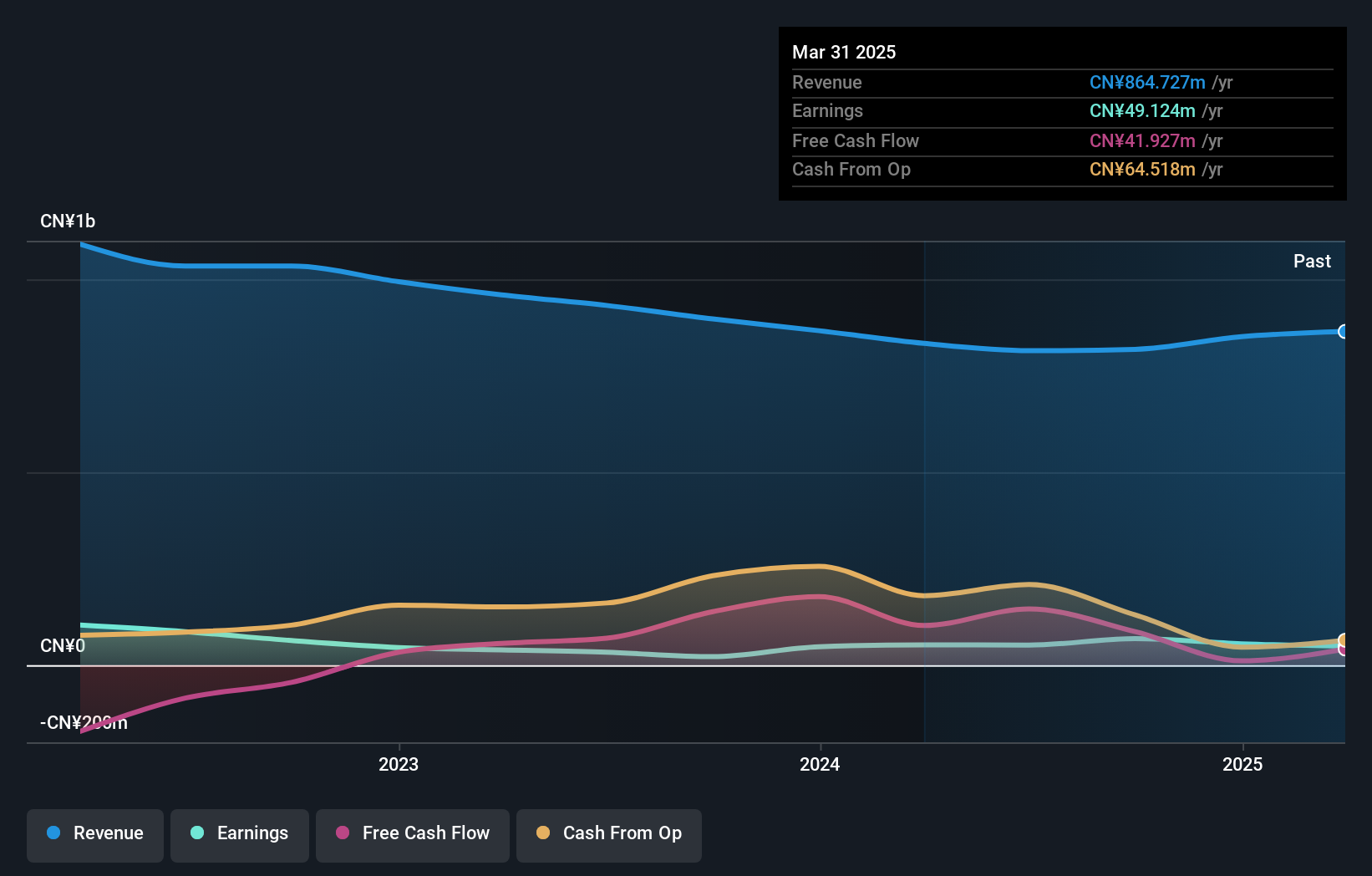

Shenzhen Bestek Technology has seen a remarkable earnings growth of 213% over the past year, outpacing the Electrical industry by a significant margin. Despite this, its earnings have decreased by 31% annually over the last five years. The company is debt-free now, having reduced its debt from a debt-to-equity ratio of 0.6 five years ago. With high-quality past earnings and positive free cash flow, Bestek appears to be on solid financial footing; however, its share price has been highly volatile recently. This volatility could present both challenges and opportunities for investors looking at this dynamic player in technology manufacturing.

Make It Happen

- Click through to start exploring the rest of the 4721 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603150

Anhui Higasket PlasticsLtd

Manufactures and sells refrigerator door seals in China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives