Here's Why We Think Hiecise Precision EquipmentLtd (SZSE:300809) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hiecise Precision EquipmentLtd (SZSE:300809). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Hiecise Precision EquipmentLtd

How Quickly Is Hiecise Precision EquipmentLtd Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Hiecise Precision EquipmentLtd has achieved impressive annual EPS growth of 58%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

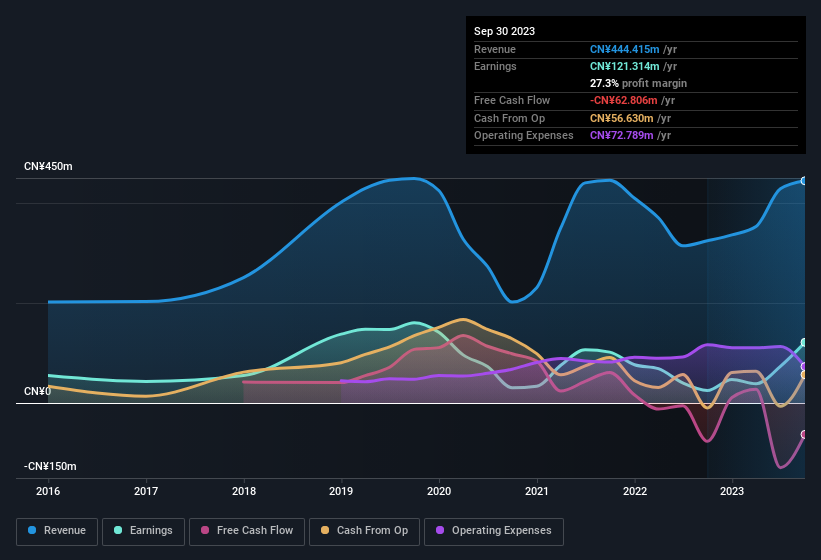

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Hiecise Precision EquipmentLtd is growing revenues, and EBIT margins improved by 19.5 percentage points to 15%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Hiecise Precision EquipmentLtd's forecast profits?

Are Hiecise Precision EquipmentLtd Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Hiecise Precision EquipmentLtd insiders own a meaningful share of the business. In fact, they own 64% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. at the current share price. This is an incredible endorsement from them.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Hiecise Precision EquipmentLtd with market caps between CN¥2.9b and CN¥12b is about CN¥914k.

The Hiecise Precision EquipmentLtd CEO received CN¥600k in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Hiecise Precision EquipmentLtd Worth Keeping An Eye On?

Hiecise Precision EquipmentLtd's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Hiecise Precision EquipmentLtd is worth considering carefully. What about risks? Every company has them, and we've spotted 2 warning signs for Hiecise Precision EquipmentLtd (of which 1 is potentially serious!) you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hiecise Precision EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300809

Hiecise Precision EquipmentLtd

Engages in the research and development, production, and sale of automatic high-precision CNC rolling grinders in China and internationally.

Flawless balance sheet with high growth potential.