As global markets grapple with inflation concerns and political uncertainties, small-cap stocks have notably underperformed, with the Russell 2000 Index entering correction territory. Amid this volatile backdrop, investors are increasingly looking for hidden opportunities in lesser-known stocks that show potential resilience and growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Limak Dogu Anadolu Cimento Sanayi ve Ticaret Anonim Sirketi (IBSE:LMKDC)

Simply Wall St Value Rating: ★★★★★★

Overview: Limak Dogu Anadolu Cimento Sanayi ve Ticaret Anonim Sirketi is a company that produces and sells cement and clinker products in Turkey, with a market cap of TRY17.48 billion.

Operations: Limak Dogu Anadolu Cimento generates revenue primarily from its cement sales, amounting to TRY3.19 billion. The company's financial performance is influenced by its cost structure and market dynamics, impacting its profitability metrics such as the gross profit margin.

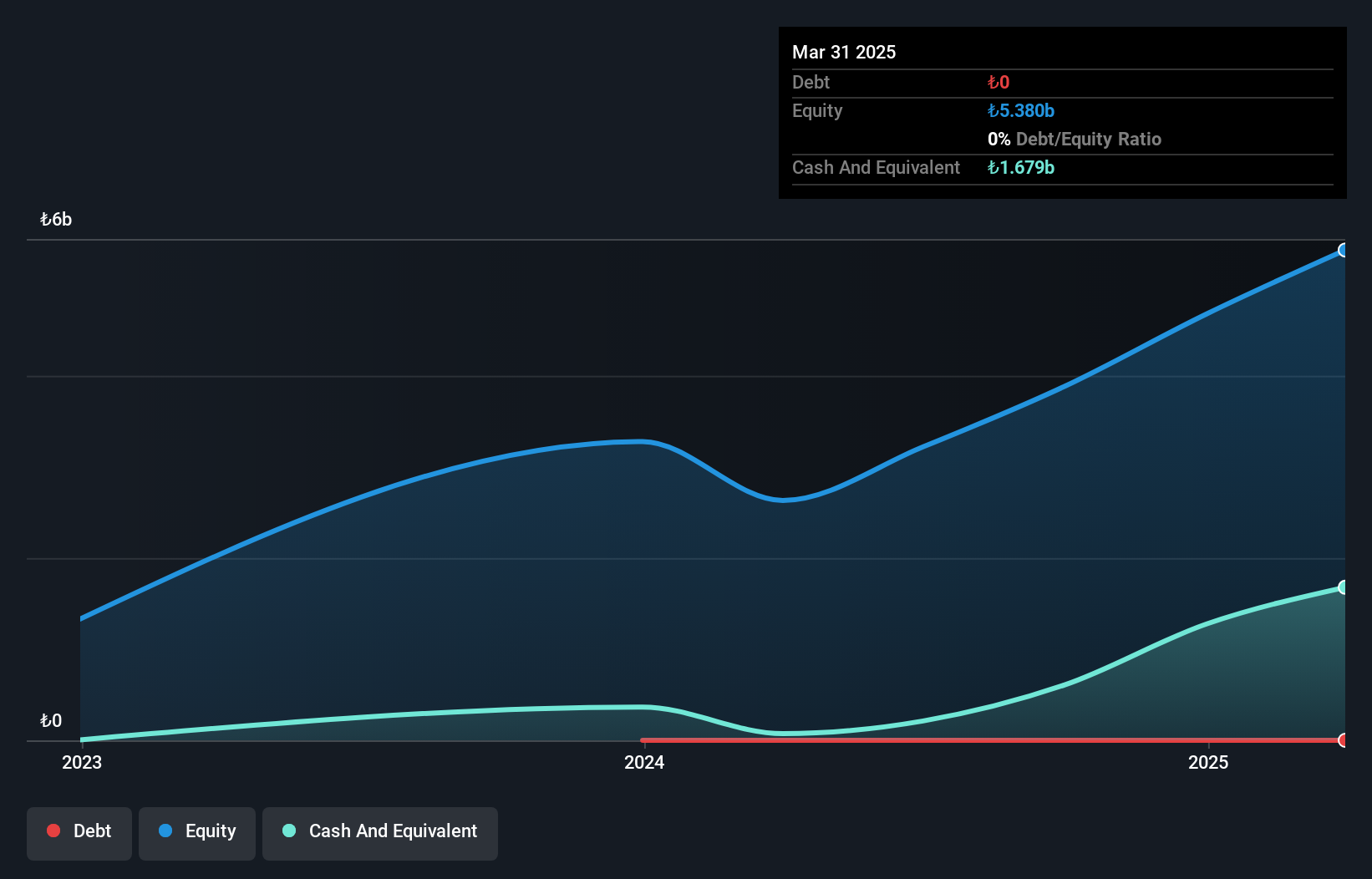

Limak Dogu Anadolu Cimento, operating in the cement sector, showcases robust financial health with no debt over the past five years and a notable earnings growth of 33.5% last year, outpacing the industry average of 19.4%. Despite a dip in third-quarter sales to TRY 1,540.94 million from TRY 1,598.23 million and net income dropping to TRY 377.08 million from TRY 490.16 million compared to last year, nine-month figures reveal improved sales at TRY 4,275.09 million and net income at TRY 1,569 million versus prior results. Trading significantly below its fair value estimate by nearly half suggests potential undervaluation opportunities for investors seeking undiscovered gems in emerging markets like Turkey's cement industry.

Guizhou Guihang Automotive ComponentsLtd (SHSE:600523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guizhou Guihang Automotive Components Co., Ltd, along with its subsidiaries, focuses on the research, development, production, and sale of automotive parts both in China and globally, with a market capitalization of CN¥4.83 billion.

Operations: Revenue streams for Guizhou Guihang Automotive Components primarily arise from the sale of automotive parts, both domestically and internationally. The company's net profit margin has shown a notable trend, reflecting its operational efficiency and cost management strategies.

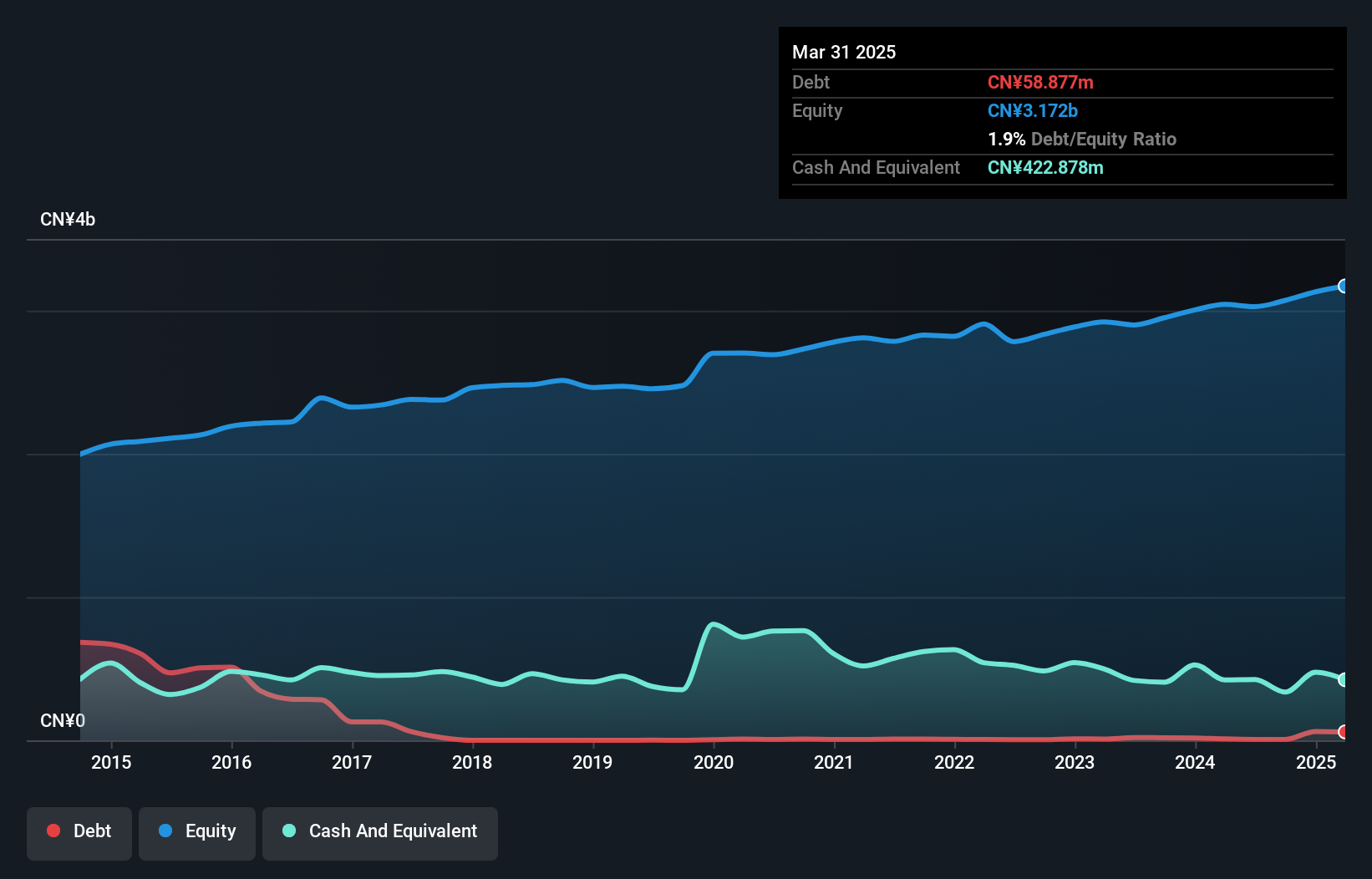

Guizhou Guihang Automotive Components, a smaller player in the auto components industry, has shown notable earnings growth of 19% over the past year, outpacing the industry average of 10%. The company reported sales of CN¥1.72 billion for the nine months ending September 2024, slightly up from CN¥1.69 billion year-on-year. Despite a debt to equity ratio increase to 0.2% over five years, it holds more cash than total debt and maintains interest coverage comfortably. However, a significant one-off gain of CN¥50 million influenced recent results and free cash flow remains negative.

- Click to explore a detailed breakdown of our findings in Guizhou Guihang Automotive ComponentsLtd's health report.

Learn about Guizhou Guihang Automotive ComponentsLtd's historical performance.

Jiamei Food Packaging (Chuzhou)Ltd (SZSE:002969)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiamei Food Packaging (Chuzhou) Co., Ltd specializes in the research, development, production, design, and sale of beverage packaging containers in China with a market capitalization of CN¥3.08 billion.

Operations: Jiamei Food Packaging generates revenue primarily from the sale of beverage packaging containers. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency in managing production and sales costs.

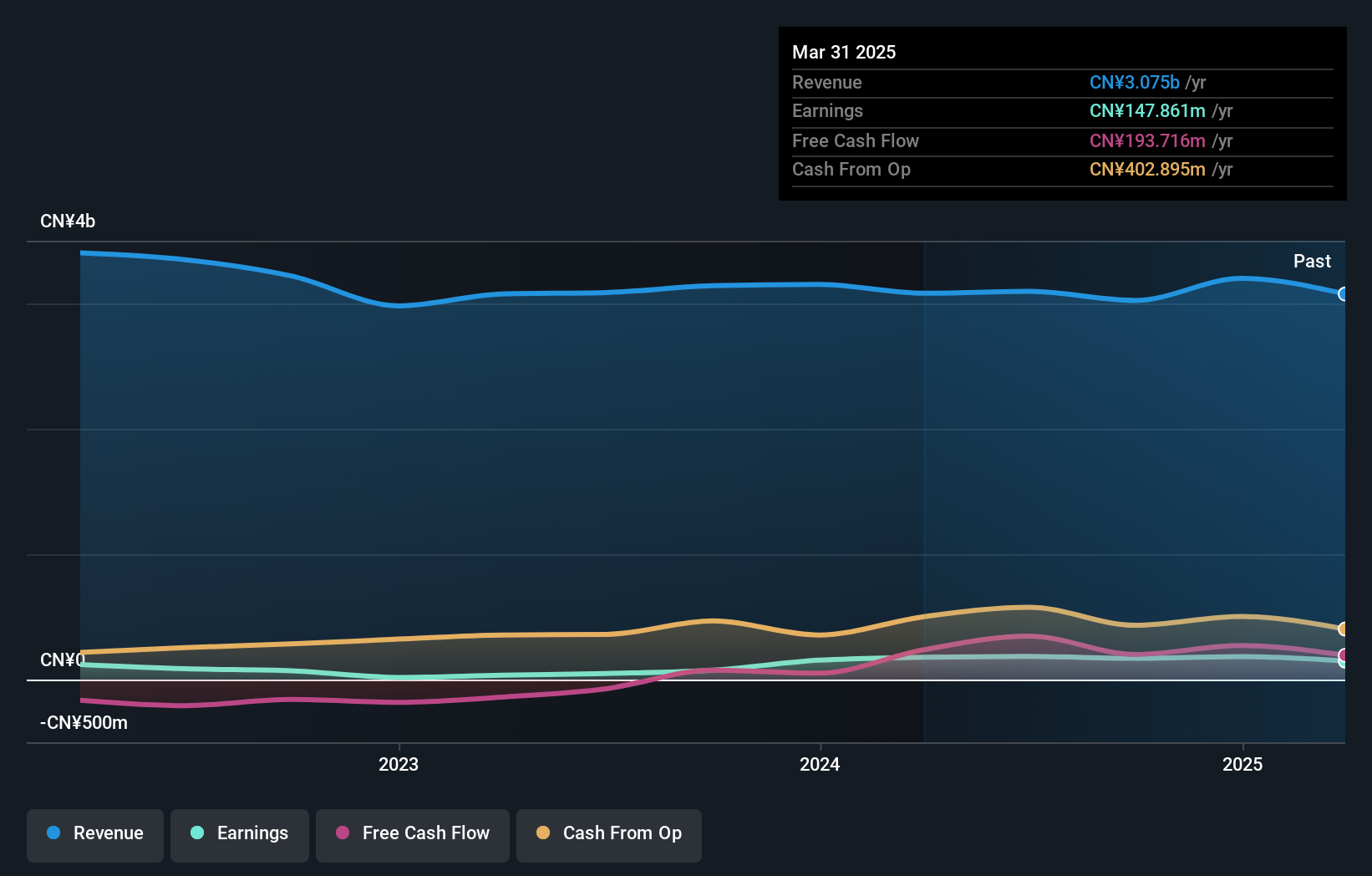

Jiamei Food Packaging, a smaller player in the packaging industry, showcases a satisfactory net debt to equity ratio of 22.7%, indicating prudent financial management. Their price-to-earnings ratio stands at 18.1x, notably below the CN market average of 33.4x, suggesting potential undervaluation. Over the past year, earnings growth hit an impressive 125.8%, outpacing the industry's 16.7%. Recent developments include amendments to company bylaws and plans for share repurchase through centralized bidding as discussed in their recent extraordinary shareholders meetings. Despite sales dipping to CNY 2 billion from CNY 2 billion last year, net income rose to CNY 74 million from CNY 59 million previously.

Where To Now?

- Discover the full array of 4568 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002969

Jiamei Food Packaging (Chuzhou)Ltd

Researches, develops, produces, designs, and sells beverage packaging containers in China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026