- China

- /

- Electrical

- /

- SZSE:300750

There Is A Reason Contemporary Amperex Technology Co., Limited's (SZSE:300750) Price Is Undemanding

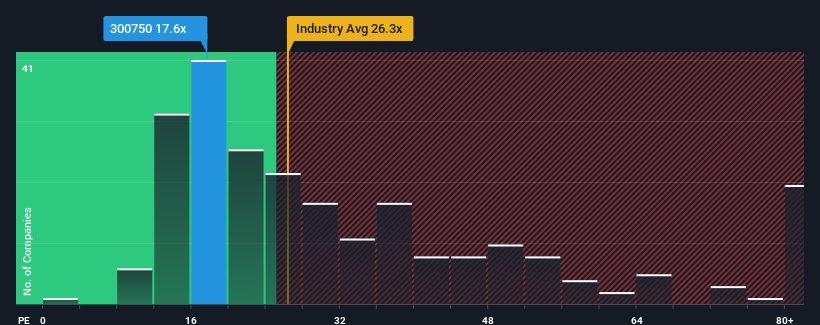

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may consider Contemporary Amperex Technology Co., Limited (SZSE:300750) as an attractive investment with its 17.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Contemporary Amperex Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Contemporary Amperex Technology

How Is Contemporary Amperex Technology's Growth Trending?

Contemporary Amperex Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 7.0% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 437% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 17% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 20% per annum, which is noticeably more attractive.

With this information, we can see why Contemporary Amperex Technology is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Contemporary Amperex Technology's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Contemporary Amperex Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Contemporary Amperex Technology that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300750

Contemporary Amperex Technology

Engages in the development, production, sale, and after-sales service of power and energy storage batteries, and battery materials in China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives