- China

- /

- Aerospace & Defense

- /

- SZSE:300719

Beijing Andawell Science & Technology Co., Ltd. (SZSE:300719) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Beijing Andawell Science & Technology Co., Ltd. (SZSE:300719) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 93%.

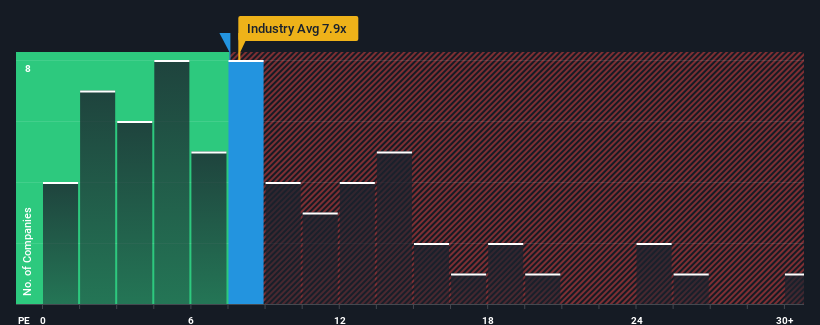

Even after such a large jump in price, it's still not a stretch to say that Beijing Andawell Science & Technology's price-to-sales (or "P/S") ratio of 7.5x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in China, where the median P/S ratio is around 7.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Beijing Andawell Science & Technology

What Does Beijing Andawell Science & Technology's Recent Performance Look Like?

Beijing Andawell Science & Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Beijing Andawell Science & Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Beijing Andawell Science & Technology's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beijing Andawell Science & Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 88% gain to the company's top line. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 32% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Beijing Andawell Science & Technology's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Beijing Andawell Science & Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Andawell Science & Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Beijing Andawell Science & Technology (3 are a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Andawell Science & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300719

Beijing Andawell Science & Technology

Beijing Andawell Science & Technology Co., Ltd.

Adequate balance sheet and slightly overvalued.