- China

- /

- Electrical

- /

- SZSE:300660

Optimistic Investors Push Jiangsu Leili Motor Co., Ltd (SZSE:300660) Shares Up 42% But Growth Is Lacking

Jiangsu Leili Motor Co., Ltd (SZSE:300660) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

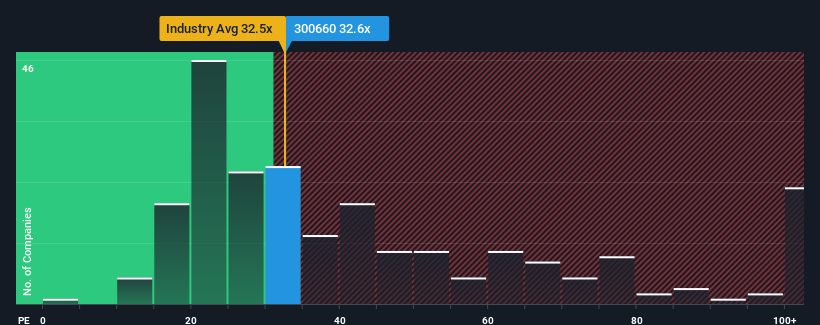

Although its price has surged higher, it's still not a stretch to say that Jiangsu Leili Motor's price-to-earnings (or "P/E") ratio of 32.6x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Jiangsu Leili Motor as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Jiangsu Leili Motor

What Are Growth Metrics Telling Us About The P/E?

Jiangsu Leili Motor's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

With this information, we find it interesting that Jiangsu Leili Motor is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Jiangsu Leili Motor's P/E

Jiangsu Leili Motor's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jiangsu Leili Motor currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Jiangsu Leili Motor has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Jiangsu Leili Motor. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300660

Jiangsu Leili Motor

Engages in the research and development, production, and sale of household appliances, micro motors, and intelligent components in China and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives