- China

- /

- Electrical

- /

- SZSE:300660

Jiangsu Leili Motor Co., Ltd (SZSE:300660) Stock Rockets 31% But Many Are Still Ignoring The Company

Those holding Jiangsu Leili Motor Co., Ltd (SZSE:300660) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 7.0% isn't as attractive.

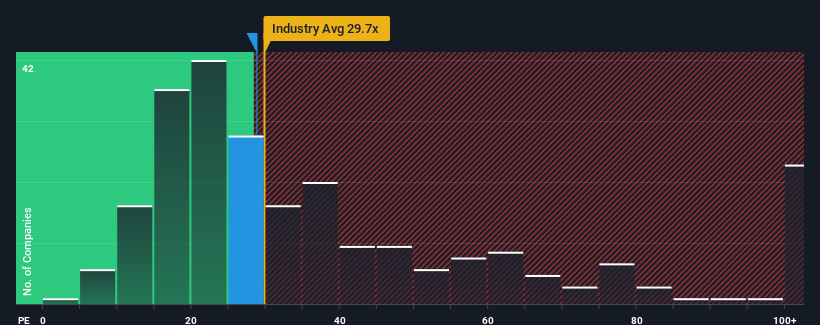

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Jiangsu Leili Motor's P/E ratio of 28.8x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Jiangsu Leili Motor as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Jiangsu Leili Motor

Does Growth Match The P/E?

Jiangsu Leili Motor's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. The latest three year period has also seen a 13% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it interesting that Jiangsu Leili Motor is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Jiangsu Leili Motor's P/E

Jiangsu Leili Motor appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jiangsu Leili Motor's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Jiangsu Leili Motor is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Jiangsu Leili Motor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300660

Jiangsu Leili Motor

Engages in the research and development, production, and sale of household appliances, micro motors, and intelligent components in China and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives