- China

- /

- Electrical

- /

- SZSE:300626

Huarui Electrical Appliance Co.,Ltd. (SZSE:300626) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

Huarui Electrical Appliance Co.,Ltd. (SZSE:300626) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 22% in that time.

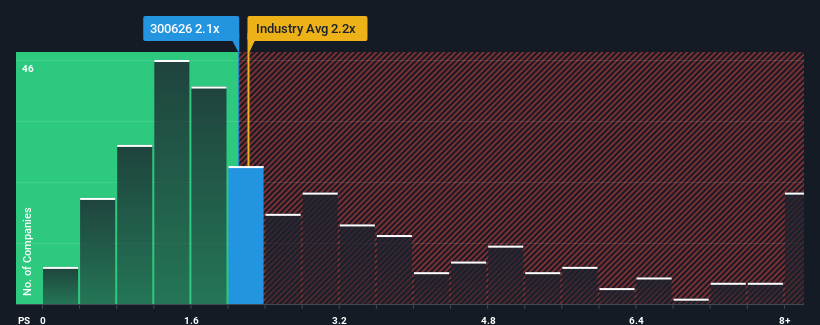

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Huarui Electrical ApplianceLtd's P/S ratio of 2.1x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in China is also close to 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Huarui Electrical ApplianceLtd

What Does Huarui Electrical ApplianceLtd's Recent Performance Look Like?

Revenue has risen firmly for Huarui Electrical ApplianceLtd recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Huarui Electrical ApplianceLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Huarui Electrical ApplianceLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.9%. However, this wasn't enough as the latest three year period has seen an unpleasant 28% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Huarui Electrical ApplianceLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Following Huarui Electrical ApplianceLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Huarui Electrical ApplianceLtd currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Huarui Electrical ApplianceLtd that you should be aware of.

If these risks are making you reconsider your opinion on Huarui Electrical ApplianceLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Huarui Electrical ApplianceLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300626

Huarui Electrical ApplianceLtd

Engages in research, development, design, production, and sale of low-power motors and micro-motor commutators in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives