- China

- /

- Electrical

- /

- SZSE:300617

Discover JiangSu Changling HydraulicLtd And 2 Other Undiscovered Gems With Solid Potential

Reviewed by Simply Wall St

In a global market where major indexes like the S&P 500 and Nasdaq Composite continue to reach record highs, small-cap stocks, as represented by the Russell 2000 Index, have recently faced some challenges. This divergence highlights the importance of identifying promising opportunities within smaller companies that may not yet be on investors' radars. A good stock in this context is one with solid fundamentals and potential for growth despite broader market fluctuations, such as JiangSu Changling Hydraulic Ltd and two other under-the-radar companies with strong potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

JiangSu Changling HydraulicLtd (SHSE:605389)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Changling Hydraulic Co., Ltd engages in the research, development, production, and sale of hydraulic components both in China and internationally, with a market cap of CN¥3.91 billion.

Operations: The company generates revenue through the sale of hydraulic components in domestic and international markets. It has a market capitalization of CN¥3.91 billion, reflecting its scale and presence in the industry.

JiangSu Changling Hydraulic, a small-cap player in the machinery sector, showcases resilience with its recent performance. Over the past year, earnings grew by 6.2%, surpassing the industry average of -0.4%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio stood at 1.4%. Its price-to-earnings ratio of 33.6x remains competitive against the broader CN market at 38x. Recent financials reveal sales of CNY 678 million for nine months ending September 2024, up from CNY 576 million last year; net income rose to CNY 91 million from CNY 77 million previously, reflecting strong operational efficiency and potential for future growth within its niche market segment.

Jiangsu Ankura Intelligent Power (SZSE:300617)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Ankura Intelligent Power Co., Ltd. focuses on the development and production of intelligent power equipment, with a market cap of CN¥4.63 billion.

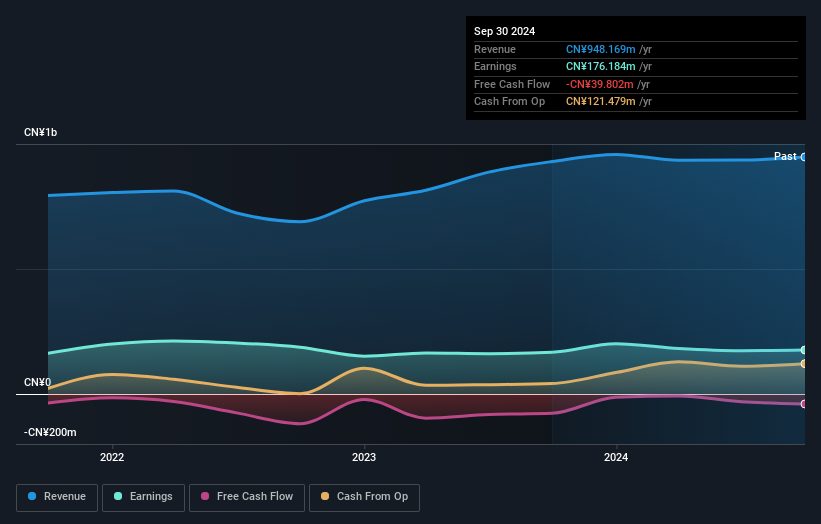

Operations: The primary revenue stream for Jiangsu Ankura Intelligent Power is its electric equipment segment, generating CN¥948.17 million.

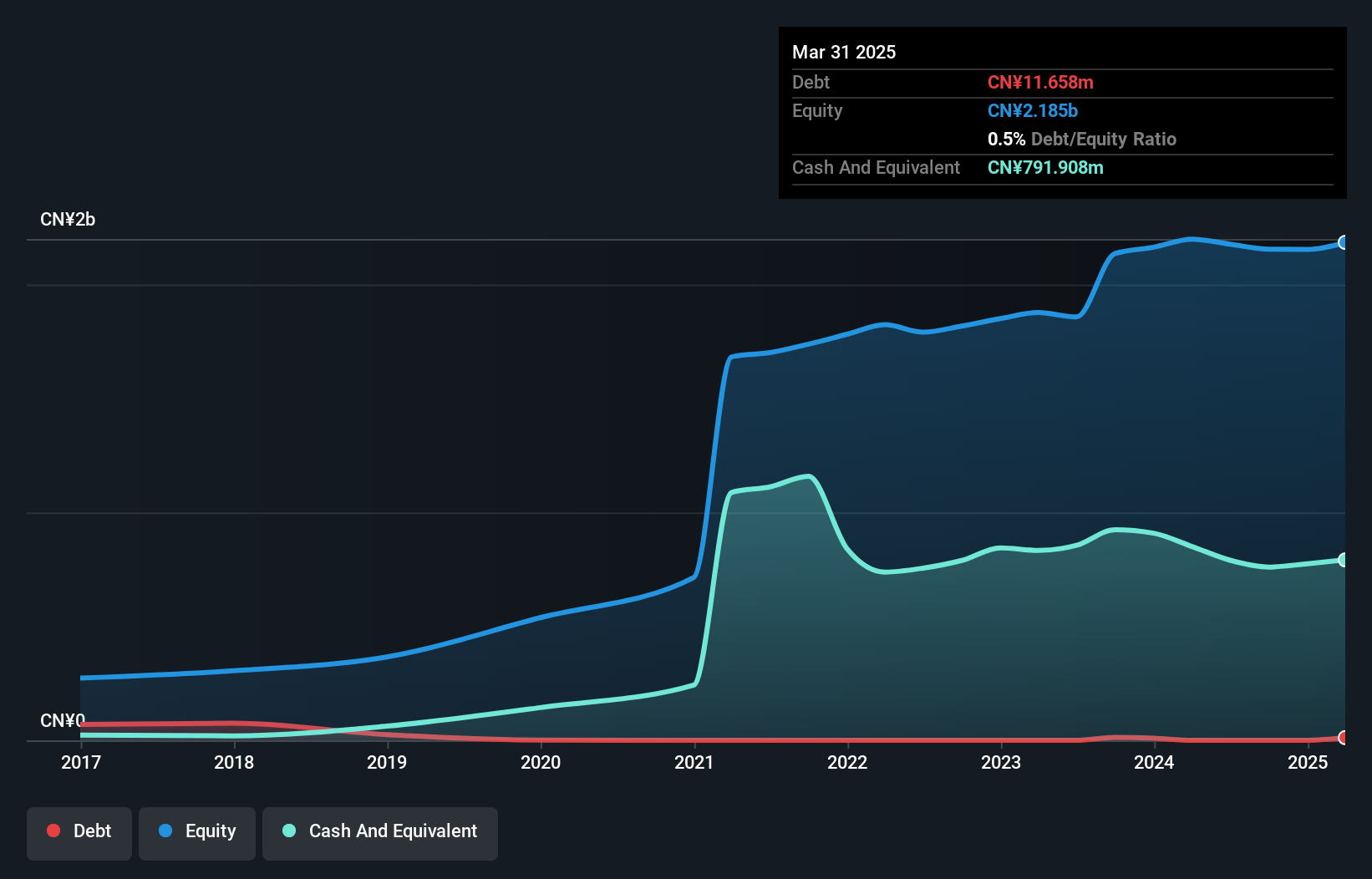

Jiangsu Ankura Intelligent Power, a promising player in the electrical industry, showcases solid financial health with cash exceeding total debt and a reduced debt-to-equity ratio from 12.4 to 11.8 over five years. Despite recent challenges reflected in decreased net income of CNY 135.99 million compared to CNY 160.98 million last year, its earnings growth of 5.7% outpaces the industry's average of 1.1%. The company's P/E ratio at 26x is attractive against the CN market's average of 38x, suggesting potential value for investors seeking growth opportunities within this sector's dynamics.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Ankura Intelligent Power.

Understand Jiangsu Ankura Intelligent Power's track record by examining our Past report.

Shanghai National Center of Testing and Inspection for Electric Cable and Wire (SZSE:301289)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai National Center of Testing and Inspection for Electric Cable and Wire Co., Ltd. specializes in the testing and inspection of electric cables and wires, with a market capitalization of CN¥4.08 billion.

Operations: The company generates revenue primarily from research services, amounting to CN¥285.49 million.

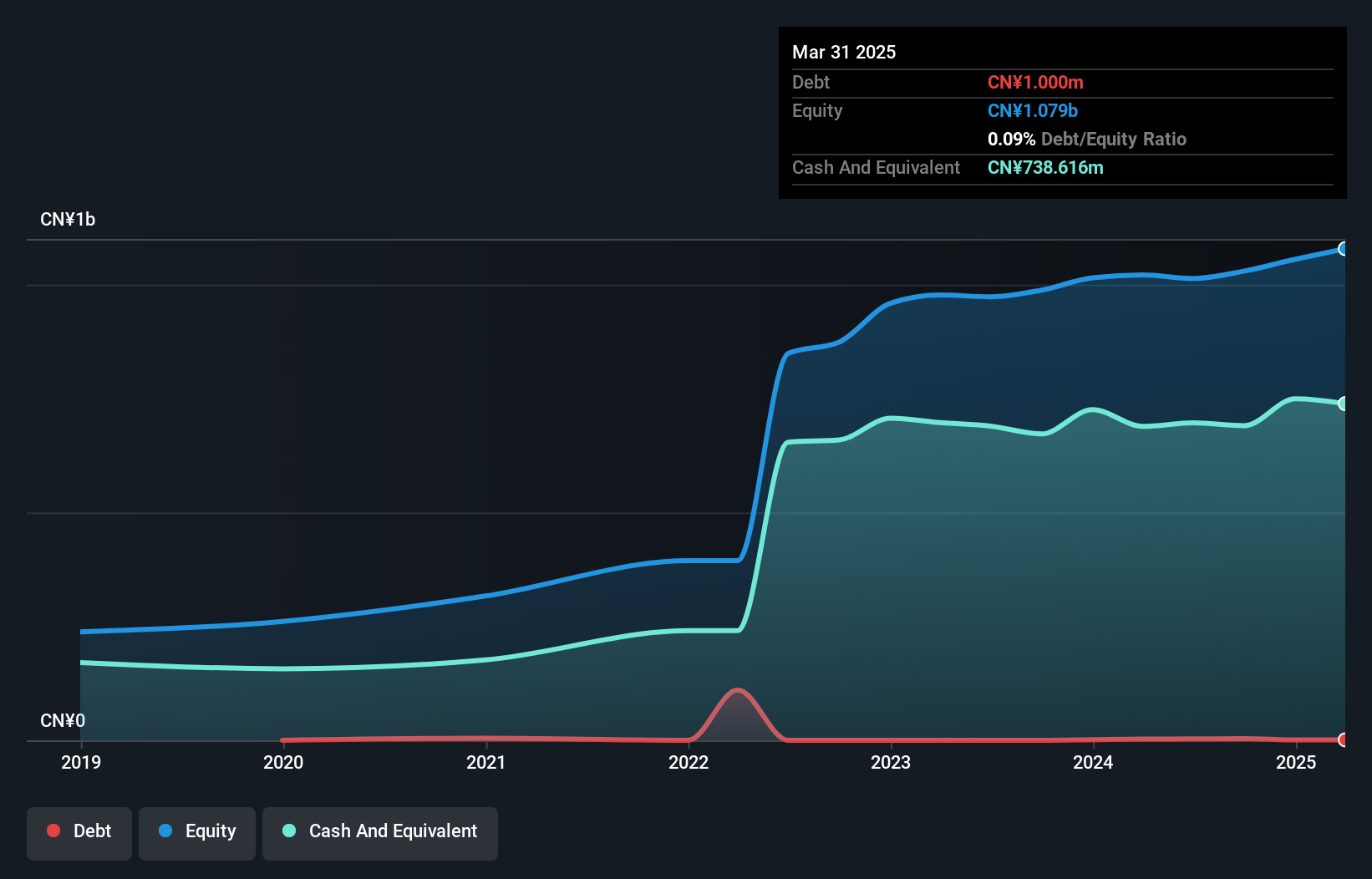

Shanghai National Center of Testing and Inspection for Electric Cable and Wire, a small player in its niche, has shown promising financial resilience. Over the past five years, its debt to equity ratio increased slightly from 0% to 0.3%, yet it remains financially sound with more cash than total debt. The company reported a revenue increase to CNY 218 million for the first nine months of 2024, up from CNY 194 million last year. Net income also rose modestly to CNY 54 million compared to CNY 51 million previously, indicating steady growth despite industry challenges.

Key Takeaways

- Click here to access our complete index of 4621 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300617

Jiangsu Ankura Intelligent Power

Jiangsu Ankura Intelligent Power Co., Ltd.

Flawless balance sheet with proven track record.