- China

- /

- Electronic Equipment and Components

- /

- SZSE:002960

3 Asian Growth Companies With High Insider Ownership Growing Revenues Up To 31%

Reviewed by Simply Wall St

As global markets face challenges such as regulatory uncertainties and economic growth concerns, the Asian market remains a focal point for investors seeking opportunities amidst volatility. In this environment, companies with strong insider ownership and impressive revenue growth can offer a level of resilience and alignment with shareholder interests, making them attractive considerations for those navigating these complex conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| PharmaResearch (KOSDAQ:A214450) | 38.6% | 26.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.4% |

| Bioneer (KOSDAQ:A064550) | 15.9% | 104.8% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 148.5% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| giftee (TSE:4449) | 34.3% | 69.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

Let's uncover some gems from our specialized screener.

Jade Bird Fire (SZSE:002960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jade Bird Fire Co., Ltd. develops, manufactures, and sells professional fire safety electronic products and systems both in China and internationally, with a market cap of CN¥9.65 billion.

Operations: Jade Bird Fire Co., Ltd. generates revenue through the development, manufacturing, and sale of fire safety electronic products and systems across domestic and international markets.

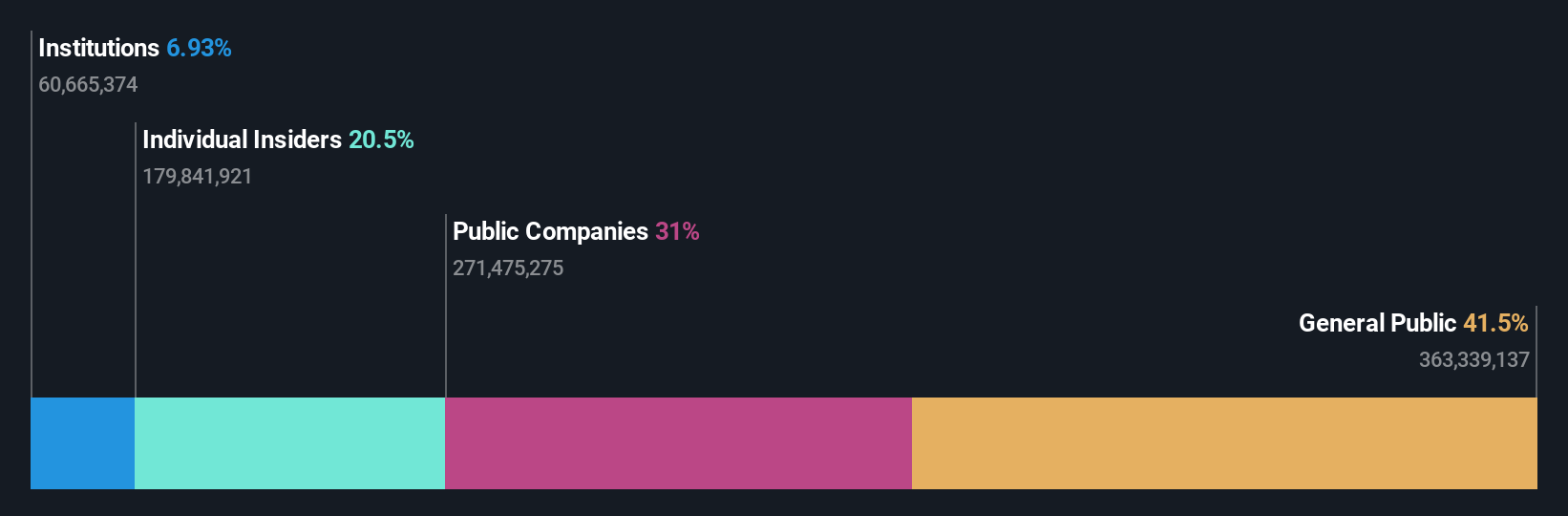

Insider Ownership: 21.3%

Revenue Growth Forecast: 15.4% p.a.

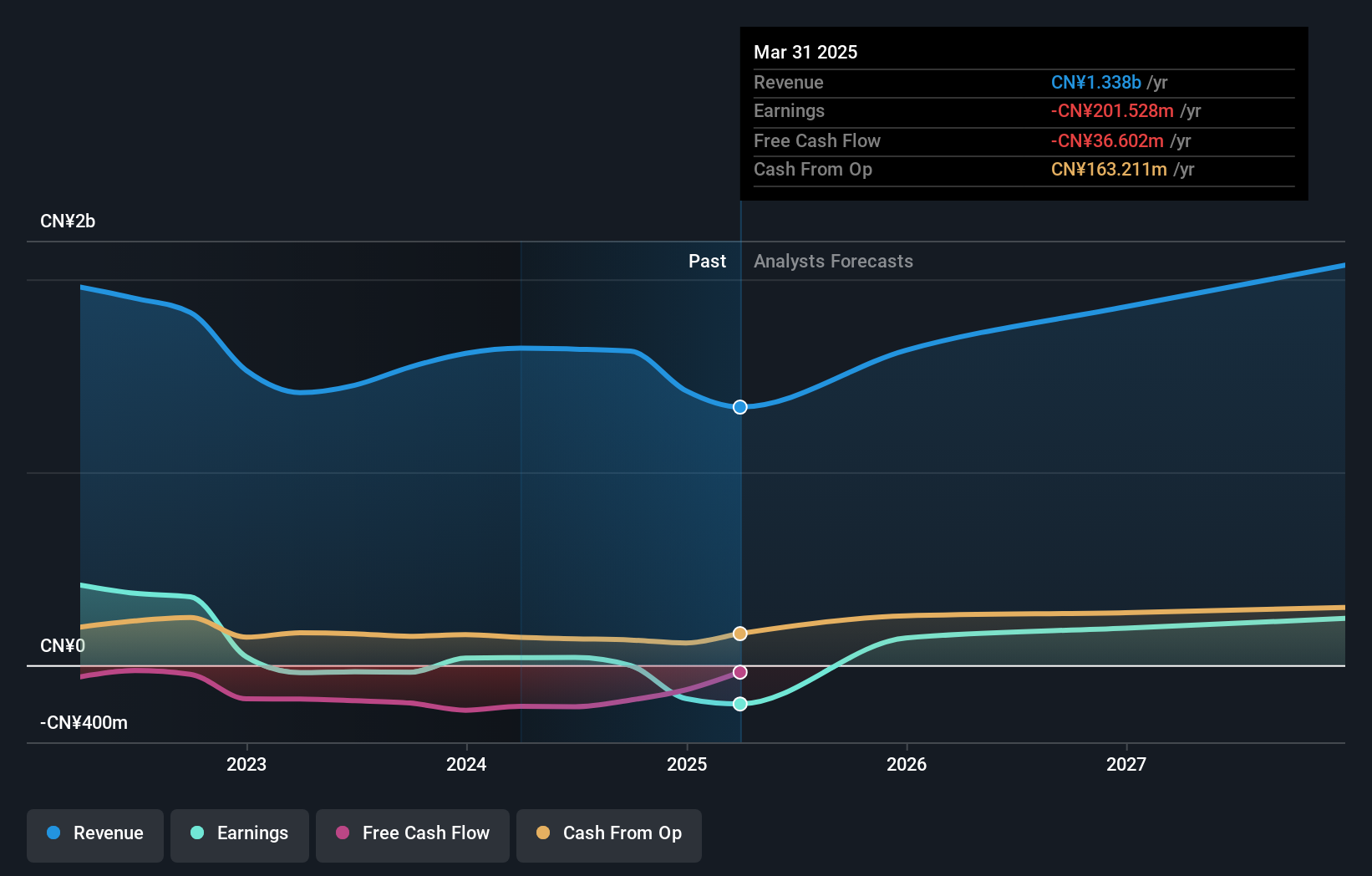

Jade Bird Fire is trading at a favorable price-to-earnings ratio of 19.7x, below the CN market average, indicating good relative value. Its earnings are forecast to grow significantly at 27.1% annually, surpassing the CN market's growth rate of 25.4%. However, its revenue growth forecast of 15.4% per year lags behind the typical high-growth threshold but remains above the market average. A recent shareholders meeting focused on stock repurchase and incentive plan adjustments reflects active corporate governance strategies.

- Click here to discover the nuances of Jade Bird Fire with our detailed analytical future growth report.

- Our expertly prepared valuation report Jade Bird Fire implies its share price may be lower than expected.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health informatization industry in China, with a market cap of CN¥10.63 billion.

Operations: B-SOFT Co., Ltd. generates its revenue from the medical and health informatization sector in China.

Insider Ownership: 15.4%

Revenue Growth Forecast: 16.5% p.a.

B-SOFT Ltd. is expected to transition to profitability within three years, with earnings projected to grow 66.63% annually, surpassing market averages. Despite a forecasted revenue growth of 16.5% per year being below the high-growth threshold, it exceeds the CN market's 13.2%. The company's return on equity is anticipated to be low at 6.4%, and its share price has been highly volatile recently, but there are no significant insider trading activities reported over the past three months.

- Take a closer look at B-SOFTLtd's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of B-SOFTLtd shares in the market.

Beijing Relpow Technology (SZSE:300593)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Relpow Technology Co., Ltd manufactures and sells power supply products both in China and internationally, with a market cap of CN¥7.86 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 30.2%

Revenue Growth Forecast: 31.1% p.a.

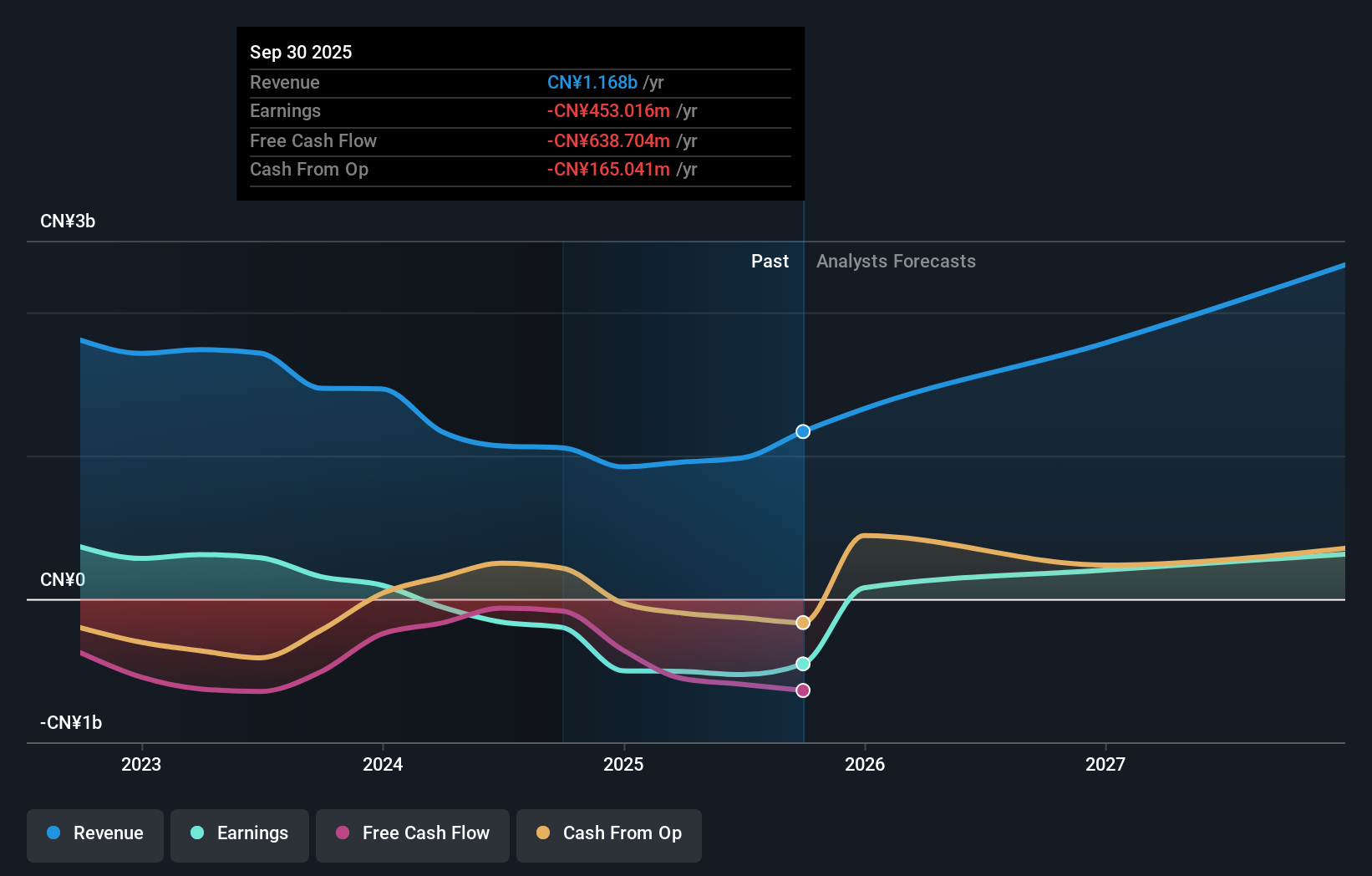

Beijing Relpow Technology is expected to achieve profitability within three years, with earnings projected to grow 117.4% annually, significantly outpacing market averages. The company's revenue growth forecast of 31.1% per year exceeds both the high-growth threshold and the CN market's 13.2%. Despite this strong growth outlook, its return on equity is anticipated to remain low at 7.8%, and recent share price volatility has been high without substantial insider trading activities reported recently.

- Navigate through the intricacies of Beijing Relpow Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Beijing Relpow Technology is priced higher than what may be justified by its financials.

Seize The Opportunity

- Get an in-depth perspective on all 642 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002960

Jade Bird Fire

Develops, manufactures, and sells professional fire safety electronic products and fire safety systems in China and internationally.

Flawless balance sheet with reasonable growth potential.