- China

- /

- Electrical

- /

- SZSE:300569

Qingdao Tianneng Heavy Industries Co.,Ltd's (SZSE:300569) Prospects Need A Boost To Lift Shares

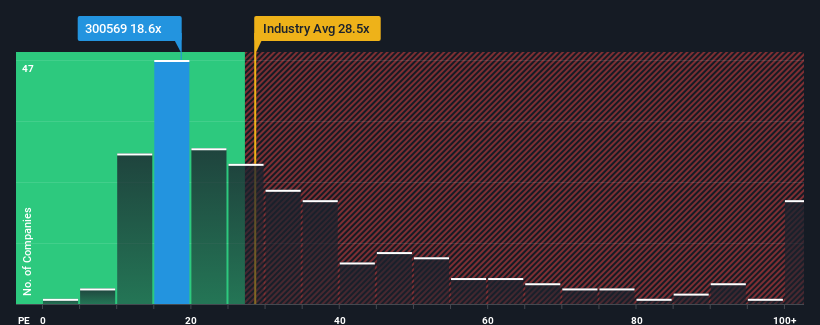

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 28x, you may consider Qingdao Tianneng Heavy Industries Co.,Ltd (SZSE:300569) as an attractive investment with its 18.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Qingdao Tianneng Heavy IndustriesLtd over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Qingdao Tianneng Heavy IndustriesLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Qingdao Tianneng Heavy IndustriesLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. This means it has also seen a slide in earnings over the longer-term as EPS is down 68% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Qingdao Tianneng Heavy IndustriesLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Qingdao Tianneng Heavy IndustriesLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Qingdao Tianneng Heavy IndustriesLtd (1 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Qingdao Tianneng Heavy IndustriesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Tianneng Heavy IndustriesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300569

Qingdao Tianneng Heavy IndustriesLtd

Manufactures and sells wind turbine towers and related equipment in China and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives