Jiangsu Newamstar Packaging Machinery Co.,Ltd (SZSE:300509) Stock Catapults 50% Though Its Price And Business Still Lag The Industry

Jiangsu Newamstar Packaging Machinery Co.,Ltd (SZSE:300509) shares have continued their recent momentum with a 50% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 5.4% isn't as attractive.

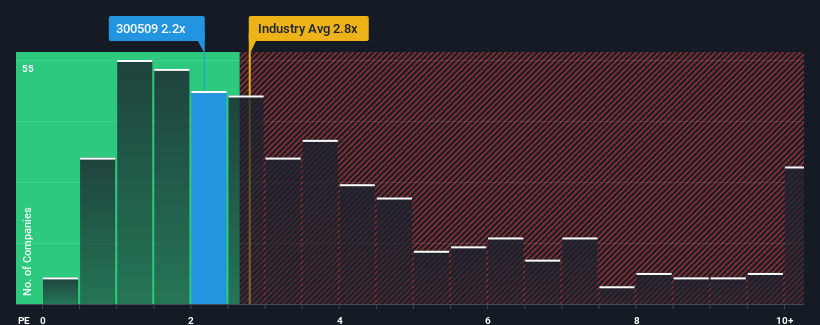

In spite of the firm bounce in price, Jiangsu Newamstar Packaging MachineryLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.2x, considering almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Jiangsu Newamstar Packaging MachineryLtd

How Has Jiangsu Newamstar Packaging MachineryLtd Performed Recently?

Jiangsu Newamstar Packaging MachineryLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Newamstar Packaging MachineryLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Jiangsu Newamstar Packaging MachineryLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Jiangsu Newamstar Packaging MachineryLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Jiangsu Newamstar Packaging MachineryLtd's P/S Mean For Investors?

Despite Jiangsu Newamstar Packaging MachineryLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Jiangsu Newamstar Packaging MachineryLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jiangsu Newamstar Packaging MachineryLtd (of which 1 is concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300509

Jiangsu Newamstar Packaging MachineryLtd

Engages in the research and development, manufacturing, and sale of beverage packaging machinery in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives