After Leaping 29% Guangzhou Goaland Energy Conservation Tech. Co., Ltd. (SZSE:300499) Shares Are Not Flying Under The Radar

Guangzhou Goaland Energy Conservation Tech. Co., Ltd. (SZSE:300499) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 60%.

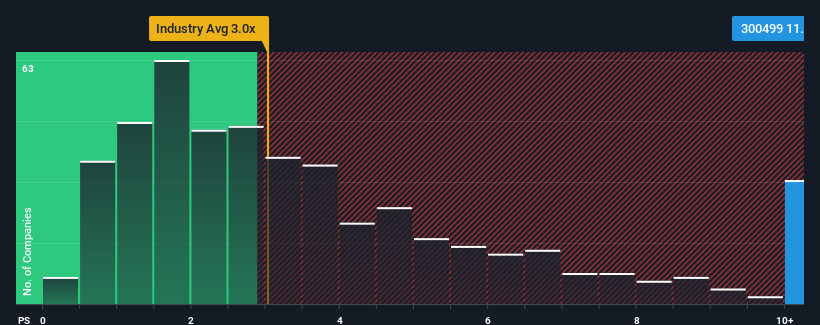

Since its price has surged higher, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3x, you may consider Guangzhou Goaland Energy Conservation Tech as a stock to avoid entirely with its 11.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Guangzhou Goaland Energy Conservation Tech

How Guangzhou Goaland Energy Conservation Tech Has Been Performing

Guangzhou Goaland Energy Conservation Tech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangzhou Goaland Energy Conservation Tech.How Is Guangzhou Goaland Energy Conservation Tech's Revenue Growth Trending?

Guangzhou Goaland Energy Conservation Tech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. This means it has also seen a slide in revenue over the longer-term as revenue is down 64% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 90% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Guangzhou Goaland Energy Conservation Tech's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Guangzhou Goaland Energy Conservation Tech's P/S

Shares in Guangzhou Goaland Energy Conservation Tech have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Guangzhou Goaland Energy Conservation Tech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Guangzhou Goaland Energy Conservation Tech that you should be aware of.

If you're unsure about the strength of Guangzhou Goaland Energy Conservation Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300499

Guangzhou Goaland Energy Conservation Tech

Guangzhou Goaland Energy Conservation Tech.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives