Shannon Semiconductor TechnologyLtd (SZSE:300475) Is Posting Promising Earnings But The Good News Doesn’t Stop There

Shannon Semiconductor Technology Co.,Ltd. (SZSE:300475) announced a healthy earnings result recently, and the market rewarded it with a strong uplift in the stock price. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

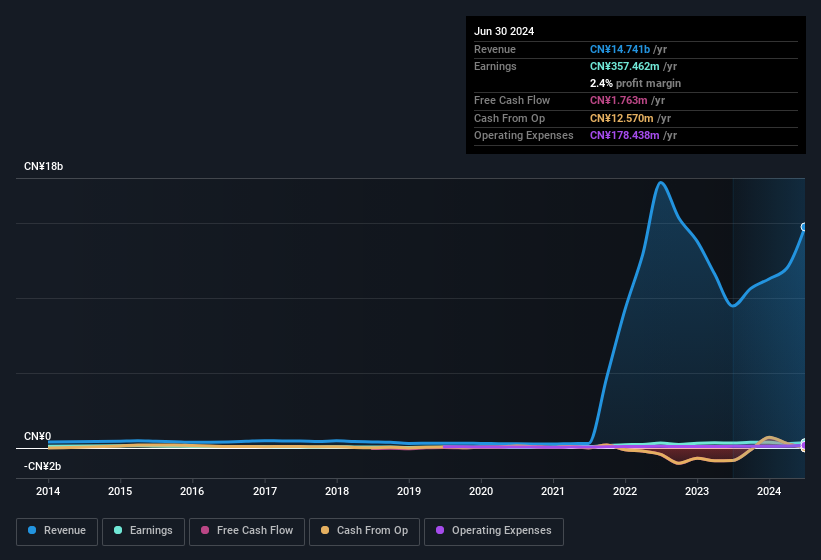

See our latest analysis for Shannon Semiconductor TechnologyLtd

The Impact Of Unusual Items On Profit

To properly understand Shannon Semiconductor TechnologyLtd's profit results, we need to consider the CN¥128m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Shannon Semiconductor TechnologyLtd to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Shannon Semiconductor TechnologyLtd's Profit Performance

Because unusual items detracted from Shannon Semiconductor TechnologyLtd's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Shannon Semiconductor TechnologyLtd's statutory profit actually understates its earnings potential! Better yet, its EPS are growing strongly, which is nice to see. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Shannon Semiconductor TechnologyLtd, you'd also look into what risks it is currently facing. To that end, you should learn about the 2 warning signs we've spotted with Shannon Semiconductor TechnologyLtd (including 1 which can't be ignored).

This note has only looked at a single factor that sheds light on the nature of Shannon Semiconductor TechnologyLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Shannon Semiconductor TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300475

Shannon Semiconductor TechnologyLtd

Shannon Semiconductor Technology Co.,Ltd.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives