Further Upside For Wuxi Lead Intelligent Equipment CO.,LTD. (SZSE:300450) Shares Could Introduce Price Risks After 36% Bounce

Wuxi Lead Intelligent Equipment CO.,LTD. (SZSE:300450) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

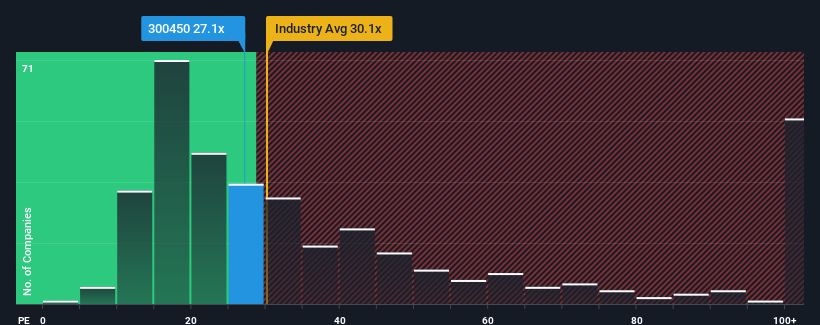

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Wuxi Lead Intelligent EquipmentLTD as an attractive investment with its 27.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Wuxi Lead Intelligent EquipmentLTD as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Wuxi Lead Intelligent EquipmentLTD

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wuxi Lead Intelligent EquipmentLTD's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. As a result, earnings from three years ago have also fallen 8.6% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 39% each year as estimated by the analysts watching the company. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Wuxi Lead Intelligent EquipmentLTD's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Wuxi Lead Intelligent EquipmentLTD's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Wuxi Lead Intelligent EquipmentLTD's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Wuxi Lead Intelligent EquipmentLTD (2 shouldn't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Wuxi Lead Intelligent EquipmentLTD. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Lead Intelligent EquipmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300450

Wuxi Lead Intelligent EquipmentLTD

Develops, manufactures, and sells intelligent equipment in China.

Good value with reasonable growth potential.

Market Insights

Community Narratives