- China

- /

- Electrical

- /

- SZSE:300444

Beijing SOJO Electric Co., Ltd.'s (SZSE:300444) Shares Leap 25% Yet They're Still Not Telling The Full Story

Beijing SOJO Electric Co., Ltd. (SZSE:300444) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

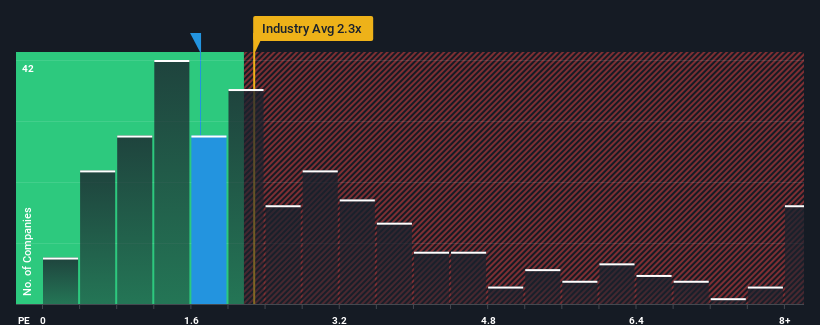

Even after such a large jump in price, it would still be understandable if you think Beijing SOJO Electric is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in China's Electrical industry have P/S ratios above 2.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing SOJO Electric

How Has Beijing SOJO Electric Performed Recently?

Beijing SOJO Electric certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Beijing SOJO Electric will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Beijing SOJO Electric would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. Pleasingly, revenue has also lifted 167% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 24% shows it's noticeably more attractive.

With this information, we find it odd that Beijing SOJO Electric is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Beijing SOJO Electric's P/S

Beijing SOJO Electric's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Beijing SOJO Electric revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Beijing SOJO Electric (of which 1 is concerning!) you should know about.

If these risks are making you reconsider your opinion on Beijing SOJO Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Beijing SOJO Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing SOJO Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300444

Beijing SOJO Electric

Engages in the research, production, export, and sale of power distribution equipment and automation equipment in the field of power transmission and distribution networks.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives