- China

- /

- Electrical

- /

- SZSE:300438

Global Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, including steady U.S. inflation and geopolitical uncertainties in Europe, investors are keeping a close eye on growth companies with high insider ownership. In this environment, stocks that combine robust growth potential with significant insider investment can offer unique insights into company confidence and long-term strategy alignment, making them particularly noteworthy for market participants.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 56.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 29.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 49.2% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

We'll examine a selection from our screener results.

Hangzhou First Applied Material (SHSE:603806)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou First Applied Material Co., Ltd. designs, develops, manufactures, and sells solar battery encapsulation materials both in China and internationally, with a market cap of CN¥38.02 billion.

Operations: Revenue Segments (in millions of CN¥): Solar battery encapsulation materials - CN¥null

Insider Ownership: 13.5%

Revenue Growth Forecast: 17.1% p.a.

Hangzhou First Applied Material, despite a recent drop in revenue and net income, is forecast to experience significant earnings growth of 36.03% annually over the next three years. The company's price-to-earnings ratio of 45.6x suggests it trades at good value compared to its industry peers. However, its profit margins have declined from last year, and it was recently removed from the Shanghai Stock Exchange 180 Value Index, indicating potential challenges ahead.

- Click to explore a detailed breakdown of our findings in Hangzhou First Applied Material's earnings growth report.

- The analysis detailed in our Hangzhou First Applied Material valuation report hints at an deflated share price compared to its estimated value.

Trina Solar (SHSE:688599)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. focuses on the research, development, production, and sales of photovoltaic (PV) modules across various global markets including China, Europe, North America, and more, with a market capitalization of approximately CN¥35.32 billion.

Operations: Trina Solar Co., Ltd. generates revenue through its activities in the research, development, production, and sales of photovoltaic modules across multiple regions including China, Europe, North America, Japan, the Asia Pacific, the Middle East, and Africa.

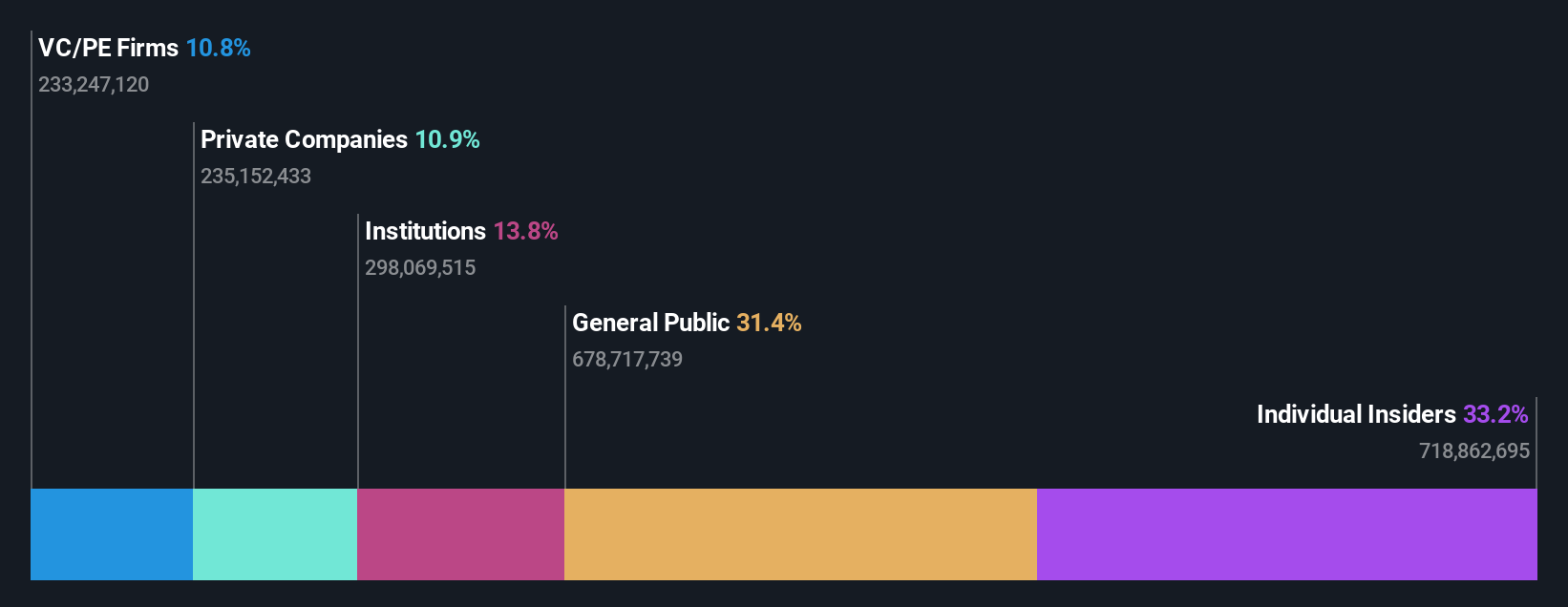

Insider Ownership: 33.2%

Revenue Growth Forecast: 13.9% p.a.

Trina Solar's revenue is forecast to grow at 13.9% annually, slightly above the Chinese market average. Despite recent financial setbacks with a net loss of CNY 2.92 billion for H1 2025, Trina is expected to become profitable within three years, indicating strong growth potential. The company continues to innovate in solar and storage technologies with its Vertex modules and Elementa platform, showcasing significant advancements at RE+ 2025 in Las Vegas.

- Click here to discover the nuances of Trina Solar with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Trina Solar is priced lower than what may be justified by its financials.

Guangzhou Great Power Energy and Technology (SZSE:300438)

Simply Wall St Growth Rating: ★★★★☆☆

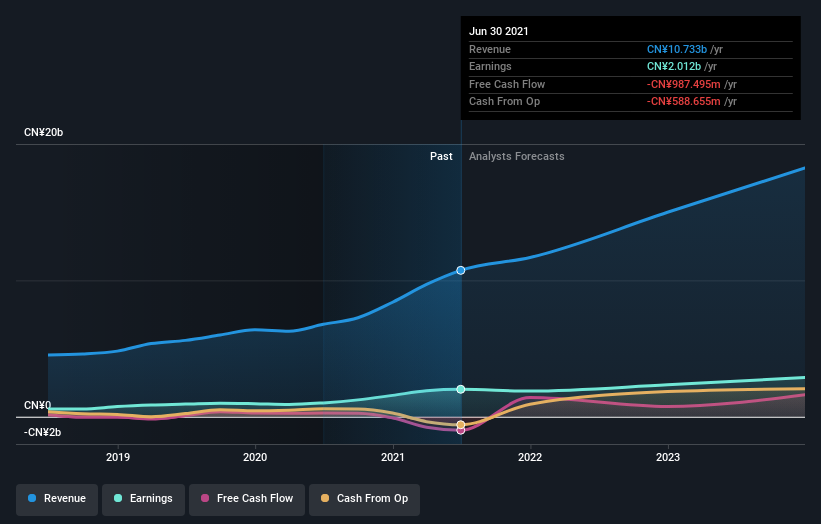

Overview: Guangzhou Great Power Energy and Technology Co., Ltd focuses on the research, development, production, and sale of energy batteries in China and has a market capitalization of approximately CN¥14.68 billion.

Operations: The company's revenue primarily comes from its electronic component manufacturing segment, which generated approximately CN¥8.49 billion.

Insider Ownership: 34.5%

Revenue Growth Forecast: 18.5% p.a.

Guangzhou Great Power Energy and Technology's revenue for the first half of 2025 increased to CNY 4.30 billion from CNY 3.77 billion a year prior, though it reported a net loss of CNY 88.23 million compared to last year's net income. Despite this, the company is forecasted to achieve profitability within three years with earnings expected to grow significantly each year. However, its debt situation is concerning as it's not well covered by operating cash flow.

- Delve into the full analysis future growth report here for a deeper understanding of Guangzhou Great Power Energy and Technology.

- The valuation report we've compiled suggests that Guangzhou Great Power Energy and Technology's current price could be inflated.

Taking Advantage

- Click through to start exploring the rest of the 827 Fast Growing Global Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300438

Guangzhou Great Power Energy and Technology

Engages in the research, development, productions, and sale of energy batteries in China.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives