- China

- /

- Aerospace & Defense

- /

- SZSE:300324

Benign Growth For Beijing Watertek Information Technology Co., Ltd. (SZSE:300324) Underpins Stock's 28% Plummet

Beijing Watertek Information Technology Co., Ltd. (SZSE:300324) shares have had a horrible month, losing 28% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

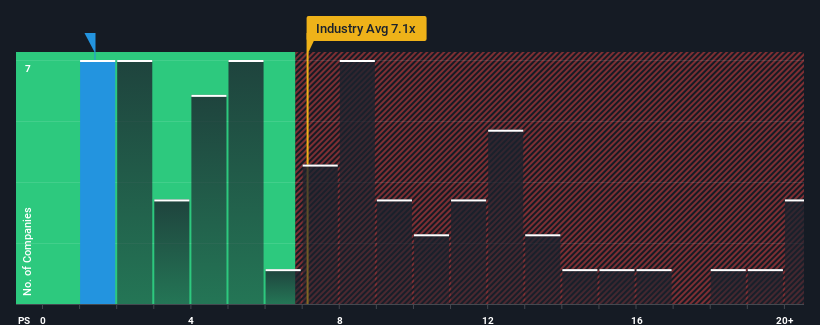

Since its price has dipped substantially, Beijing Watertek Information Technology's price-to-sales (or "P/S") ratio of 1.4x might make it look like a strong buy right now compared to the wider Aerospace & Defense industry in China, where around half of the companies have P/S ratios above 7.1x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Beijing Watertek Information Technology

How Has Beijing Watertek Information Technology Performed Recently?

Revenue has risen firmly for Beijing Watertek Information Technology recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Beijing Watertek Information Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Beijing Watertek Information Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Beijing Watertek Information Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. As a result, it also grew revenue by 7.2% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Beijing Watertek Information Technology is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Beijing Watertek Information Technology's P/S

Having almost fallen off a cliff, Beijing Watertek Information Technology's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Beijing Watertek Information Technology maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Beijing Watertek Information Technology (1 is significant!) that you need to be mindful of.

If you're unsure about the strength of Beijing Watertek Information Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Beijing Watertek Information Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Watertek Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300324

Beijing Watertek Information Technology

Beijing Watertek Information Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives