Shenyang Blue Silver Industry Automation Equipment Co., Ltd (SZSE:300293) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Shenyang Blue Silver Industry Automation Equipment Co., Ltd (SZSE:300293) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 77%.

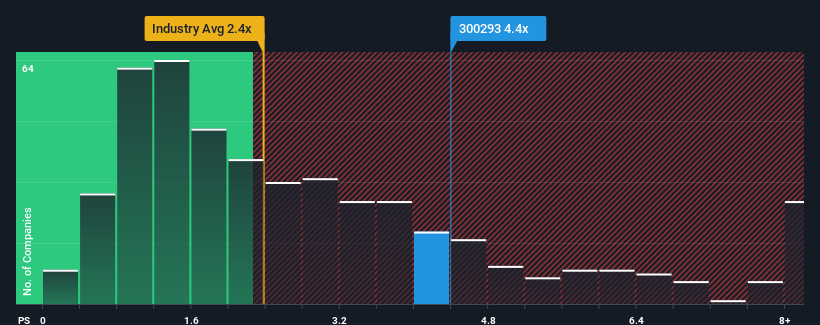

Following the firm bounce in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Shenyang Blue Silver Industry Automation Equipment as a stock to avoid entirely with its 4.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shenyang Blue Silver Industry Automation Equipment

How Shenyang Blue Silver Industry Automation Equipment Has Been Performing

Shenyang Blue Silver Industry Automation Equipment has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenyang Blue Silver Industry Automation Equipment's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Shenyang Blue Silver Industry Automation Equipment's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see revenue up by 31% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 22% shows it's noticeably less attractive.

With this in mind, we find it worrying that Shenyang Blue Silver Industry Automation Equipment's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Shenyang Blue Silver Industry Automation Equipment's P/S Mean For Investors?

Shares in Shenyang Blue Silver Industry Automation Equipment have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Shenyang Blue Silver Industry Automation Equipment currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shenyang Blue Silver Industry Automation Equipment you should be aware of.

If you're unsure about the strength of Shenyang Blue Silver Industry Automation Equipment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Shenyang Blue Silver Industry Automation Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300293

Shenyang Blue Silver Industry Automation Equipment

Engages in the industrial cleaning and surface treatment, and industrial intelligent equipment manufacturing businesses in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives