Fujian Zitian Media Technology Co., Ltd. (SZSE:300280) Looks Inexpensive After Falling 32% But Perhaps Not Attractive Enough

Fujian Zitian Media Technology Co., Ltd. (SZSE:300280) shares have had a horrible month, losing 32% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 18% in the last year.

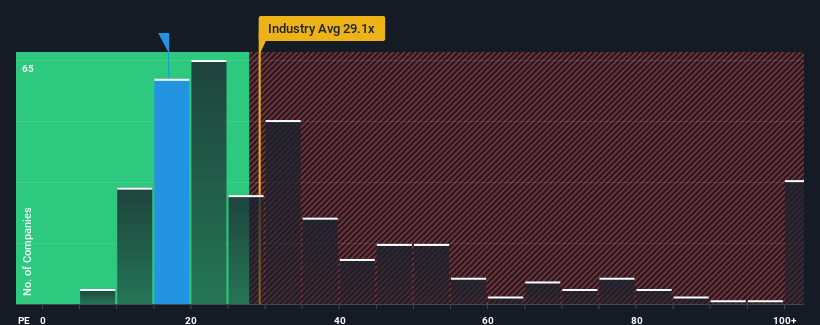

Since its price has dipped substantially, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Fujian Zitian Media Technology as an attractive investment with its 16.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Fujian Zitian Media Technology as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Fujian Zitian Media Technology

Does Growth Match The Low P/E?

Fujian Zitian Media Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 227%. As a result, it also grew EPS by 7.0% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 35% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Fujian Zitian Media Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Fujian Zitian Media Technology's P/E?

The softening of Fujian Zitian Media Technology's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fujian Zitian Media Technology maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Fujian Zitian Media Technology that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300280

Fujian Zitian Media Technology

Designs, manufactures, and sells forging hydraulic and mechanical press equipment in China.

Excellent balance sheet very low.

Market Insights

Community Narratives