The one-year decline in earnings might be taking its toll on Huachangda Intelligent Equipment GroupLtd (SZSE:300278) shareholders as stock falls 8.2% over the past week

Huachangda Intelligent Equipment Group Co.,Ltd. (SZSE:300278) shareholders might be concerned after seeing the share price drop 17% in the last month. But looking back over the last year, the returns have actually been rather pleasing! Looking at the full year, the company has easily bested an index fund by gaining 83%.

In light of the stock dropping 8.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Huachangda Intelligent Equipment GroupLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Huachangda Intelligent Equipment GroupLtd actually saw its earnings per share drop 2.4%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

Unfortunately Huachangda Intelligent Equipment GroupLtd's fell 5.6% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

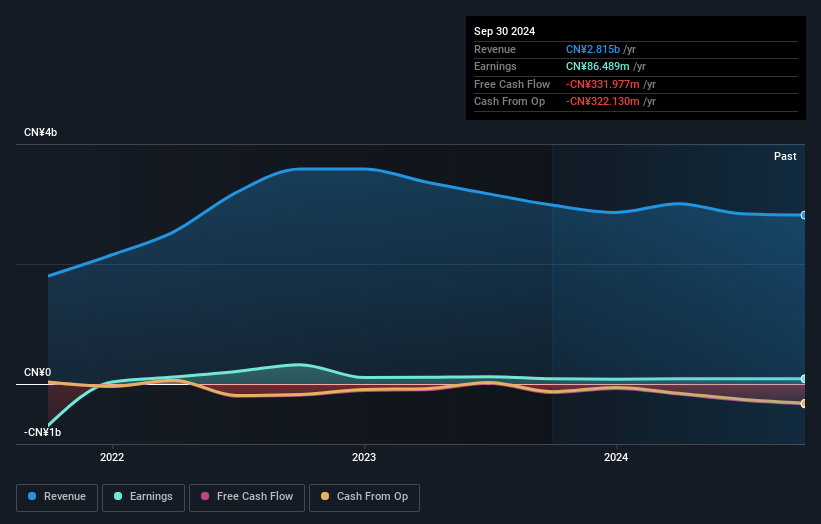

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Huachangda Intelligent Equipment GroupLtd shareholders have received a total shareholder return of 83% over one year. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Huachangda Intelligent Equipment GroupLtd you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huachangda Intelligent Equipment GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300278

Huachangda Intelligent Equipment GroupLtd

Huachangda Intelligent Equipment Group Co.,Ltd.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives