Shenzhen Changhong Technology And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating economic indicators and shifting investor sentiment, the Russell 2000 Index has notably outperformed, reflecting optimism in small-cap stocks amid expectations of lower interest rates. In this environment, identifying promising opportunities requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market uncertainties. Shenzhen Changhong Technology and two other undiscovered gems in Asia exemplify such opportunities, offering unique value propositions that may capture investor interest in today's dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Woori Technology Investment | NA | 11.06% | -3.63% | ★★★★★★ |

| MSC | 29.29% | 6.15% | 15.10% | ★★★★★★ |

| CYMECHS | 8.28% | -3.30% | -18.05% | ★★★★★★ |

| BIO-FD&CLtd | 0.15% | 2.82% | 18.20% | ★★★★★★ |

| Messe eSangLtd | 0.21% | 35.18% | 96.55% | ★★★★★☆ |

| ITCENGLOBAL | 73.61% | 17.53% | 18.23% | ★★★★★☆ |

| Chinyang Holdings | 31.14% | 7.30% | -20.39% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| BIOBIJOULtd | 0.07% | 45.63% | 49.17% | ★★★★★☆ |

| Kyungbangco.Ltd | 26.56% | 3.71% | -24.98% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Changhong Technology (SZSE:300151)

Simply Wall St Value Rating: ★★★★★☆

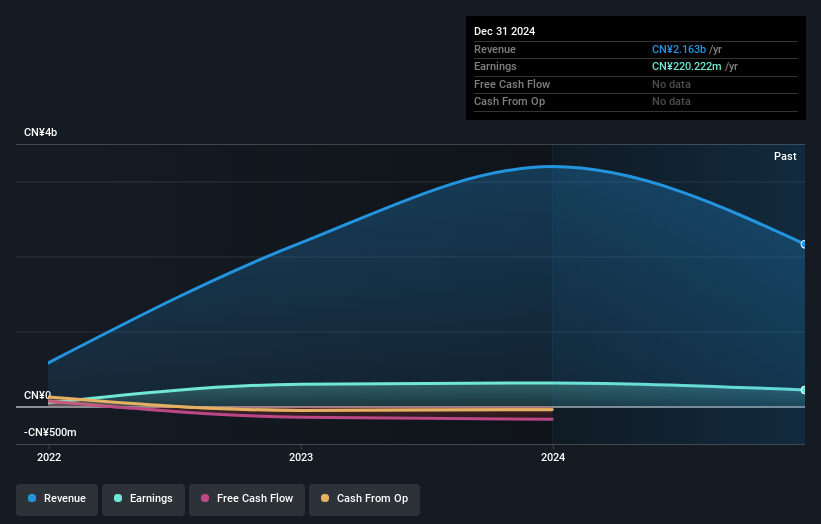

Overview: Shenzhen Changhong Technology Co., Ltd. specializes in the design, manufacture, and sale of plastic molds and precision injection molded parts both in China and abroad, with a market capitalization of CN¥7.71 billion.

Operations: Shenzhen Changhong Technology generates revenue primarily through the sale of plastic molds and precision injection molded parts. The company's net profit margin has shown notable fluctuations, reflecting changes in operational efficiency and market conditions.

Shenzhen Changhong Technology, a burgeoning player in the machinery sector, has demonstrated notable earnings growth of 173% over the past year, outpacing its industry peers. With interest payments well-covered by EBIT at a 7x ratio and a net debt to equity ratio of 9.3%, financial stability seems robust. However, despite high-quality earnings, recent results show some challenges with net income dropping to CNY 30.88 million from CNY 43.6 million last year. Looking ahead, projected annual earnings growth of about 24% suggests potential for continued expansion amidst these mixed signals.

Nanjing Hicin Pharmaceutical (SZSE:300584)

Simply Wall St Value Rating: ★★★★☆☆

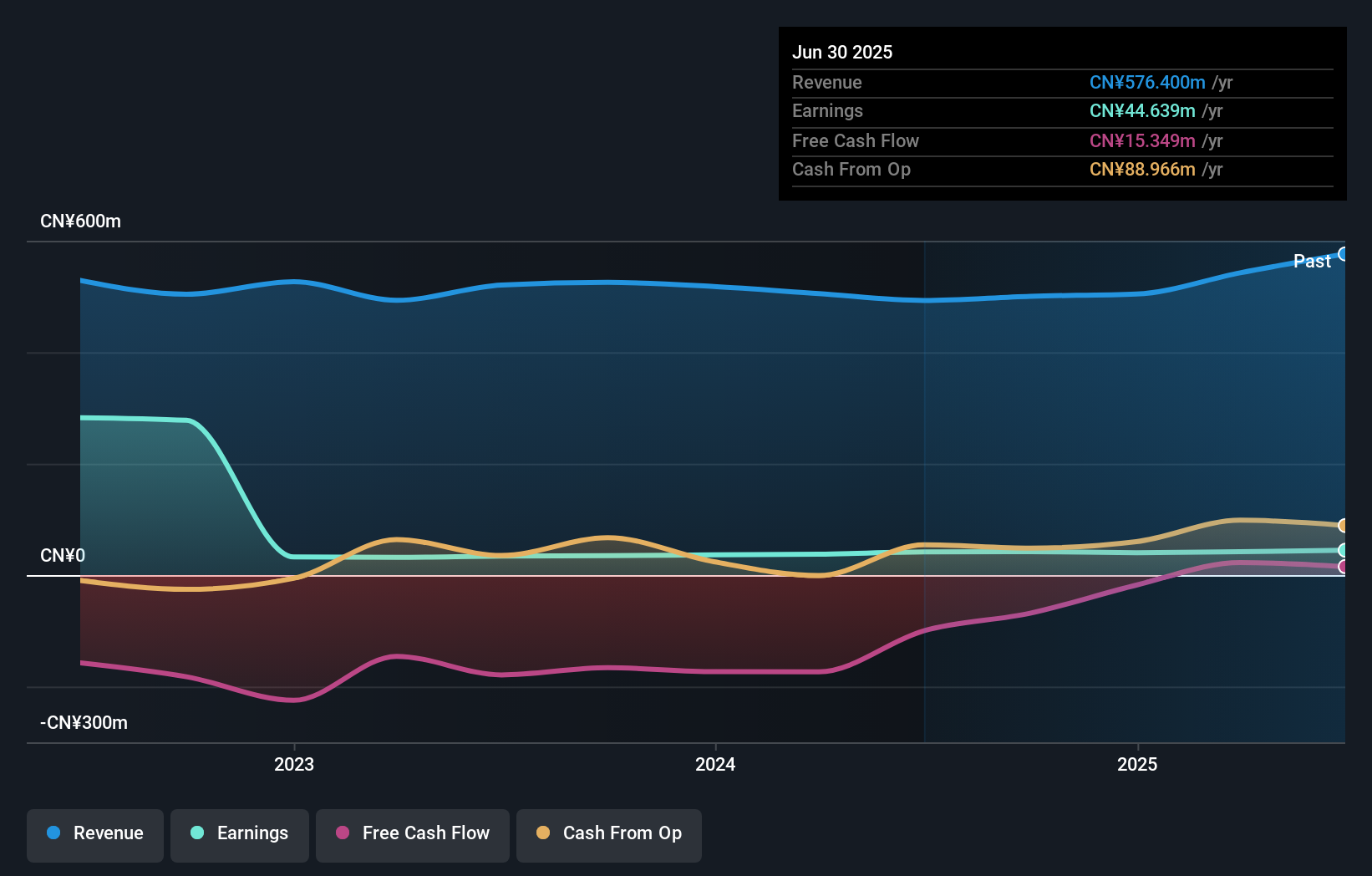

Overview: Nanjing Hicin Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of chemical preparations, APIs, and intermediates with a market cap of CN¥7.66 billion.

Operations: The company's primary revenue stream is from its pharmaceuticals segment, generating CN¥576.40 million.

Nanjing Hicin Pharmaceutical, a smaller player in the market, has shown promising growth with earnings increasing by 7.4% over the past year, outpacing the industry's -0.6%. For the half-year ending June 2025, sales reached CNY 306.01 million from CNY 235.46 million previously, while net income improved to CNY 29.16 million from CNY 24.74 million a year ago. The company is handling its debt well with a net debt to equity ratio of 22.5%, considered satisfactory and interest payments are comfortably covered by EBIT at seven times coverage, indicating financial robustness despite share price volatility recently observed.

Ongoal Technology (SZSE:301662)

Simply Wall St Value Rating: ★★★★★☆

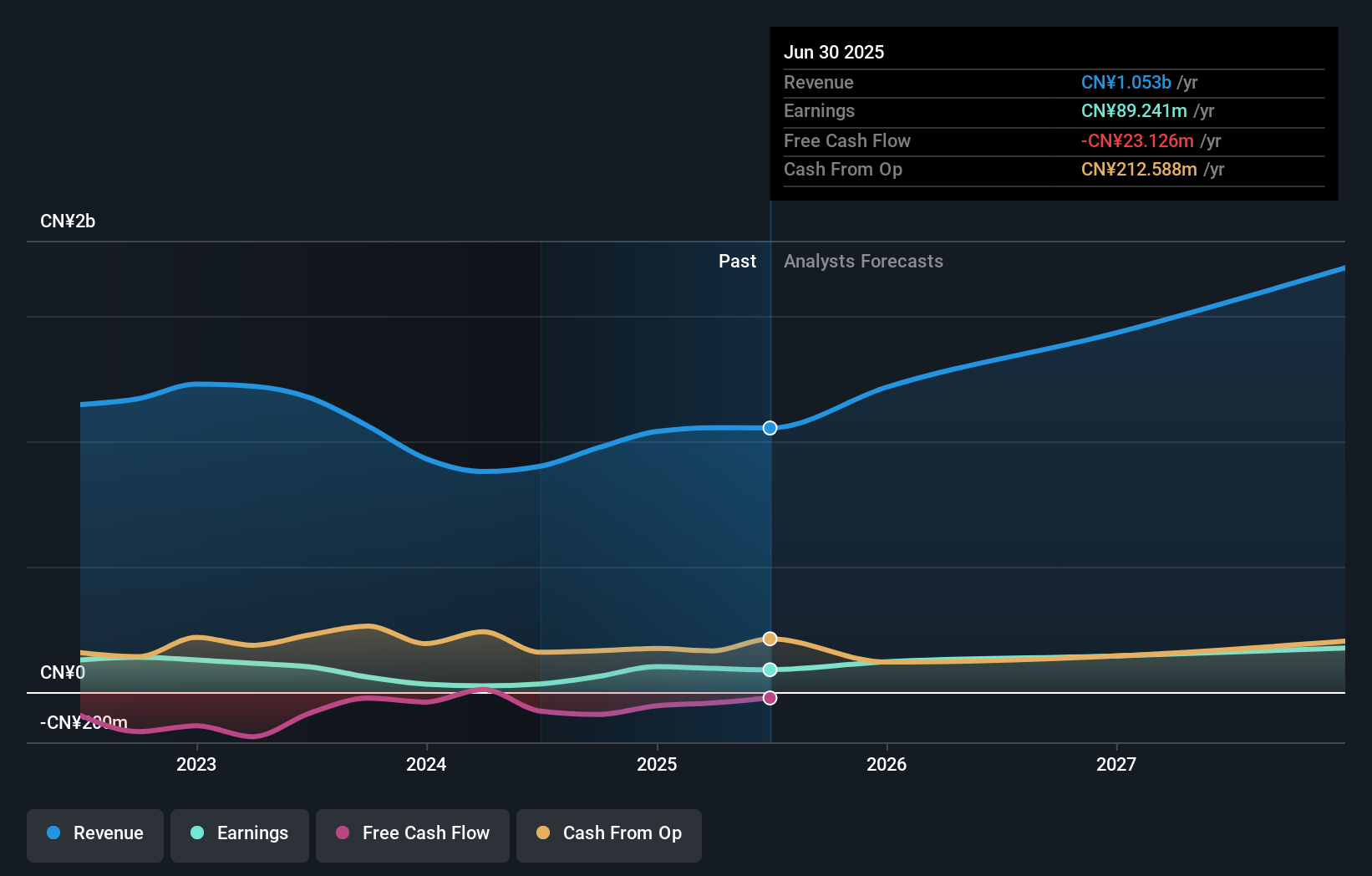

Overview: Ongoal Technology Co., Ltd. specializes in the research, design, production, and sale of material handling and automation equipment in China with a market capitalization of CN¥11.15 billion.

Operations: The primary revenue stream for Ongoal Technology comes from its special equipment manufacturing segment, generating CN¥1.91 billion.

Ongoal Technology, a smaller player in the industry, recently joined the S&P Global BMI Index, reflecting its growing recognition. Despite reporting a drop in half-year sales to CNY 757 million from CNY 939 million last year, it maintains profitability with net income at CNY 54 million. The debt-to-equity ratio rose to 44.6% over five years; however, cash exceeds total debt and free cash flow is positive. Although earnings growth was negative at -24.4%, interest payments are well-covered by EBIT at 12.7 times coverage, suggesting financial resilience despite recent volatility and valuation challenges.

Next Steps

- Click this link to deep-dive into the 2369 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Hicin Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300584

Nanjing Hicin Pharmaceutical

Engages in the research, development, production, and sale of chemical preparations, APIs, and intermediates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives