- China

- /

- Aerospace & Defense

- /

- SZSE:300123

Does YaGuang Technology Group (SZSE:300123) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, YaGuang Technology Group Company Limited (SZSE:300123) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for YaGuang Technology Group

What Is YaGuang Technology Group's Net Debt?

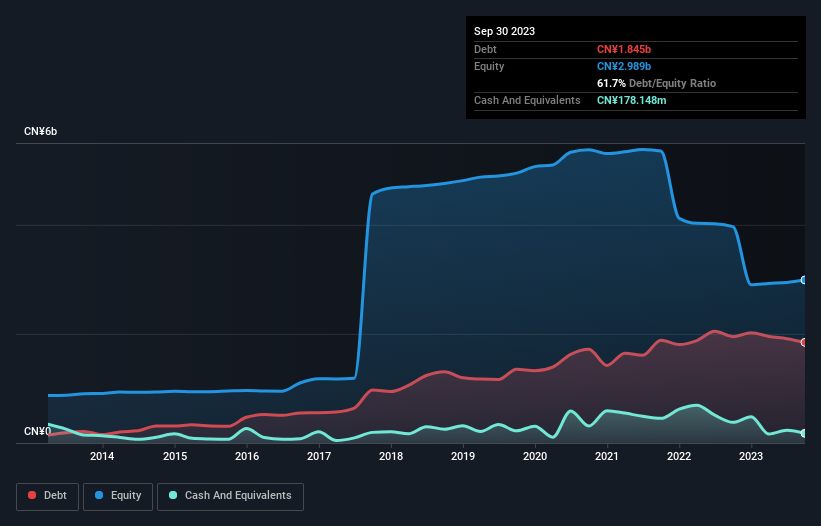

The image below, which you can click on for greater detail, shows that YaGuang Technology Group had debt of CN¥1.85b at the end of September 2023, a reduction from CN¥1.95b over a year. On the flip side, it has CN¥178.1m in cash leading to net debt of about CN¥1.67b.

How Strong Is YaGuang Technology Group's Balance Sheet?

According to the last reported balance sheet, YaGuang Technology Group had liabilities of CN¥2.91b due within 12 months, and liabilities of CN¥599.7m due beyond 12 months. Offsetting this, it had CN¥178.1m in cash and CN¥2.22b in receivables that were due within 12 months. So it has liabilities totalling CN¥1.11b more than its cash and near-term receivables, combined.

Given YaGuang Technology Group has a market capitalization of CN¥5.97b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. There's no doubt that we learn most about debt from the balance sheet. But it is YaGuang Technology Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year YaGuang Technology Group wasn't profitable at an EBIT level, but managed to grow its revenue by 27%, to CN¥1.8b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate YaGuang Technology Group's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at CN¥178m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CN¥258m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with YaGuang Technology Group .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300123

YaGuang Technology Group

Researches, develops, manufactures, and sells military microwave electronics and intelligent ships in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives