Subdued Growth No Barrier To Dalian Zhiyun Automation Co., Ltd. (SZSE:300097) With Shares Advancing 27%

Those holding Dalian Zhiyun Automation Co., Ltd. (SZSE:300097) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 32%.

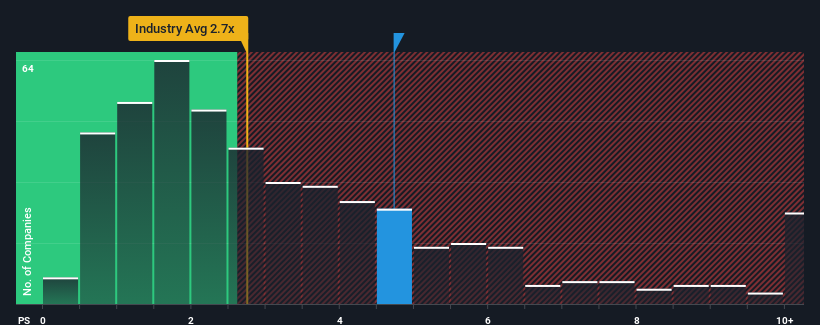

Since its price has surged higher, given close to half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Dalian Zhiyun Automation as a stock to potentially avoid with its 4.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Dalian Zhiyun Automation

What Does Dalian Zhiyun Automation's P/S Mean For Shareholders?

For instance, Dalian Zhiyun Automation's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dalian Zhiyun Automation will help you shine a light on its historical performance.How Is Dalian Zhiyun Automation's Revenue Growth Trending?

In order to justify its P/S ratio, Dalian Zhiyun Automation would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 39% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 28% shows it's an unpleasant look.

With this in mind, we find it worrying that Dalian Zhiyun Automation's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Dalian Zhiyun Automation's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Dalian Zhiyun Automation currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 2 warning signs for Dalian Zhiyun Automation that you should be aware of.

If these risks are making you reconsider your opinion on Dalian Zhiyun Automation, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300097

Dalian Zhiyun Automation

Engages in the research and development, and system integration of automation machines in China.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives