- China

- /

- Electrical

- /

- SZSE:300068

Further Upside For ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) Shares Could Introduce Price Risks After 45% Bounce

Despite an already strong run, ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) shares have been powering on, with a gain of 45% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

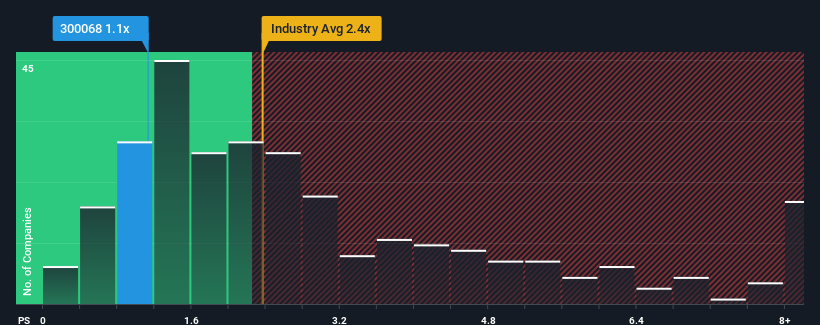

Although its price has surged higher, ZHEJIANG NARADA POWER SOURCE may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.4x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for ZHEJIANG NARADA POWER SOURCE

What Does ZHEJIANG NARADA POWER SOURCE's P/S Mean For Shareholders?

ZHEJIANG NARADA POWER SOURCE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZHEJIANG NARADA POWER SOURCE.How Is ZHEJIANG NARADA POWER SOURCE's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as ZHEJIANG NARADA POWER SOURCE's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.9% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 32% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 23% growth forecast for the broader industry.

With this information, we find it odd that ZHEJIANG NARADA POWER SOURCE is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On ZHEJIANG NARADA POWER SOURCE's P/S

The latest share price surge wasn't enough to lift ZHEJIANG NARADA POWER SOURCE's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems ZHEJIANG NARADA POWER SOURCE currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for ZHEJIANG NARADA POWER SOURCE that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if ZHEJIANG NARADA POWER SOURCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300068

ZHEJIANG NARADA POWER SOURCE

Engages in the research, development, manufacture, sale, and service of lithium-ion batteries and systems, lead-acid batteries and systems, fuel cells and lithium products, and lead resource regeneration products.

Reasonable growth potential and fair value.