- China

- /

- Electrical

- /

- SZSE:300062

Ceepower Co., Ltd. (SZSE:300062) surges 13%; retail investors who own 55% shares profited along with insiders

Key Insights

- Ceepower's significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- A total of 23 investors have a majority stake in the company with 45% ownership

- Insiders own 42% of Ceepower

To get a sense of who is truly in control of Ceepower Co., Ltd. (SZSE:300062), it is important to understand the ownership structure of the business. We can see that retail investors own the lion's share in the company with 55% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

While retail investors were the group that reaped the most benefits after last week’s 13% price gain, insiders also received a 42% cut.

Let's delve deeper into each type of owner of Ceepower, beginning with the chart below.

See our latest analysis for Ceepower

What Does The Institutional Ownership Tell Us About Ceepower?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

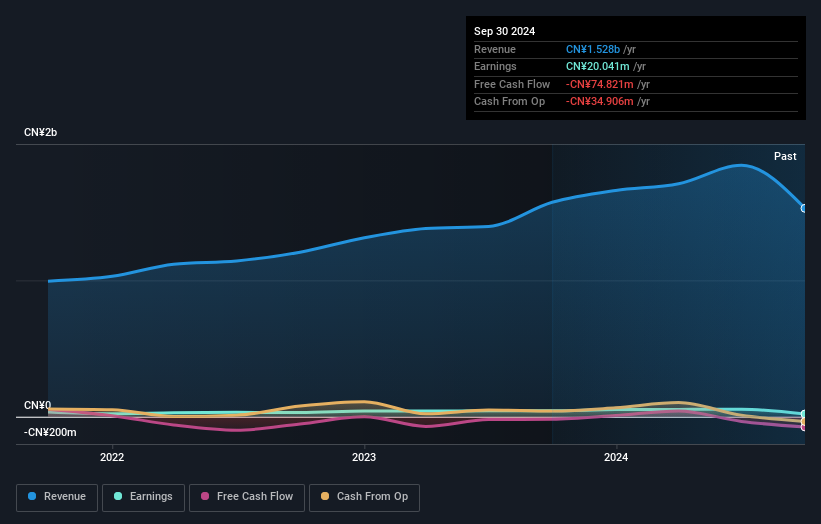

Since institutions own only a small portion of Ceepower, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

We note that hedge funds don't have a meaningful investment in Ceepower. With a 17% stake, CEO Manhong Chen is the largest shareholder. Meanwhile, the second and third largest shareholders, hold 16% and 8.4%, of the shares outstanding, respectively. Interestingly, the third-largest shareholder, Hao Wu is also a Vice Chairman, again, indicating strong insider ownership amongst the company's top shareholders.

On studying our ownership data, we found that 23 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ceepower

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Ceepower Co., Ltd.. It has a market capitalization of just CN¥3.3b, and insiders have CN¥1.4b worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a substantial 55% stake in Ceepower, suggesting it is a fairly popular stock. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Ceepower that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300062

Ceepower

Engages in the research and development, production, and sale of intelligent power transmission and distribution equipment in China and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives