Even though Siasun Robot&AutomationLtd (SZSE:300024) has lost CN¥1.5b market cap in last 7 days, shareholders are still up 52% over 3 years

Siasun Robot&Automation Co.,Ltd. (SZSE:300024) shareholders might be concerned after seeing the share price drop 24% in the last month. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. To wit, the share price did better than an index fund, climbing 52% during that period.

In light of the stock dropping 5.3% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Siasun Robot&AutomationLtd

Given that Siasun Robot&AutomationLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Siasun Robot&AutomationLtd's revenue trended up 11% each year over three years. That's pretty nice growth. While the share price has done well, compounding at 15% yearly, over three years, that move doesn't seem over the top. If that's the case, then it could be well worth while to research the growth trajectory. Keep in mind that the strength of the balance sheet impacts the options open to the company.

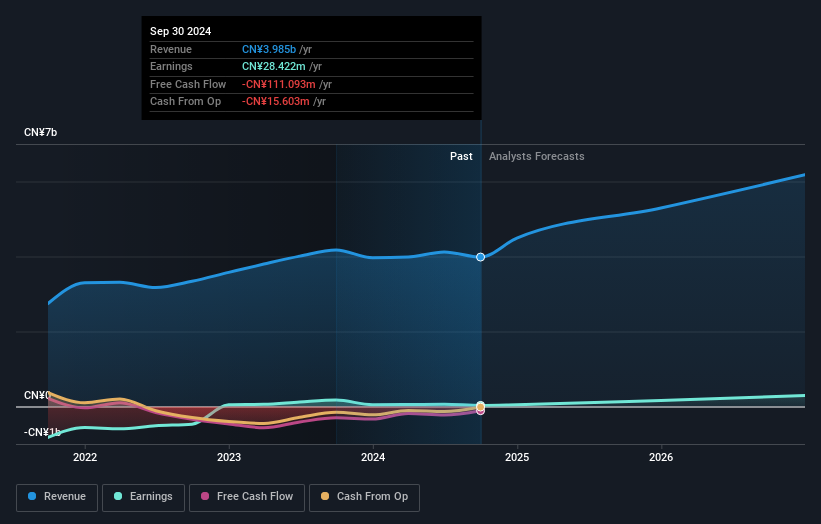

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Siasun Robot&AutomationLtd has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Siasun Robot&AutomationLtd has rewarded shareholders with a total shareholder return of 51% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Siasun Robot&AutomationLtd (including 1 which can't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300024

Siasun Robot&AutomationLtd

Operates in robotic industry in China and internationally.

Reasonable growth potential with mediocre balance sheet.