Beijing Tianma Intelligent Control Technology CO., LTD.'s (SHSE:688570) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

It is hard to get excited after looking at Beijing Tianma Intelligent Control Technology's (SHSE:688570) recent performance, when its stock has declined 13% over the past month. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Specifically, we decided to study Beijing Tianma Intelligent Control Technology's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Beijing Tianma Intelligent Control Technology

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Beijing Tianma Intelligent Control Technology is:

9.1% = CN¥391m ÷ CN¥4.3b (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Beijing Tianma Intelligent Control Technology's Earnings Growth And 9.1% ROE

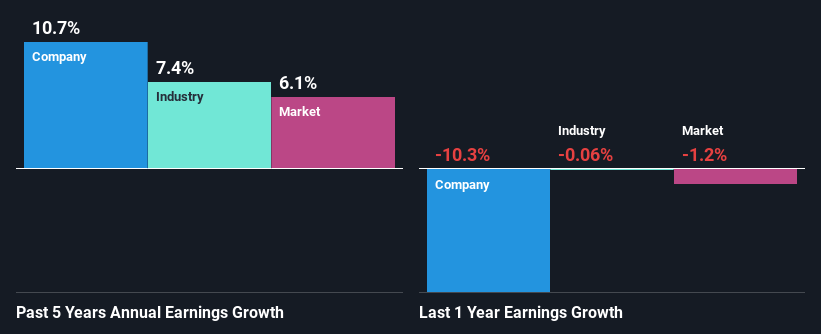

On the face of it, Beijing Tianma Intelligent Control Technology's ROE is not much to talk about. Although a closer study shows that the company's ROE is higher than the industry average of 6.3% which we definitely can't overlook. This certainly adds some context to Beijing Tianma Intelligent Control Technology's moderate 11% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So there might well be other reasons for the earnings to grow. Such as- high earnings retention or the company belonging to a high growth industry.

As a next step, we compared Beijing Tianma Intelligent Control Technology's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 7.4%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Beijing Tianma Intelligent Control Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Beijing Tianma Intelligent Control Technology Making Efficient Use Of Its Profits?

Beijing Tianma Intelligent Control Technology has a three-year median payout ratio of 40%, which implies that it retains the remaining 60% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

While Beijing Tianma Intelligent Control Technology has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Summary

On the whole, we feel that Beijing Tianma Intelligent Control Technology's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth.

If you're looking to trade Beijing Tianma Intelligent Control Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Tianma Intelligent Control Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688570

Beijing Tianma Intelligent Control Technology

Beijing Tianma Intelligent Control Technology Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives