- China

- /

- Semiconductors

- /

- SHSE:688256

Asian Growth Companies Led By Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate expectations and economic fluctuations, Asian markets continue to capture investor attention with their unique growth potential. In this environment, companies with high insider ownership often stand out as they reflect strong internal confidence and alignment of interests, making them attractive candidates for those looking to capitalize on the region's evolving opportunities.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Ganfeng Lithium Group (SZSE:002460) | 27.1% | 45.9% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's dive into some prime choices out of the screener.

Hebei Huatong Wires and Cables Group (SHSE:605196)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hebei Huatong Wires and Cables Group Co., Ltd. (ticker: SHSE:605196) is engaged in the manufacturing and distribution of wires and cables, with a market cap of approximately CN¥18.51 billion.

Operations: I'm sorry, but it seems the revenue segments information for Hebei Huatong Wires and Cables Group Co., Ltd. is missing from the provided text. If you can provide that data, I would be happy to help summarize it for you.

Insider Ownership: 37.3%

Hebei Huatong Wires and Cables Group demonstrates strong growth potential, with earnings expected to increase 53% annually over the next three years, outpacing the Chinese market average. Despite recent volatility in its share price, revenue is forecast to grow at 23.6% per year, surpassing market expectations. Recent earnings showed sales of CNY 5.34 billion but a slight decline in net income compared to last year, highlighting some financial challenges despite its promising growth trajectory.

- Click to explore a detailed breakdown of our findings in Hebei Huatong Wires and Cables Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that Hebei Huatong Wires and Cables Group is priced higher than what may be justified by its financials.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★★

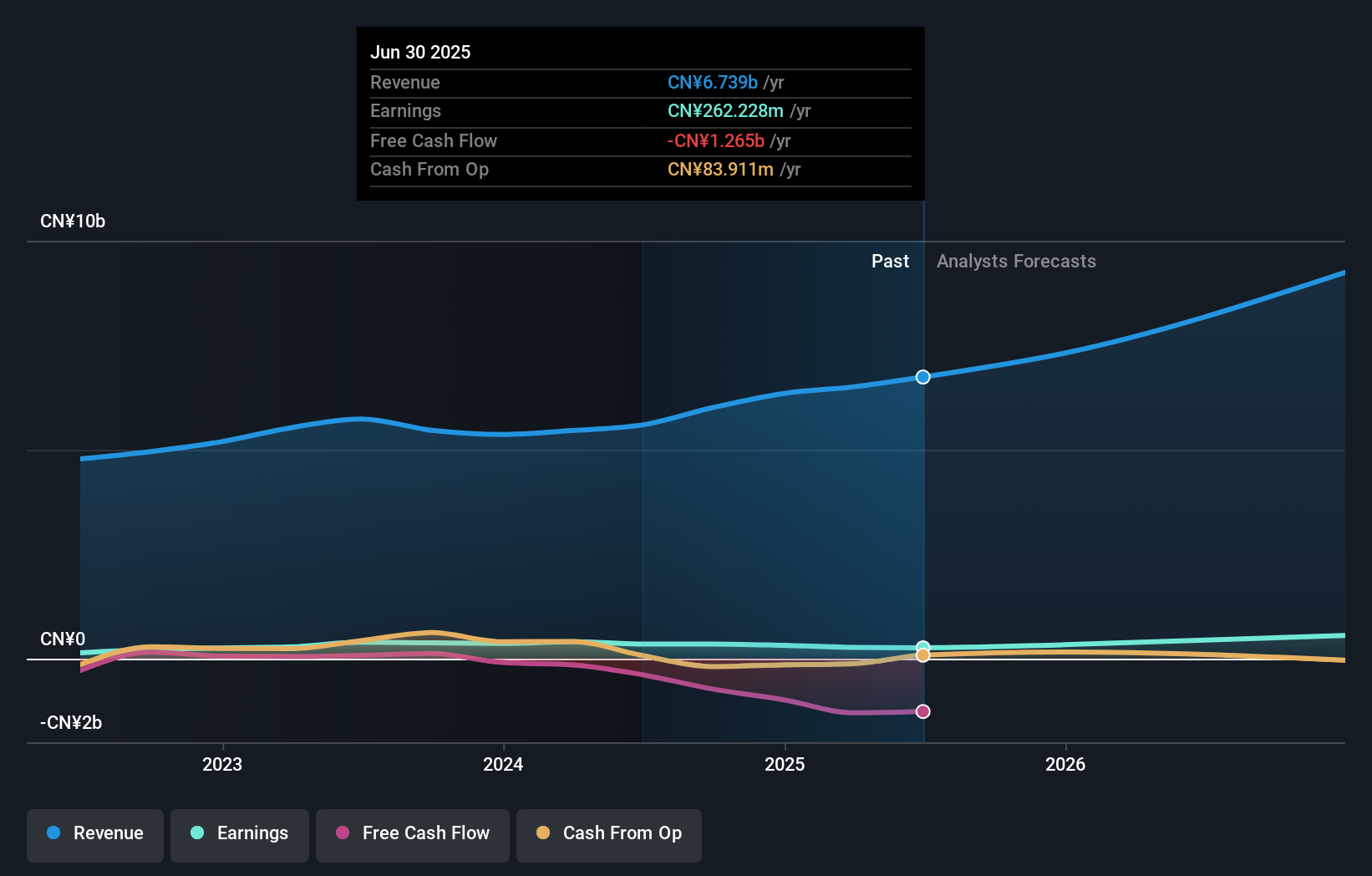

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥571.38 billion.

Operations: Cambricon Technologies generates revenue through its core chip offerings for cloud servers, edge computing, and terminal equipment in China.

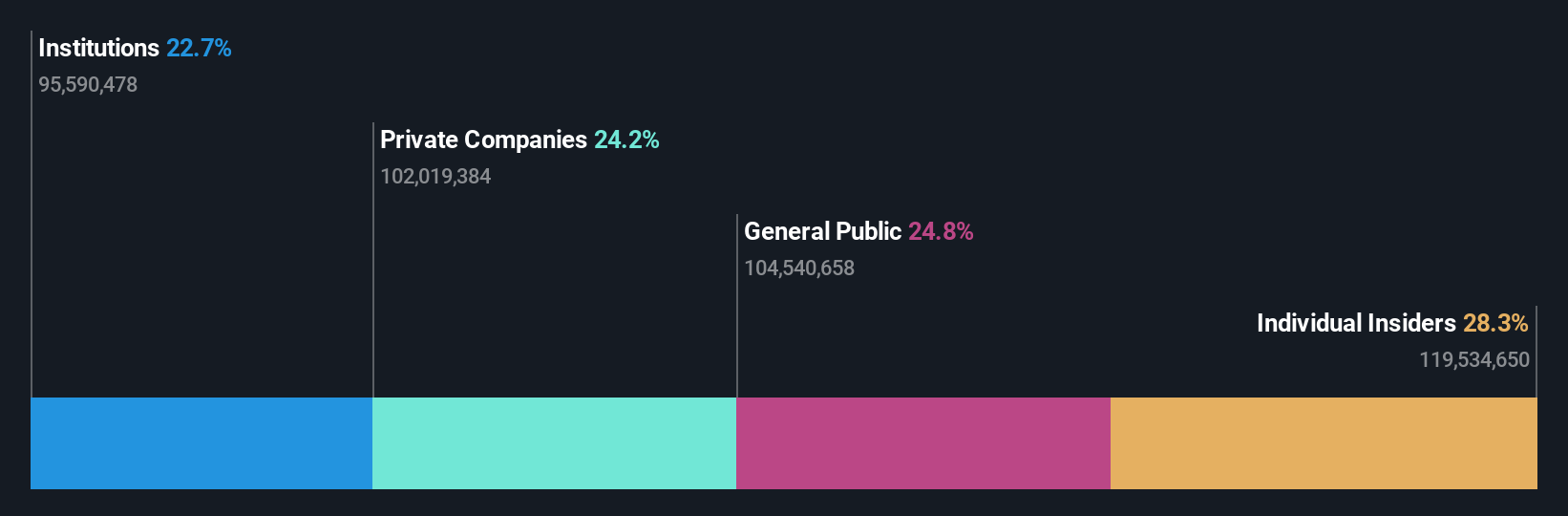

Insider Ownership: 28.3%

Cambricon Technologies is poised for significant growth, with revenue and earnings expected to grow at 48.4% and 51.5% annually, respectively, outpacing the Chinese market. Recent financials show a dramatic increase in sales to CNY 4.61 billion from CNY 185.31 million year-on-year, alongside a net income turnaround to CNY 1.60 billion from a loss of CNY 724.49 million previously, despite high share price volatility and no substantial insider trading activity recently noted.

- Delve into the full analysis future growth report here for a deeper understanding of Cambricon Technologies.

- According our valuation report, there's an indication that Cambricon Technologies' share price might be on the expensive side.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector, with a market cap of CN¥26.28 billion.

Operations: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. generates revenue through its operations in the machinery and electronics sector, with a market cap of CN¥26.28 billion.

Insider Ownership: 18.2%

Shenzhen Zhaowei Machinery & Electronics is set for robust growth, with revenue forecasted to increase by 26.4% annually, surpassing the Chinese market's average. Recent earnings reports show sales rising to CNY 1.26 billion from CNY 1.06 billion year-on-year, and net income improving to CNY 181.23 million from CNY 159.16 million previously. Despite a forecasted low return on equity of 10.6% in three years, significant insider ownership aligns management interests with shareholders'.

- Dive into the specifics of Shenzhen Zhaowei Machinery & Electronics here with our thorough growth forecast report.

- Our valuation report unveils the possibility Shenzhen Zhaowei Machinery & Electronics' shares may be trading at a premium.

Next Steps

- Explore the 642 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026